Healthcare for Simpletons: How to Read a Medical Bill

If you’re in the majority of those who find medical bills confusing, you’ve come to the right blog post. I’m going to break down the different elements so that you don’t have to approach them like solving a puzzle.

If you’re reading this, know that the title of this blog post isn’t to say that you’re dumb. It’s satirical and based on the popular instructional “For Dummies” book series that started in 1991. Since then, the series has grown into a massive organization with its sole purpose being to make complex concepts easy to understand.

You would think that medical bills would be straightforward. You go to the doctor, they reach out to your insurance and then you receive a bill in the mail stating how much you owe. Yet, if you don’t understand it you’re in the majority.

According to InstaMed’s Trends in Healthcare Payments 2020 Report, 71% of consumers find medical bills confusing.

In other words, three out of every ten patients understand what they owe their doctor and how to pay it. That’s abysmal and a failure by the millions of healthcare practices and organizations out there.

How are you supposed to pay the amount you owe your doctor if you can’t understand how to read its format? The answer to that question is simple, you can’t.

Yet, not paying your medical bills won’t make anything easier because it's not going anywhere. 30 days after you receive it, you’ll receive another copy with an attached past due letter. You’ll continue to receive both of these pieces of paper on day 60 and day 90.

In a last-ditch effort, your doctor will send you a collection letter stating that this is your last chance before they send your outdated balance to a collection agency. If it goes to collections, you’ll have to deal with a bombardment of emails, phone calls and mail plus a negative report on your credit.

All of that wouldn’t happen, though, if your doctor made your medical bill easy to understand in the first place. Of course, assuming you’re not a part of the 41% of working-age Americans who have difficulty paying off their medical debt (another upsetting statistic).

If you’re in the majority of those who find medical bills confusing, you’ve come to the right blog post. I’m going to break down the different elements so that you don’t have to approach them like solving a puzzle.

Jargon and Processes You Should Know

I don’t know about you but I could do without technical jargon. It seems like every industry uses certain words over others, yet they mean the same thing. That last sentence might not make very much sense, let me give you an example related to medical bills.

Many healthcare organizations outsource the designing, printing and mailing of their patients’ bills altogether. Yes, you read that right.

Your doctor evaluates and chooses a print and mail vendor to work with and then sends all of the information that happened during your appointment to them. The vendor then itemizes everything, designs your bill and mails it to your address on your doctor’s behalf.

This is a little bit of a tangent, but it’s important to know (especially if after you’re feeling a little worried about hearing your sensitive information being in the hands of another organization).

The vendor and your physician have a law-binding agreement known as a Business Associate Agreement (BAA). This type of agreement puts liability on any vendor your physician works within case something happens to your sensitive information.

“Business Associate” is another industry-specific jargon that simply stands for vendors that work with healthcare organizations. The Health Insurance Portability and Accountability Act (HIPAA) references the term. HIPAA (another term) is the mandated law that explains what healthcare organizations must implement to keep the sensitive data that they work with private and secure.

Even your sensitive data has a term associated with it in the medical space. Protected Health Information (PHI) is the technical term for patient information.

Are you still with me?

I broke down all of this for two main reasons. First, the reason why you’re having trouble understanding your medical bills might be because your doctor chose a bad print and mail vendor. Second, I work for one of those organizations and we all refer to healthcare bills as patient statements.

If you were a customer in the commercial space, we would then call them invoices. Statements and invoices are just jargon that means...bills. Nonetheless, now that you know that word I’ll use all three terms interchangeably throughout the rest of this blog post.

The Anatomy of a Medical Bill

Now that you know what a healthcare statement is and that your doctor might not be the person making them so hard to understand, it’s time to break down the different parts of one.

