The Comprehensive Guide to Timely Filing for Healthcare Insurances

Timely filing is a constant deadline for healthcare companies of all sizes. This comprehensive guide explains everything you need to know and how your team should approach them to help avoid their related denials.

In medical billing, time is important because of the deadlines involved. Specifically, timely filing guidelines are constant due dates that healthcare companies cannot avoid.

If you fail to meet these defined deadlines, you could lose some serious revenue.

Below is a table of contents to help navigate through the guide:

- What is Timely Filing?

- Why Does it Exist?

- Where Can You Find Timely Filing Limits?

- Are Insurance Companies Responsible for Accepting Your Claims?

- Do Insurances All Have The Same Deadlines?

- Our Analysis of Over 200 Different Timely Filing Limits

- What Can You do to Further Reduce These Denials?

- How Long Does it Take to Submit Claims?

- Can You Still Receive a Denial When Submitting Before a Limit?

What is Timely Filing?

Every medical biller is familiar with timely filing. If you aren’t, it pertains to the deadlines and/or limits set by health insurance companies. To receive payment, doctors must submit their patient's claims within these designated timeframes.

For example, a patient visited a doctor’s office on February 20th. They have health insurance Company ABC. Company ABC has set their timely filing limit to 90 days “after the day of service.”

This means that the doctor's office has 90 days from February 20th to submit the patient's insurance claim after the patient's visit. In this example, the last day the health insurance will accept Company ABC's claim is May 21st.

Why Does it Exist?

You could argue that these limits are unfair, especially for smaller healthcare providers. But from the insurance company’s perspective, they ensure submission as soon as possible. After all, the biggest insurance payers process millions of claims on a daily basis.

Timely filing deadlines make it easier for insurance companies to process claims. In a way, they also help doctors receive money faster.

Where Can You Find Timely Filing Limits?

Health insurance companies publish comprehensive manuals known as provider manuals. These manuals are lengthy and contain a ton of information regarding their claim submission and reimbursement processes.

If an insurance company has a defined timely filing limit, it’s located within their provider manual. Pay particular attention to their claims section.

