Patient Payment Solutions for Healthcare Billing

Collecting patient payment isn’t an easy task. As the healthcare landscape continues to change, healthcare organizations are left behind trying to find out why their collection process continues to slow down. They’re not the only one.

Patient collection, which is the process of collecting payments from patients. It's not as simple as it sounds, especially for a busy medical practice managing multiple patients and billing complexities.

Collecting patient payment isn’t as simple as it sounds.

According to HealthLeaders, 77% of healthcare providers say that collecting any form of payment from patients takes more than 30 days. Even worse, the same report states that 56% of consumers would not be able to pay a health bill of more than $1,000.

But how often do medical invoices actually cost that much?

A $1,000 invoice is only one-tenth of the average cost of a hospital stay in the United States.

After reading those statistics, it’s safe to say that receiving payment from the average person seeking services from their doctor is low.

If you’re a healthcare provider, I imagine these three thoughts are crossing your mind right now…

- How can I decrease the amount of time it takes a patient to pay their bill?

- Is there any way I can decrease the up-front costs of the services I provide?

- How am I expected to grow my practice without getting paid?

Don’t overwhelm yourself.

First, there are trends that explain why your collection slows down. Second, there are techniques you can implement today that’ll have an immediate positive impact on your collections.

What Strategies Increase Patient Satisfaction with Payment Solutions?

There are many scenarios in healthcare that lead to surprise medical bills. One common example is receiving care from an out-of-network provider, like an anesthesiologist, at an in-network hospital. The result? Two bills for one visit, and one very confused (and frustrated) patient.

When patients don’t understand what they’re being charged for, or feel blindsided by a second invoice, they're far less likely to pay, and even less likely to return.

To avoid this breakdown in trust, here are a few strategies to increase patient satisfaction with your payment process:

- Be transparent about costs upfront: Use tools to estimate out-of-pocket costs and explain them clearly before the visit whenever possible.

- Educate patients about in-network vs. out-of-network providers: Especially for procedures that may involve specialists like radiologists or anesthesiologists.

- Provide itemized bills with plain language: Help patients understand what services they’re being billed for and who provided them.

- Offer payment plans or discounts for surprise balance bills to ease financial stress.

- Ensure your staff is trained to answer billing questions and guide patients through next steps clearly and calmly.

- When patients feel informed and supported, not confused and ambushed, they’re more likely to pay on time and recommend your practice to others.

How Can Healthcare Organizations Simplify Patient Billing?

Think of Yoda’s famous quote, “Fear leads to anger. Anger leads to hate. Hate leads to suffering." If Yoda was a healthcare Jedi, his new quote would be…

Surprise or balance billing is so frustrating that they’re more likely to seek medical services from a different provider than pay.

One of the biggest trends among healthcare organizations on the revenue cycle side is offering cost estimates and price transparency. This is largely a trend because it helps doctors prevent claim denials, but it also enhances your experience.

A second solution is to be proactive with your patients. Instead of making them come to you with a surprise medical billing dispute, help them along the way. The best way to avoid surprising medical billing patients is to catch them before they happen.

If your patient is coming in for a preventive-care visit, call their insurer to find out what is covered. After finding out, let the patient know what is and isn’t covered by their plan.

This will not only enhance your experience, but also increase your patient payment since you’ll be actively avoiding surprise billing altogether.

How Can Healthcare Organizations Simplify Patient Billing?

Even with the right tools and payment options in place, poor patient communication can derail the entire collection process.

Many patients will delay or avoid making payments simply because they don’t understand what they owe or why. That is why it is critical to have clear and proactive communication to ensure patients feel informed and prepared.

It starts before the visit even happens, when scheduling appointments, your staff should confirm insurance and provide an estimate of out-of- pocket costs. During check in, reconfirm that the patient is aware of what is or isn't being covered.

After the visit, send billing reminders through, email, text, or display them on your payment portal. This helps avoid any ambiguity and being transparent from the start builds trust and reduces delayed payments.

How to Improve Patient Satisfaction During Collections?

