The Best, Modern and Ethical Ways to Collect Money from Patients

What is the best way to collect money from patients? Here are five methods you should consider when setting up payment options.

Besides taking care of patients, your main goal as a health practice is to get paid. After all, how else would you stay in business?

One-quarter of Americans don’t pay their bills on time. This doesn’t help you or your patients. The longer it takes patients to pay, the slower it takes for you to receive revenue. And your patients’ bills could end up getting sent to collections which negatively impacts their credit scores.

But how do you avoid this from happening?

The ways you collect money from clients will make them more likely to pay, especially on time. Having useful payment methods simplifies things for your patients and eases the process for you.

So what is the best way to collect money from patients? Here are five methods you should consider when setting up payment options.

Collect On-Site

Receiving payment when the patient is still on-site is one of the fastest ways to get paid. However, it’s also one of the most unlikely ways that they will pay. Not everyone will use this method, especially if they owe more. But if you can collect before the client leaves, you obviously receive increased revenue much sooner.

This also reduces the number of bills you’ll need to send. If you use paper statements, this saves on printing and mailing costs. When your patients have smaller bills, it’s better to offer upfront payments so you don’t waste money mailing a low charge. Not to mention that your patient will likely also want to get the payment over with so that it’s not lingering in their mind.

While they’re in your office you can also remind them about any past-due statements they have that are outstanding. Overdue charges may have slipped their mind and reminding them will prompt them to pay then. This simple addition to the in-person process also saves you money by eliminating costs associated with sending past due letters.

Eliminating some of the work that you’d have later will save your staff time. And your patients won’t be waiting for their statement, wondering why they haven’t received it yet if they don’t know your billing schedule.

Furthermore, collecting in person is also a secure option because health data won’t get printed or posted to an online portal. There’s also no need to worry about a printed statement ending up at the wrong address or getting opened by an unauthorized person.

Electronic Portal

Only collecting money via mail is a recipe for delayed revenue. You have to wait on statements to print and arrive at the patient’s address. Then, it relies on the client to open and pay for it, send it back to your office, and get delivered to you.

Mail carriers aren’t always reliable, especially during the holiday season. I’m not trying to throw shade toward these services, there’s just so much volume. During the holiday season of 2020, they saw 3 billion packages. Mail can end up at the wrong address, returned to sender, or have delayed delivery times. It doesn’t always show up when expected.

The longer it takes for mail to arrive, the more days sales outstanding to receive revenue. Waiting on mailing twice, plus waiting for the patient to send their money between, will slow things down.

Instead of relying completely on mailing statements, utilize an electronic portal as well. If people have an online option, they are more likely to pay on time. It takes less time and effort which is why 80% of people prefer digital choices.