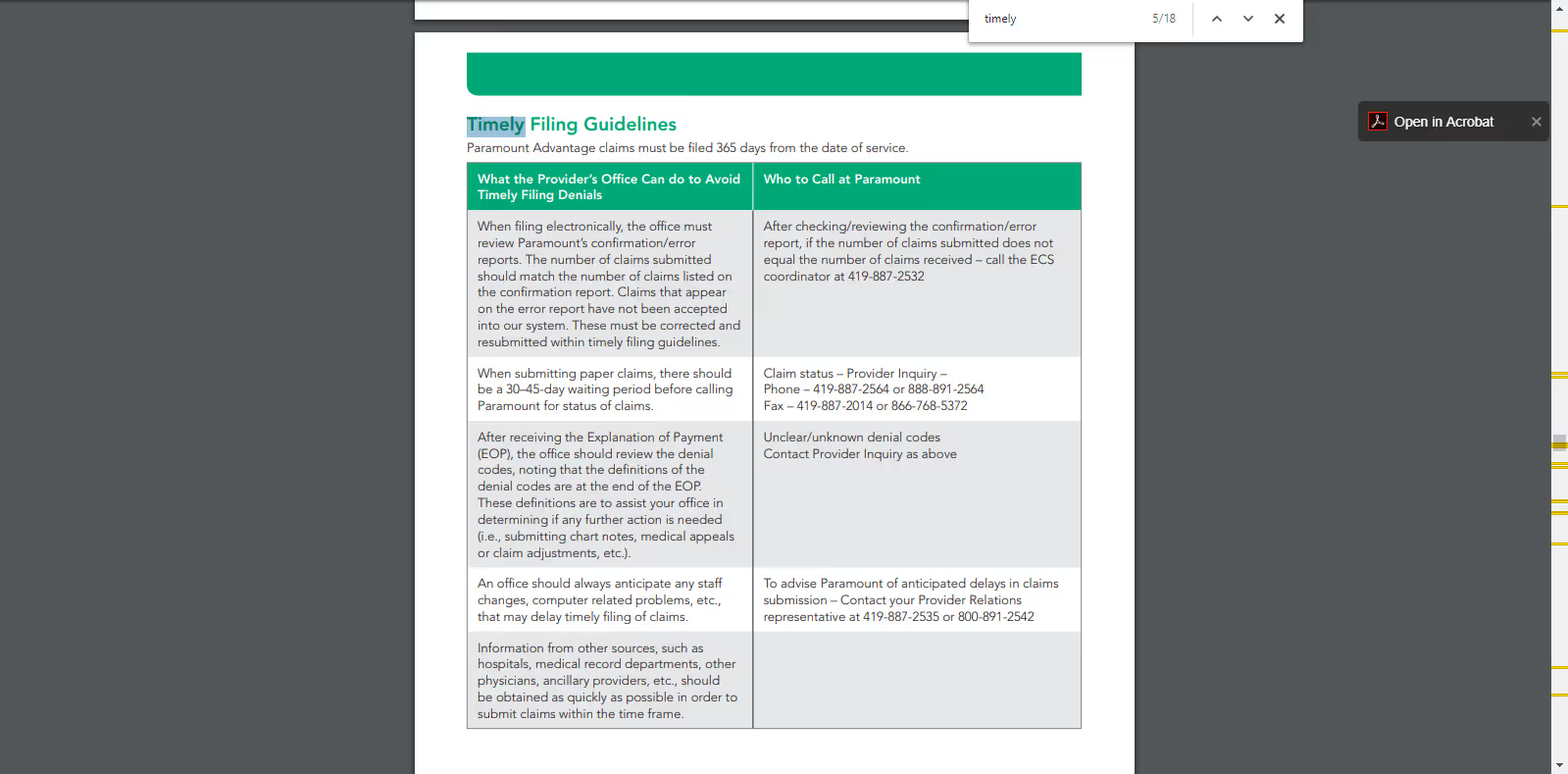

As an example, let's take a look at how we found Paramount Advantage's timely filing limit.

Many healthcare insurances make their provider manuals available online. With a quick Google search, using the keywords “Paramount Advantage provider manual”, we found the link we needed on the first page of Google.

Having clicked on the first result, we landed on Paramount’s manual page located on their website. Within the copy on the right-hand side, the words “Paramount Advantage Manual” is a clickable hyperlink.

We were then redirected to a .pdf of Paramount’s most up-to-date provider manual. There was only one problem. The manual was 134 pages in length and contained an overwhelming amount of text, charts, and images. So how could we find our objective through all of this without having to read every page?