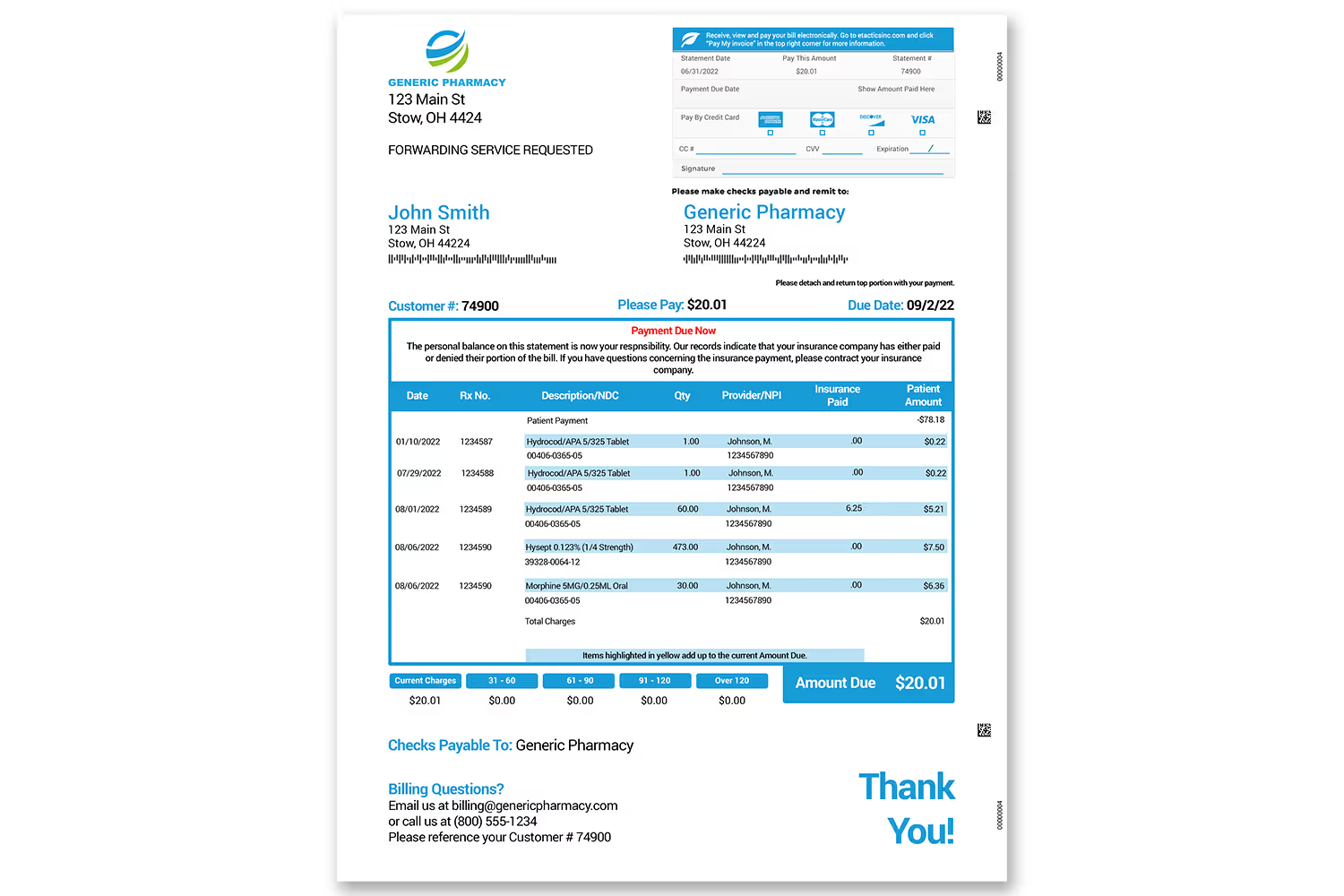

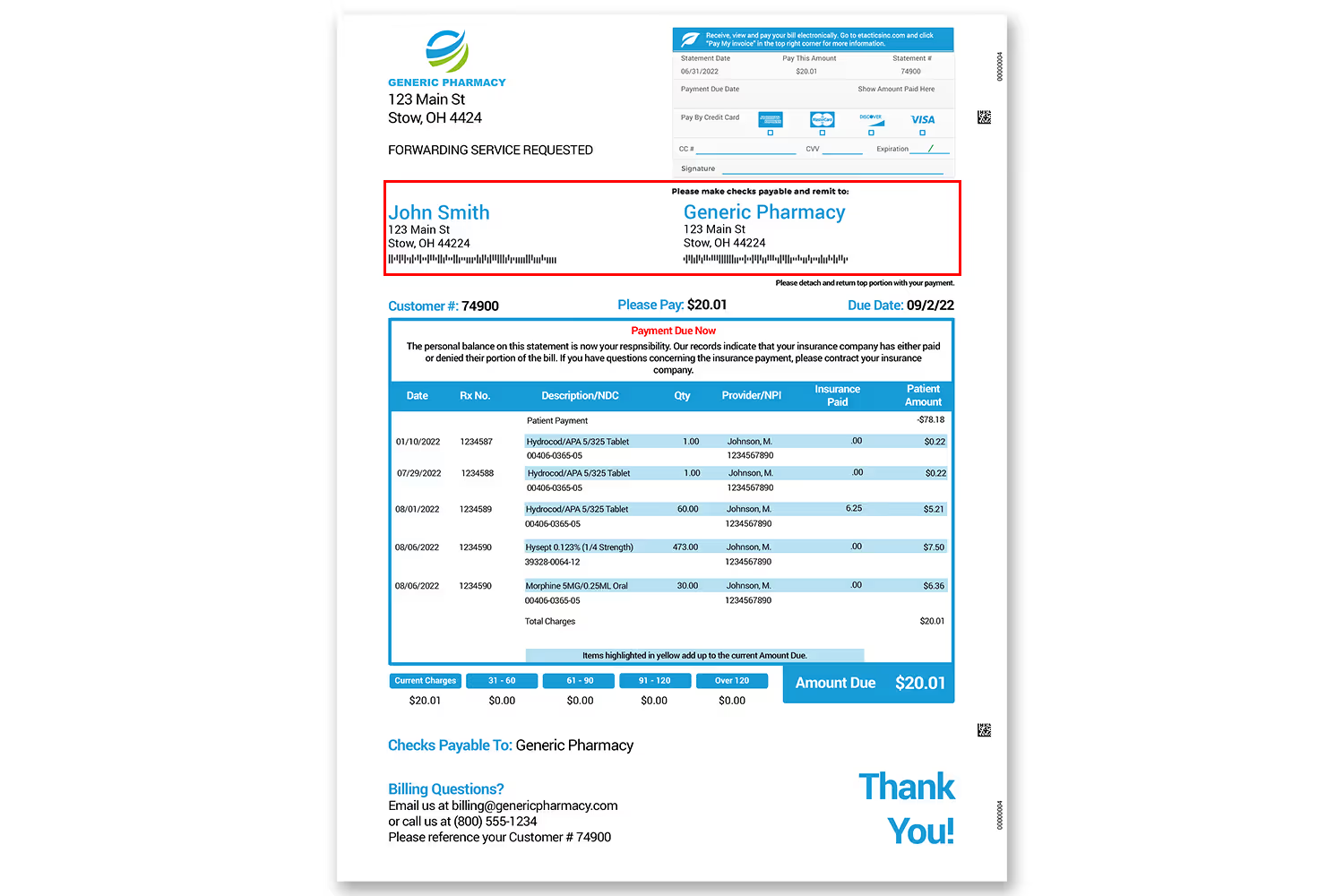

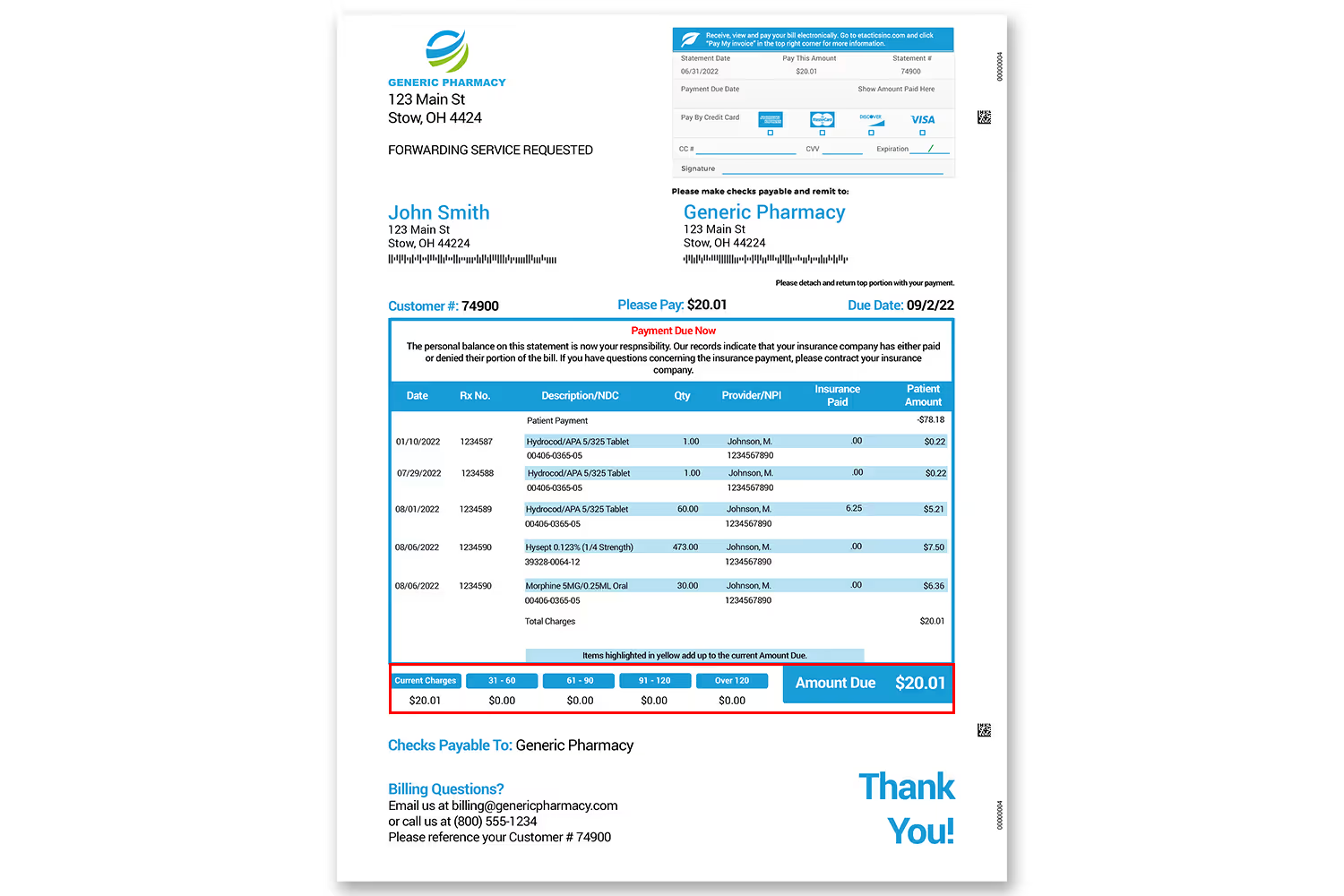

If the image above makes you shudder, you’re in the right blog post. The image above is an example of a medical bill that we design at Etactics on behalf of our clients. It’s pretty good, isn’t it? Compared to some of the other ones you’ve probably received, it’s not as intimidating.

That’s enough bragging, you came here to learn. Let’s take a look at each portion of this bill and explain what they are.

Service Requested Type

Starting at the top and going from left to right, the first thing we have other than the logo and address of the healthcare organization that sent you the bill, there’s a tiny area that often goes unnoticed called the service requested type section.

This little spot is a postal term that gives directions for the USPS. This example uses the phrase “Forwarding Service Requested” which tells mail deliverers to forward undeliverable-as-addressed mail to the recipient's new location if they have a change-of-address request on file.

There is one other direction that could go in this area called “Return Service Requested”. This directive tells the USPS to return the piece of mail if it is undeliverable as addressed, free of charge, regardless of whether a change of address order is on file for the recipient.

In other words, these directions tell the USPS what to do if the mail that they’re delivering isn’t deliverable as addressed. In one case the parcel attempts to go to the new address on file before returning it to the sender before returning to the sender. In the latter, the parcel goes back to the sender immediately.

The healthcare organization that sent you your bill spent a lot of time determining which option they wanted to include. However, most choose Forwarding Service Requested.

Who knew such a tiny portion of your medical bill provided so much insight?