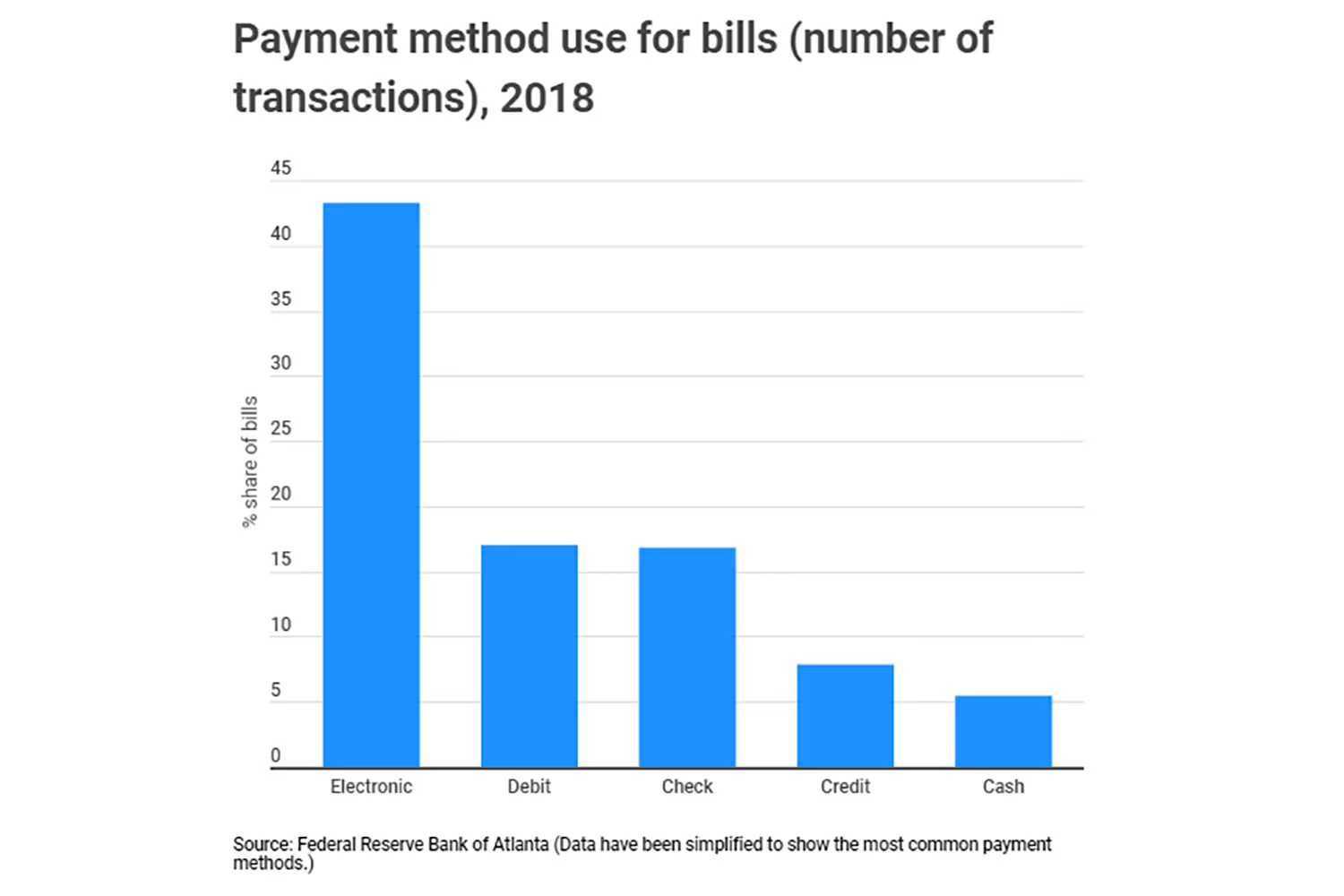

Of all options, an overwhelming majority of people choose to pay electronically. Especially with more tech-savvy adults who have their own health plans, these methods are becoming more popular.

Automatic Billing

Automating payments eases the process for the client when it comes to electronic options. It conveniently allows their statement to get paid on the same day of each billing cycle without any effort each time. Once they sign up, their money will get withdrawn from their account whenever they owe something.

That way if your client forgot something they owed, they don’t need to stress about late fees that affect their credit score. It can be hard to keep track of all our monthly bills with our usual costs such as cars, housing, utilities, and credit cards. Now add every different practice’s medical bill on top of that.

Personally, I have eight recurring payments each month which doesn’t include health expenses. So if I see my eye doctor, dentist, and primary care physician all in the same month, I’d have eleven. When all of these due dates fall on different days, it can be easy to lose track of which ones I already paid and when each one is due.

But an automatic process keeps everything organized and moving. People who use this functionality don’t need to worry about keeping track because the amount they owe gets withdrawn by each due date. It prevents bills from going to collections so that their credit score isn’t damaged.

This process also saves you mailing costs of paper billing for both the health practice and the patient. It can also save the client time from manually paying online or by phone.