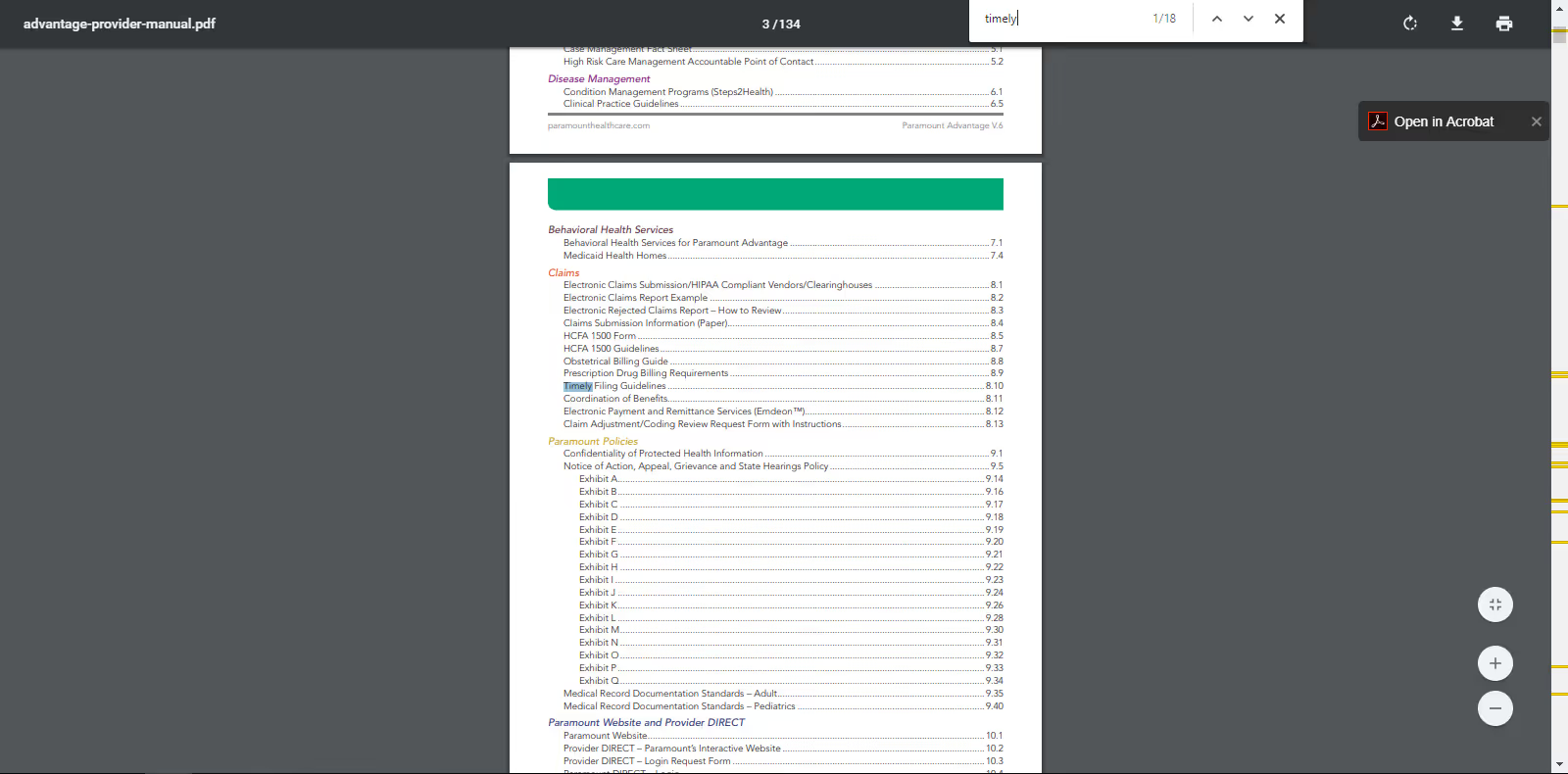

To speed up the process, we activated our browser's find function by pressing CTRL + F on our keyboard. We then began typing out what we wanted to find within the document. To find Paramount’s timely filing guidelines, we typed exactly that. As we typed, our browser searched for the words in real-time.

As soon as we typed the word “timely” our browser directed us to the table of contents and highlighted the “Timely Filing Guidelines” section of the manual. This was the section we needed.

By navigating through every instance of the word we were looking for we reached our targeted section. The first sentence within that section was the following, “Paramount Advantage claims must be filed 365 days from the date of service.”

Overall, the process to find Paramount Advantage’s timely filing limit took less than 5 minutes.

Are Insurance Companies Responsible for Accepting Your Claims?

The short answer is no, if you have a contract with the insurance company and do not follow their guidelines. If you’re a healthcare provider, it’s your responsibility to understand each insurance’s guidelines.

Let's circle back to provider manuals. They almost always have a clause stating that the payer isn't responsible for late claims. This clause is generally within the same section as their timely deadline.

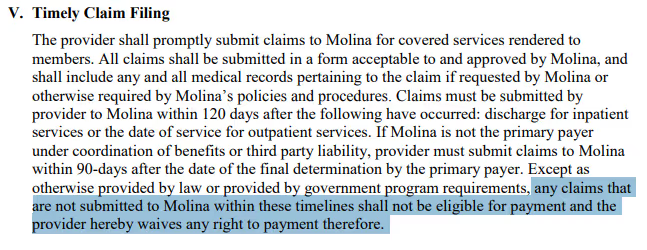

For this scenario, let's look at Molina Healthcare's provider manual. By using the same process we used to find Paramount Advantage’s guidelines we found the following clause…

In the image above, the highlighted phrase places responsibility on healthcare providers. If you send in a claim after the amount of time allotted, it’ll come back to you as a denial.

Our Analysis of Over 200 Different Timely Filing Limits

After recording everything, we then decided to analyze the data we gathered and looked for commonalities.

The median amount of days you have to submit your claim to an insurance payer is 180.

180 days is a generous window of time for healthcare entities of all sizes to submit their claims, right?

- Shortest Limit: 30 days

- 91 - 119 Days: 4

- 121 - 179 Days: 1

- 181 - 364 Days: 11

- Longest Limit: 720 days

- Median: 180 days

- <90 days: 2

- 90 Days: 40

- 120 Days: 15

- 180 Days: 76

- 365 Days: 66

- >365 Days: 4

From the bar graph and statistical data above we can conclude that…

- The two most popular timeframes are 180 days and 360 days

- There is a 34% chance that an insurance company has a deadline of 180 days

- If the deadline isn’t 180 days then there is a 46% chance that their limit is 365 days

- If the deadline isn’t 180 or 365 days then there’s a 56% chance that the limit is 90 days

- By submitting your claims within 90 days the chances that you receive a claim denial related to timely filing is 0.01%.

A 0.01% chance stacks the odds in your favor, although that percentage can still have a significant negative effect on your bottom line if you aren't vigilant. As a simple example for reference, 0.01% of $3,000,000 is $30,000.

Furthermore, that percentage is only true if you have all of those payers and submit an equal amount of claims to each. With a small amount of extra effort, you can lower your timely filing denial rate even more.

What Can You Do To Further Reduce These Denials?

Chances are, you and your staff already have a ton of work to complete on a daily basis. Some of those responsibilities include patient care, coding, and keeping track of healthcare requirements.

Ensuring your team is submitting patient claims on time is another important responsibility you need to know.

There are hundreds of thousands of insurance options your patients can choose from. But which are they actually using? Of course, I'm referring to what's known within the industry as a "payer mix."

When speaking to our clients, most of them know their payer mix.