If you send a bill to a patient and they’re confused, collecting from them will be harder.

There are four situations that cause confusion with regard to medical bills. The patient...

- Doesn’t know why they are being billed

- Doesn’t understand how to pay the bill

- Doesn’t know who it’s from

- Doesn’t trust sending payment

Each situation listed above builds after one another.

For example, if the patient doesn’t know why they have a bill or who it’s from they won’t trust sending payment to the address or account listed.

Patients who are confused will take similar actions listed within the surprise medical bills section. Thus, making it harder for you to receive revenue.

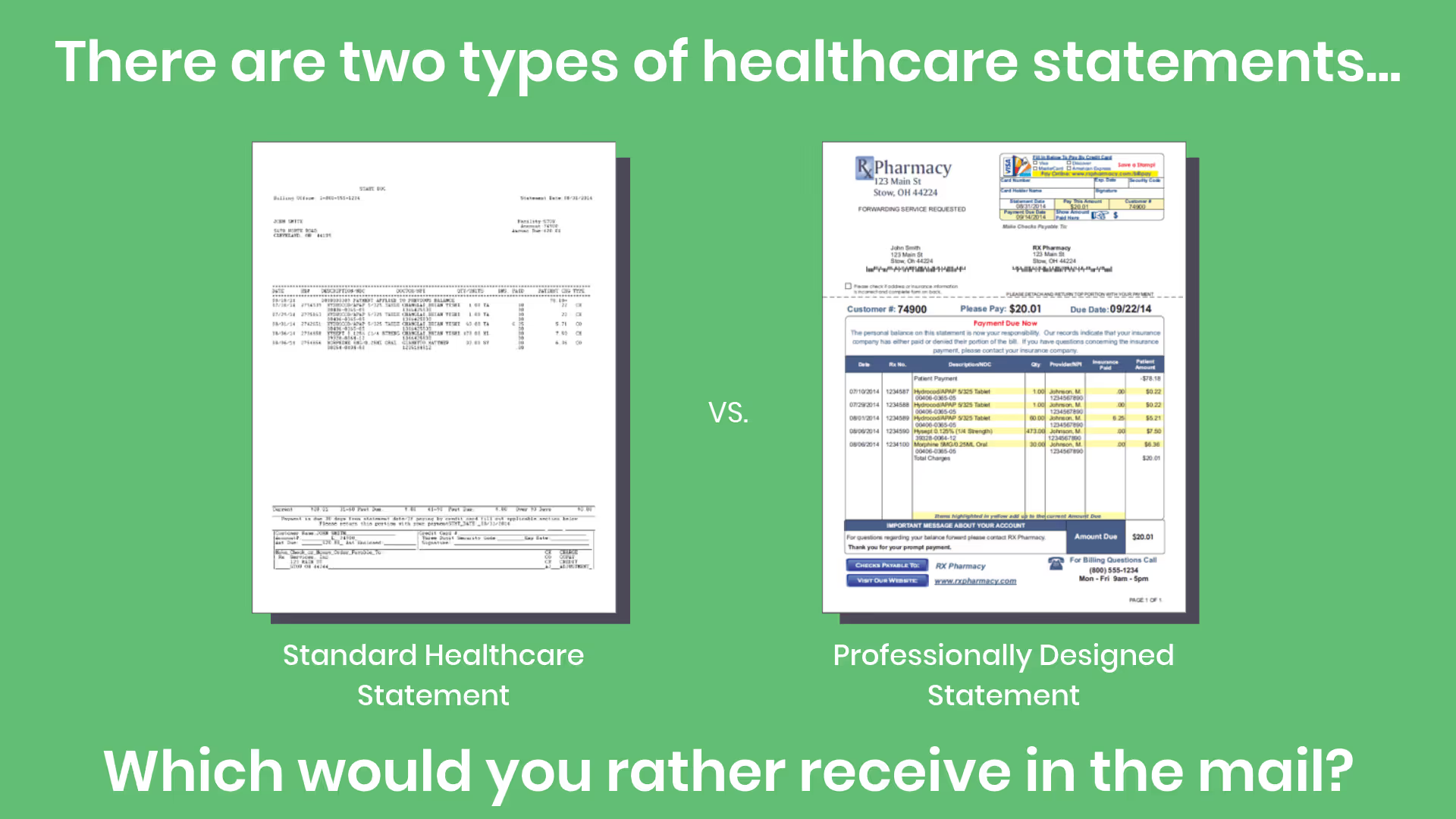

Designing Patient Statements for Clarity and Professionalism

The overall layout and design of your statement should always be an important facet to emphasize when sending statements to patients.

