5 Easy Ways to Improve Collecting Payments from Patients

We’ve found that even in times of financial uncertainty, there are a few ways to ensure and improve the processes involved with collecting payments from patients. Here are 5 easy improvements right now.

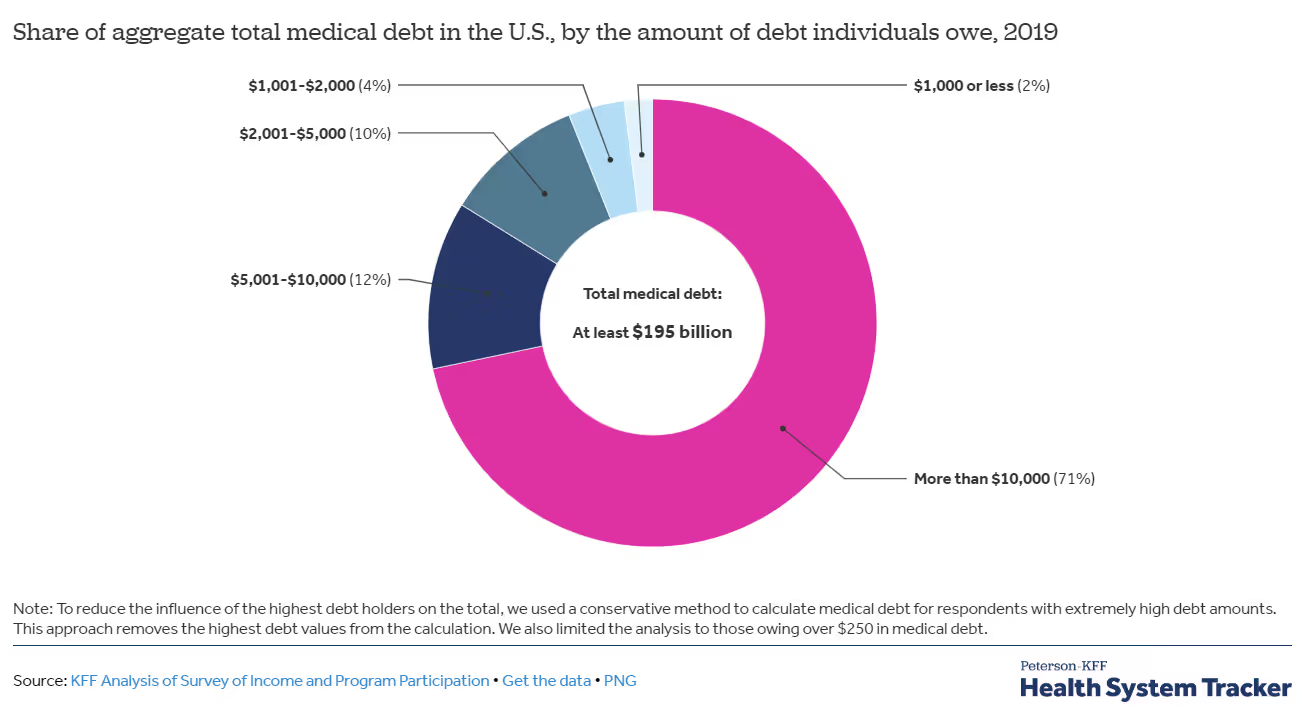

A recent study by KFF suggests that as of 2019, nearly 23 million Americans owe a significant amount of medical debt. That amounts to 1 in 10 adults!

According to the Survey of Income and Program Participation, the United States as a country owes around $195 billion in medical debt.

In the healthcare space, anything that relates to revenue falls under the industry process formerly known as “the revenue cycle”. It’s a very important process since organizations don’t get very far without revenue.

If you’re sending out statements and past due letters but failing to receive payments from your patients, this will ultimately hurt your profits. Being able to ensure that your patients will be able to pay their balances should be a top priority.

You might be reading this and thinking that collecting these payments is easier said than done. In a perfect world, everyone would pay their medical balances fully and on time, but that it’s not realistic. You're not wrong!

While these statistics may be disheartening for those struggling to get patients to pay bills, there is good news.

We’ve found that even in times of financial uncertainty, there are a few ways to ensure and improve the processes involved with collecting payments from patients.

The Accessibility of Payments

In the last few decades, our advancement in technology has progressed rapidly.

In the year 2000, roughly half of Americans had access to the internet at home. Fast forward more than 20 years and that percentage now sits at 90% of Americans.

The growth in internet access is both good and bad. On the business side, you can receive payments instantly because more Americans have the access necessary to complete them.

Meanwhile, our general ability to stay focused at hand has diminished so badly that entire universities run studies on the decrease of our attention span.

Now that we have more information and content at our disposal, we end up having too much to focus on.

The point I’m trying to make with all of this is that I doubt any patient wakes up in the morning and thinks about their medical bill from last month.