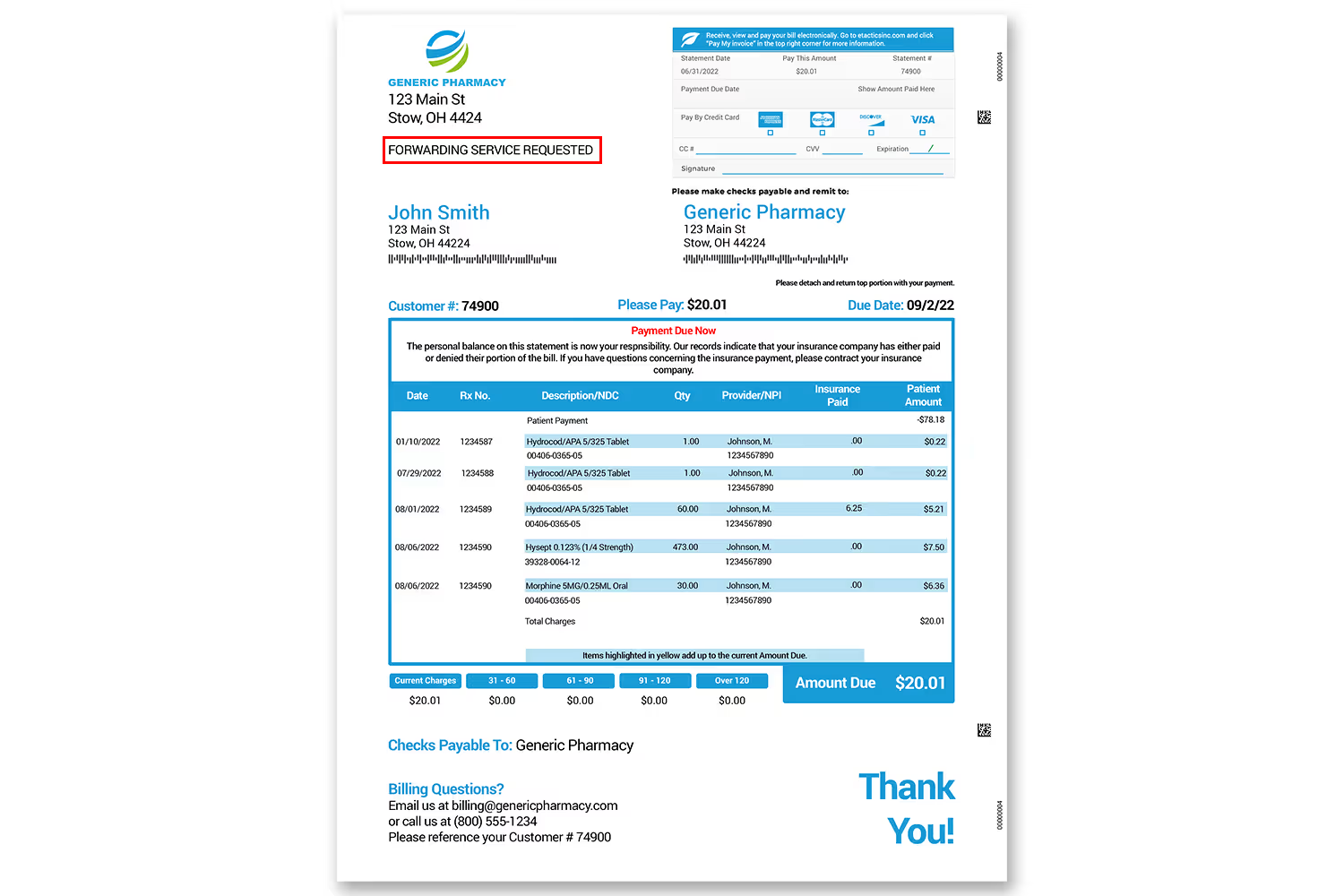

Credit Card Box

The next area in the top right of this example statement is a credit card box. This is usually the first location where you can find summarized information about your visit. Its overall purpose is to show you how much you owe and capture payment via credit card.

The very top of the box gives directions about paying online. Many modern-day patients prefer paying their medical bills online, depending on their generation.

If you trust that all of the charges from your appointment are accurate without feeling the need to check them yourself, you can fill out this section with your credit card information, fold up the statement and mail it.

However, it’s always worth reviewing all of the financial documents you receive before paying them. Especially when you consider the fact that 80% of medical statements contain errors.

Address Information

The next logical section to take a look at within a medical bill is the address information. This area is pretty self-explanatory. It tells the USPS where to send the statement as it will show up perfectly in a windowed envelope.

The right-hand side of this section provides the address of the healthcare organization to serve as a reference in case you decide to pay your statement using a check.

If you look at this section of a statement long enough, you’ll notice those weird-looking rectangle graphics underneath both addresses. Those are Intelligent Mail barcodes (IMb). IMb is a service that the USPS provides where each parcel gets a unique code.

These codes exist for tracking purposes. They’re helpful to add on a statement for tracking purposes. In other words, your healthcare provider knows whether or not you received your bill based on its tracking information.