Payment Plans

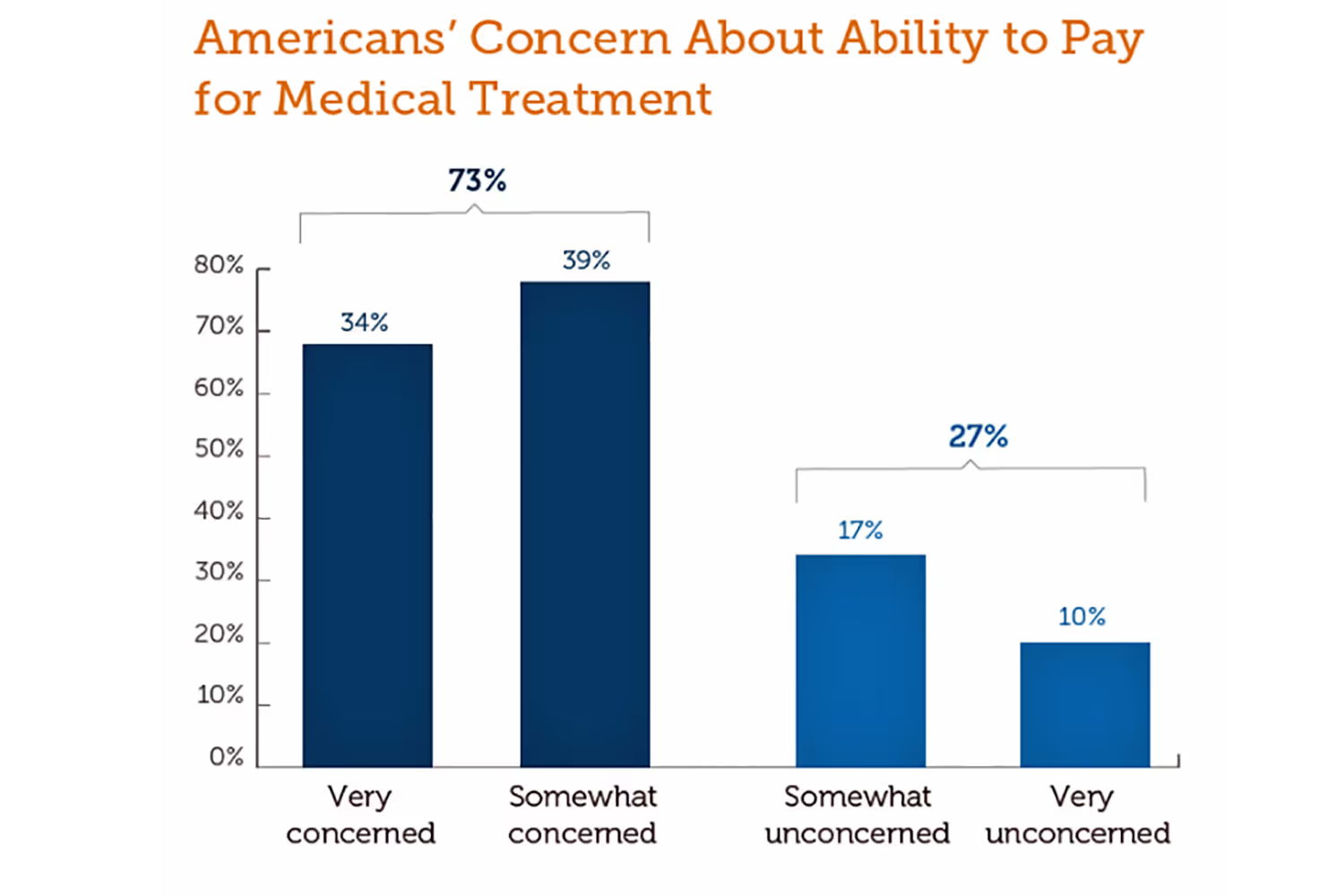

One of the reasons why people don’t pay on time is because they can’t afford it. Unfortunately, more than a quarter of Americans have trouble affording medical bills. More than half of those people have no other debts on their credit reports other than medical debt.

What’s even worse is that people delay care because of the cost. Around one-third neglect getting treatment because of financial concerns. These are potential patients you’re losing, and their health issues will only grow worse.

But creating payment plan options may help ease their worries. If patients know they can make partial deposits to a service, they’ll be more likely to schedule services and pay what they owe. After all, some revenue is better than none. And, this way, they can avoid their account going to collections.

Even people with health insurance try to avoid bills, especially if they have high deductibles. A survey found that about half of those with high deductibles didn’t have enough to afford a bill equal to their deductible without going into debt.

Thankfully, there are different ways to set up a plan so people can better afford what they owe. From this survey, 17% of those who couldn’t afford their deductible set up a plan with their provider. One option is to allow for partial payment after the service and continue following the plan until they no longer have a balance. Providing flexibility with when to pay is also helpful so patients can schedule it after their payday.

Another option to consider utilizing is to set up a prepayment plan before a service that the patient knows they’re going to receive. To avoid a large total at once after a service, a prepayment option lets people pay in smaller increments before a procedure. Then, they receive the remaining balance after their service but with a lower total.

Traditional Methods

Even though it isn’t the most convenient to rely on traditional payment methods such as cash and check, you need to take into account all of your patients. It might not be the best for getting money fast and it won’t be most beneficial for everyone.

But even though the digital payment industry reached $3885.57 billion in 2019, electronic methods aren’t everyone’s favorite. Older patients are more apprehensive to change and they don’t always want to learn how to use technology. You still need to appeal to them as well.

Some people feel uncomfortable with putting their financial information online, even if you ensure them that it’s secure. With how common cybersecurity incidents are, it isn’t shocking that patients worry a hacker will target their information.

Cash is the least likely way that your practice will get money. Most people prefer not to send cash because there’s no way to track if it arrived. Collecting on-site opens more opportunities for people to use cash, but most people don’t carry much on them anymore.

Checks surprisingly follow close behind debit as the third most common method. Of transactions in 2018, checks made up 16.8% and debit made up 17%.

Even people who like receiving statements online still want traditional options. In fact, 65% of consumers prefer receiving bills both online and on paper. Because people want both conventional and electronic delivery, they may also want both payment methods.

After all, technology isn’t always reliable. Someone might need to opt for paying over the phone or mailing a check even if their usual go-to is electronic.

Conclusion

Getting paid on time benefits both you and your clients. It streamlines your revenue and prevents medical bills from going to collections. But a quarter of people don’t pay by the due date.

Using easy methods for collecting money encourages people to pay their bills. When it requires less effort, they’re less likely to delay. And with options like autopay or paying in the office, they don’t need to keep track of when they owe.

This prevents them from missing due dates and relieves the stress of keeping track of yet another payment. The more bills they have, the harder it is to remember when they’re due. So having convenient ways to collect right away or at the same time each month makes things easier. That way, payments are always on time and you receive revenue.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.