The average attention span of a human is a little over 8 seconds long. This is shy of a goldfish's attention span which is 9 seconds long.

That fact was quite shocking to me at first… but then I ran across this funny video on my feed, and before I knew it was fine. What were we talking about again?

Anyway, what does all this information mean? It means that to secure payments promptly, it’s important to use that short window of time to catch the attention of your recipients. You should be able to explain what amount they owe and how to pay…in less than 8 seconds.

Offering convenience and easy accessibility for patients will only help with collecting payments. Researching patient financial engagement strategies to fit the demographics they serve is important. Making sure to offer different forms of accepted payment allows someone customization and a sense of control.

Improvement 1: Credit and Debit Cards

In 2019, there were around 45 billion U.S. credit card transactions. These reflected the most widely accepted card companies. Of course, those companies include Visa, MasterCard, American Express, and Discover.

To narrow this statistic down further, Visa had about 742 million cards active in the U.S. by the end of 2020.

Allowing online or over-the-phone payments by credit or debit card allows for a quick and painless transaction. This is a big plus for not only your patients but your billing team as well.

Waiting on a mailed check is time-consuming and sometimes unreliable.

If those statistics weren't enough, let me go over how much we love our cell phones.

In a recent survey of Americans 18 and older, as many as 71% of us look at our phones within 10 minutes of waking up for the day. On average, we check our phones every four minutes.

This is how many of us keep track of finances and make purchases. Allowing patients to be able to make online payments via their phones is a great way to enhance revenue for your business.

We’re already on them throughout the day anyway, right? Why not take advantage of that?

Improvement 2: QR Codes

According to Insider Intelligence, the number of consumers scanning QR codes will increase from 83.4 million in 2022 to 99.5 million in 2025.

QR codes are able to improve the customer experience from online surveys to being a way to take clients effortlessly to a customer website.

These unique barcodes can appear on your monthly statements along with your website and billing office number. Simply pull out your phone and scan the QR code for fast and simple payment.

As a bonus QR codes can also direct a patient to your business patient portal. Patient portals are tools that make it easy for your clients to pay their bills in a secure environment. They accept modern forms of payment and can tailor to the branding of your business.

QR codes have only become more popular in all sorts of industries. In fact, it’s estimated that over 11 million households scanned a QR code in 2020 alone.

Touchless payments offer a safe and quick customer experience. This can be faster for your patients than opening their wallets and removing a credit card or writing a check. They also don’t have to worry if they are without their wallet and only have their phone available.

QR codes also offer more security than credit cards. This method often reduces the number of payment errors while collecting patient information. They also serve to make the transaction process more efficient for a quicker revenue turnaround.

I could go on and on about the benefits associated with QR codes in healthcare, but you should read our other blog about it if you’re interested in learning more - https://etactics.com/blog/qr-codes-in-healthcare.

Improvement 3 & 4: Recurring Billing and Autopay

It’s no secret that medical expenses can come at a high cost. In 2020 the average cost of healthcare per person in the US was $12,530.

Yet no one should have to forgo or delay medical treatment because they can’t afford to pay for it upfront. Unless you provide them the opportunity to pay in installments.

Giving patients the option to schedule recurring billing and set up a payment plan can strengthen your report with your patient. A good report can lead to less hassle when payment due dates come around. A great way to help this is by using a payment portal.

Autopay features through portals are a great option for patients who may be more forgetful. Relieving the stress of keeping track of due dates, especially for those who have many bills, is considerate. Portals then are able to keep credit cards on file for easy access. This is a unique feature offered through a secure portal database for further convenience.

Keeping a digital wallet for someone to store their bank information eases the transaction process for you, too. However, it’s important to keep in mind that if your practice plans to accept card payments as well as store cardholder data, you will need to keep this information safe for compliance reasons.

The Payment Card Industry (PCI) requires that practices need to host all data securely with a PCI-compliant hosting provider, such as a payment portal. This should ensure that the data has gone through encryption and meets standard password requirements.

Improvement 5: Payment Reminders

If someone doesn't pay the first time around after receiving a statement it isn't the end of the world, but it does require more work on your end.

Staying organized is a top concern for patients when it comes to mapping out their bills for the month. Sending email reminders and adding letter attachments to statements refresh the patient’s memory without the nagging feeling of phone calls.

Being polite in your overdue statement letters is another revenue solution to consider.

FreshBooks shares that patients are 5% more likely to pay their invoices when businesses use phrases like “please pay your past due balance”. Making sure to include “please” and “thank you” can go a long way!

Conclusion

Taking people’s preferences into consideration and being aware of the technological advancements that are constantly evolving will keep you ahead of the curve with collecting payments from patients.

There are plenty of resources that can make your job easier and possibly even lessen your workload. But if you take anything from this blog post, it should be that a payment portal provides the most value with this hurdle.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.