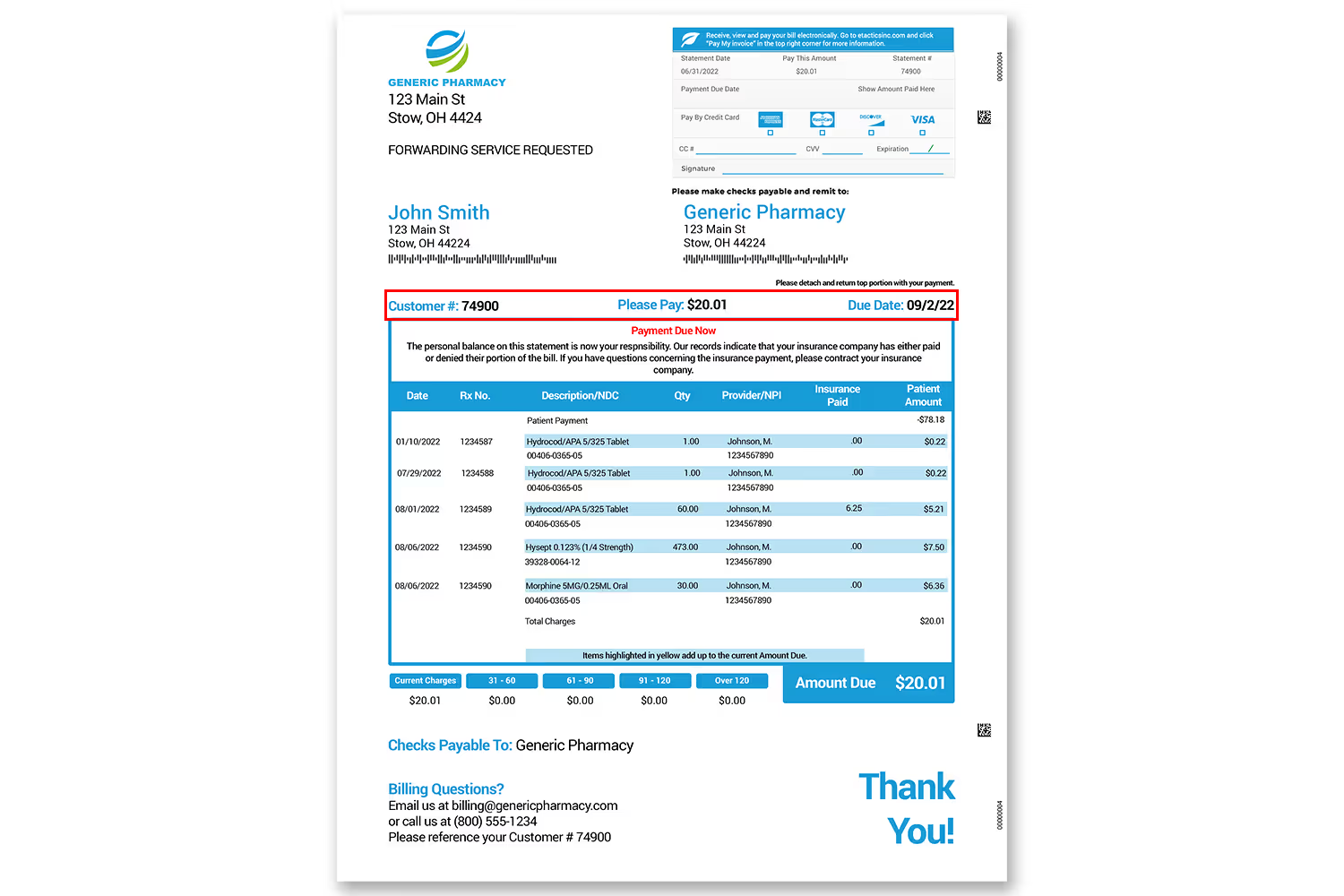

Account Information

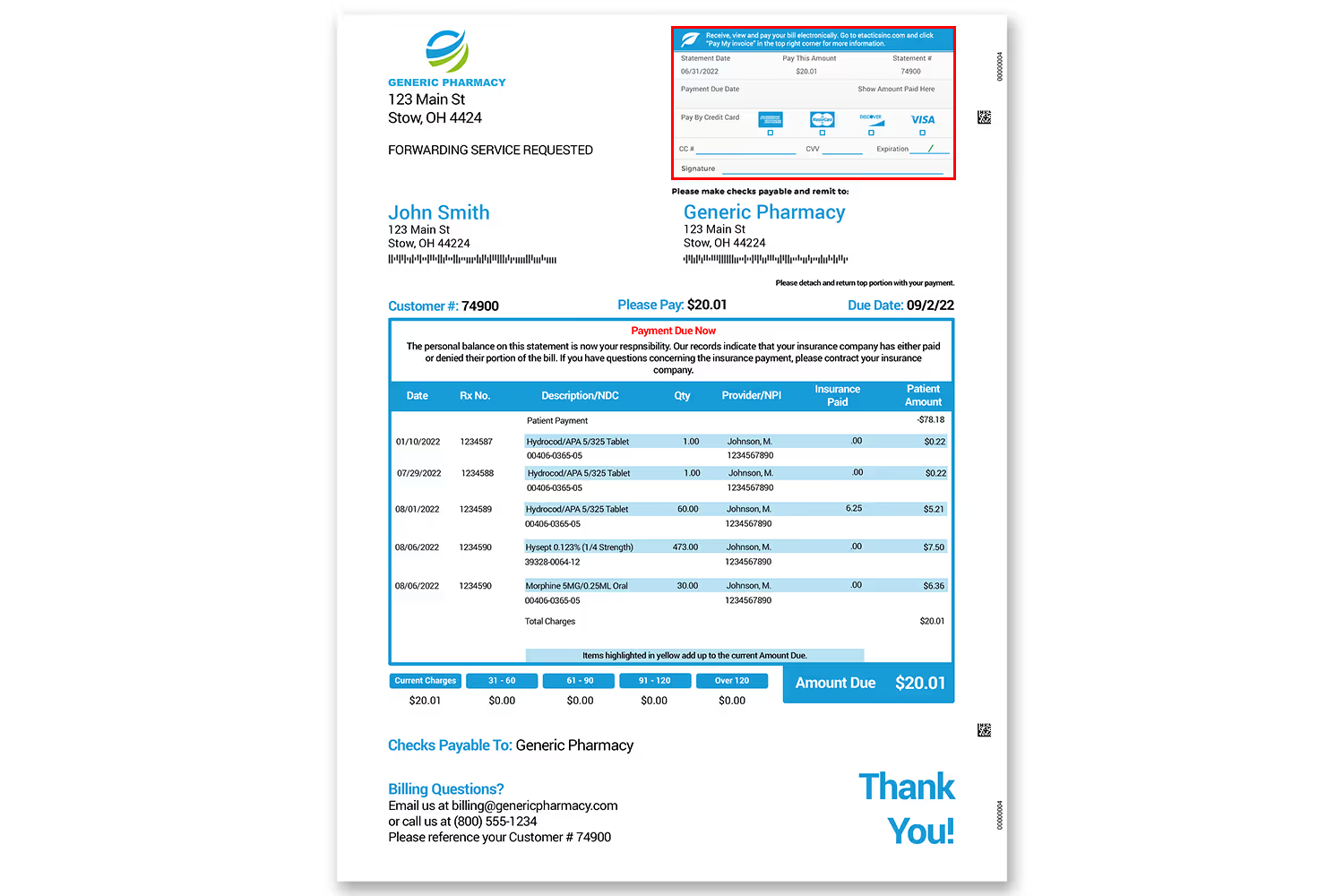

Moving further down the document, we get to the account information section.

At this point, we’ve now pushed past the top remit section of the statement. Medical bills usually provide a detachable area via perforation. That area exists to make it easy for the recipient to detach the portion that contains their payment information, slide it into an envelope and mail it.