A payer mix is a listing of the different healthcare insurances your patients use. It's helpful in breaking down what percentage of revenue comes from common insurances.

Why not use it as a guide to help identify the most important timely filing limits your team should be aware of?

Knowing the deadlines of payers that attribute to most of your revenue before your patients visit your office will help your team anticipate and submit your claims faster.

On the flipside, if your team isn't familiar with the limits for the insurances the majority of your patients use, you're losing revenue.

Submitting a claim past an insurance's timely filing limit will come back to you as Claim Adjustment Reason Code (CARC) 29 and state, “The time limit for filing has expired.”

CARC 29 has a high chance of prevention but a low overturn rate. Simply put, it has a low chance of appeal after you’ve received the denial, thus you lose money.

How Long Does it Take to Submit Claims?

There are three main steps involved in getting claims to a payer…

- Coding a claim

- Billing a claim

- The clearinghouse transmitting a claim to the payer

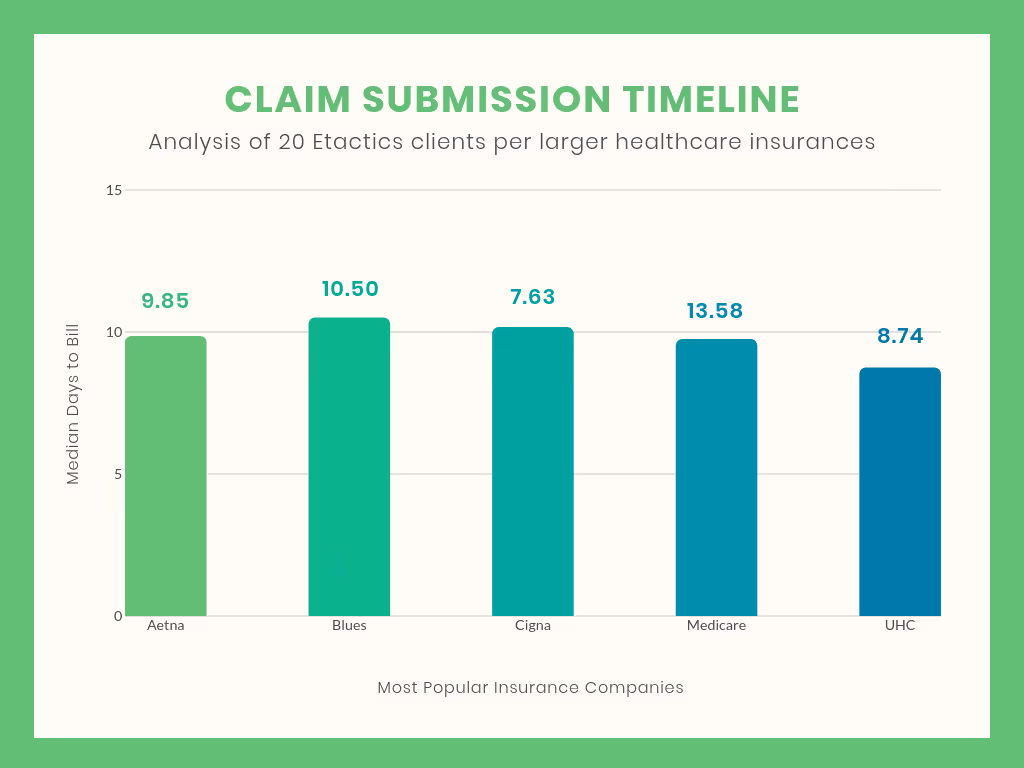

With that process in mind, we looked at 20 clients that use our denial management solution. We selected five major payers for this study, and found the median number of days from the claim’s date of service to payer received date for each client.

We then averaged those resulting medians to obtain an “average median” number of days from the date of service to payer received date or “average median claims submission time.”

The chart above is a visual representation of the average median days it took for our 20 clients to bill to five of the larger healthcare insurances.

Our results determined that the average median time it takes for a claim to reach a given payer is 9.8 days. That’s pretty quick!

In reality, sometimes there are claims that don’t get out the door on time. But if you experience a delay in your claim submission, it is your responsibility to determine what happened.

Can You Still Receive a Denial When Submitting Before a Limit?

Even if you submit a correct claim within an insurance's deadline you can still receive CARC 29.

It is possible that the insurance provider lost or never received the claim you sent due to an error.

If this situation happens, your clearinghouse should offer a timely filing report. This report lists the claim submission date to the clearinghouse and payer. Submit this report to the insurance company as an appeal in order to overturn the timely filing denial.

Conclusion

There are millions of variables that come into play when dealing with claim submission and denial management. Although timely filing limits are only a small piece of the denial management landscape, understanding what they are, where to find them, and priorizing them based on your patient’s most popular insurances will bring in more revenue.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.