There are two types of remits, top and bottom. The location of the remit depends on where the credit card box sits on the statement.

Anyways, back to the account information section. This is another area that provides specific information regarding your account balance, due date and account number. If you’re paying online, you’ll need to know your account number for reference.

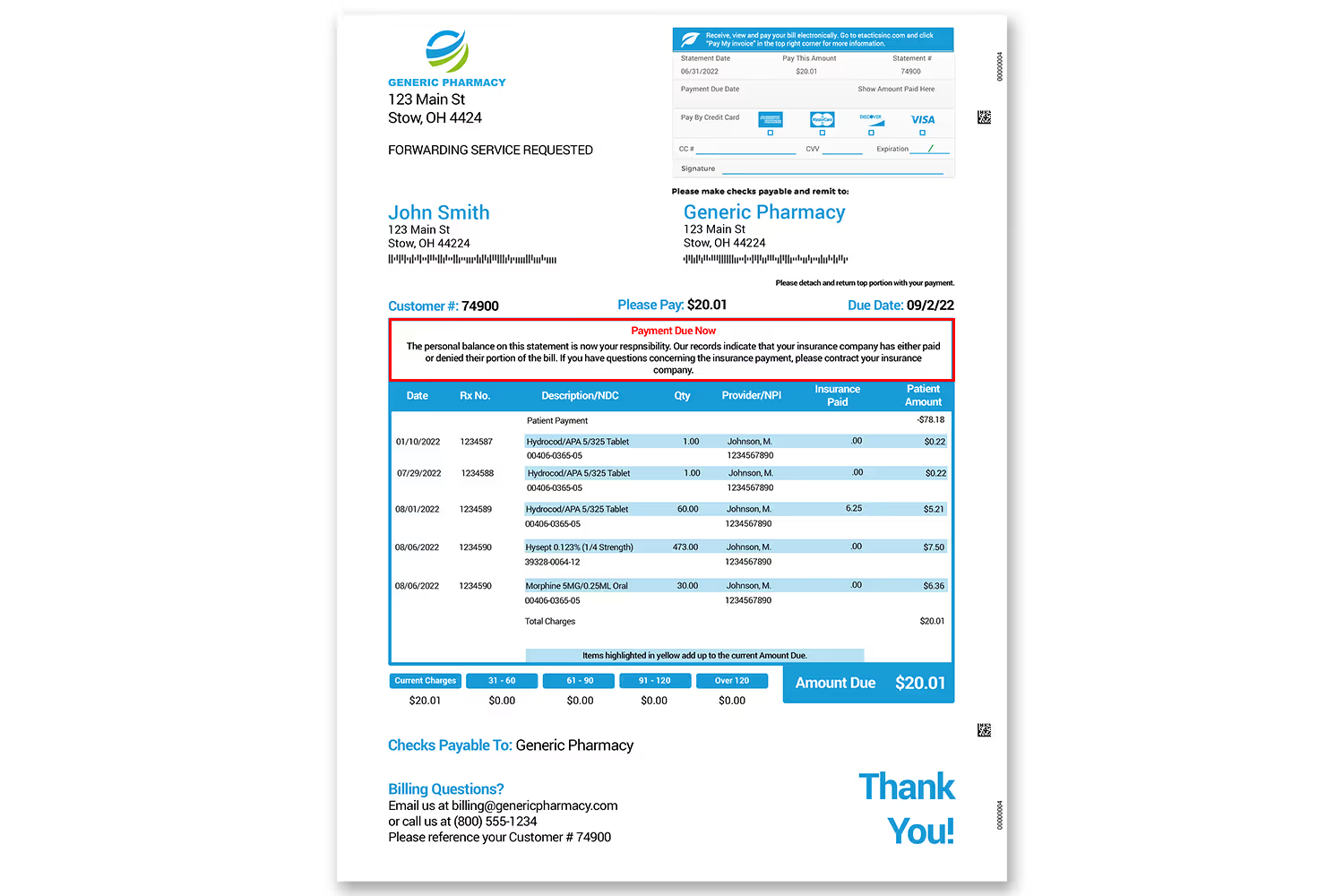

Dunning Message

Underneath your account information is usually a textbox that the industry refers to as the dunning message (I know, more jargon).

This textbox serves as an area of communication between you and your provider. Naturally, you can’t reply, but it gives you important information and updates regarding your balance and easier ways to pay.

If your balance is overdue, you’ll receive a past due letter included within the envelope with your statement. The dunning message area will reiterate the status of your account.

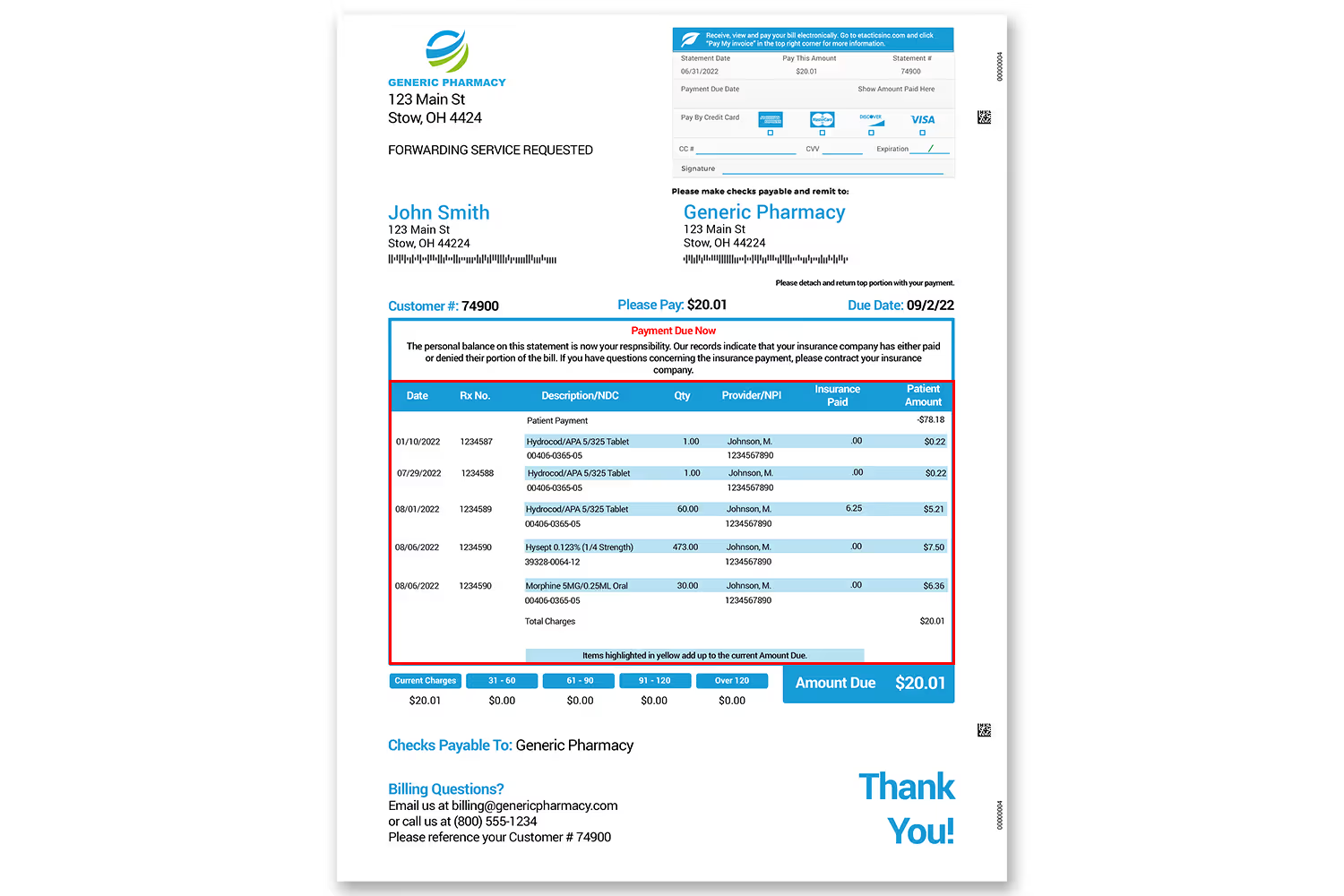

Details Table

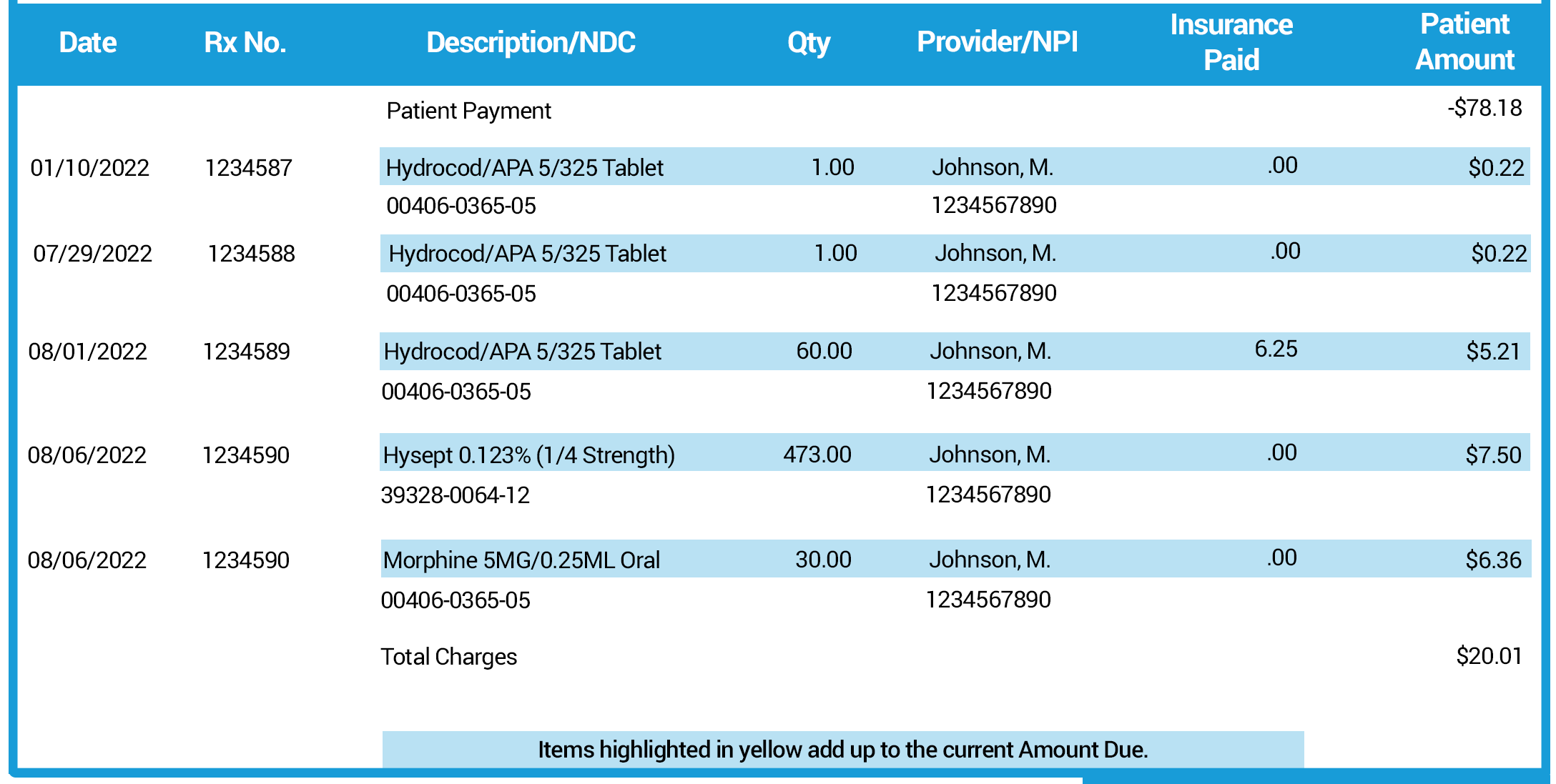

The next area takes up a lot of space on your medical bill while providing the most information. The official name of this giant table is the details section. It’s an itemized list of every charge from your provider.

In other words, if you’re planning on taking a look at an explanation of your bill, this is the best place to look. It also happens to be the most confusing.

There’s a lot of information and terms within this section. Don’t worry, we’re going to take a deeper look at it.

Before getting into the weeds of the example detail section I need to point out that the type of statement we’re looking at right now is from a pharmacy. More specifically, a long-term care pharmacy (LTC). This section would look a little bit different if the medical bill came from a pediatrician or family physician.

The top sections of this table from left to right are date, Rx Number, Description and National Drug Code, Quantity, Provider and National Provider Identifier, Insurance Paid, and Patient Amount.

Date describes when the patient (you) received what the row describes. Rx Number is your prescription number. Quantity describes how much of the prescription your provider gave you. Provider and National Provider Identifier give the name of the medical professional and their unique identifying code. Insurance paid tells you how much money your insurance covered. The patient amount tells you any payments you’ve made (as a negative/credit) and any payments you still owe.

Although it seems like a daunting section because of all the official terms, it’s pretty self-explanatory once you look at everything one at a time.

Aging Buckets

There are only a few sections left to go over. Underneath the giant details section is sometimes an area known as aging buckets.

Aging buckets are commonly used in the financial industry to show what happens to your balance as it gets “older”. In other words, it visualizes any late fees that may happen over the lifetime of your bill.

The bottom area of a medical bill is the most obvious. We’ll call this the wrap-up/call-to-action section. This section reiterates where to make checks payable and provides additional information to contact the healthcare organization. It also usually has an area that either thanks you for your “business”.

It’s a simple, yet required area that every organization that sends a bill should provide because it gives recipients information to reach out in case they have any questions.

Conclusion

You’ve done it! You now know the technical language and inner workings of a medical bill. In other words, you should be able to read and understand them properly so that you’re less likely to have a negative impact on your credit score.

Even better, having the ability to read your bill makes it easier for you to identify any errors. Thus, providing you with some leverage to negotiate for a lower payment.

Bills aren’t fun to receive but they’re necessary for businesses to stay afloat. Even though medical facilities and physicians aren’t the same as a corporation whose sole purpose is to make money, they still need revenue to keep their doors open.

That means they have no choice but to send you medical bills for your visits, even if they aren’t easy to understand.

If you received a bill from your doctor that’s hard to understand, I’m glad you read this blog post. However, you should refer them to Etactics.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.