When you send a statement, you’re sending something that represents your organization.

Not only that, but the main goal of a statement in the first place is to ask for money.

It’s important that all patient-facing material is professionally designed so that…

- It’s easy to understand

- They know who sent it to them

- They can identify the best way to pay

In the picture above you can see a poorly designed statement versus a professional one.

In the left example, you can see it’s hard to identify who it’s from, what they are charging you, what forms of payment they accept, and how to actually pay them. Overall, it looks unprofessional and faulty.

On the right, the information's placed into understandable segments. It also looks cleaner, and more professional. The company sending the statement on the right can be proud of what they are sending.

What Are the Challenges in Implementing Patient Payment Solutions?

The average mind thinks almost 80,000 thoughts each day. That’s an incredible amount of information continuously streaming through your brain.

Implementing patient payment solutions sounds straightforward, but it often comes with unexpected hurdles.

Here are some of the most common challenges practices face:

- System Integration: Many solutions need to connect with your EHR or practice management system, which can be costly or complex.

- Staff Training: Your front office and billing staff need to learn new workflows and technologies, which takes time and resources.

- Patient Adoption: Even the best systems fail if patients don't use them. Older or less tech-savvy patients may resist digital portals or auto-pay options.

- Security & Compliance: You must ensure the solution meets HIPAA and PCI compliance standards, especially when handling sensitive patient and payment data.

- Budget Constraints: Smaller practices may struggle with the up-front or ongoing costs of high-quality solutions.

- Workflow Disruption: Changing how payments are collected can disrupt daily operations during implementation, especially if not well-managed.

Overcoming these challenges requires thoughtful planning, the right vendor partnerships, and clear communication with both staff and patients.

What Are the Best Practices for Post-Visit Payment?

Post-visit collections often fall apart because of outdated contact information, especially if the patient has recently moved. In fact, 35.5 million people in the U.S. move every year, and many don’t update their address right away. A returned bill slows down payment and increases costs.

To improve your post-visit collection success rate, consider the following best practices:

- Verify contact details before the patient leaves: Double-check their mailing address, email, and phone number during check-out.

- Send bills quickly: The sooner the bill goes out, the less likely it is that the patient has moved or forgotten about the visit.

- Offer digital billing: Give patients the option to receive bills via email, SMS, or through a payment portal.

- Use address correction and skip-tracing tools: These services can identify and update mailing addresses before bills are sent.

Follow up with automated reminders: Send follow-up messages to remind patients of outstanding balances and offer easy ways to pay.

How to Streamline the Patient Payment Process?

One of the easiest ways to streamline patient payments is to reduce the number of billing delays. A major cause of delay? Returned or misdelivered mail.

To avoid this, start by using address correction services. These tools automatically validate and fix address errors before mailing, reducing the risk of undeliverable statements.

For patients who have moved, consider using skip-tracing services. These solutions pull from a variety of consumer data sources, like magazine subscriptions, change-of-address requests, and mobile apps that require login credentials, to locate a patient’s most recent mailing address.

For example, if a patient updates their address with a subscription service like a fitness magazine, the skip-tracing system may flag that new address, helping ensure your statement reaches the right place the first time.

Using tools like these helps eliminate delays, reduce reprints, and ultimately speeds up the payment process, saving you time and money.

What Are the Benefits of Digital Payment Methods

While mail-based billing still has its place, relying on it exclusively introduces avoidable risks. For example, USPS service disruptions due to natural disasters or regional emergencies can halt your entire billing process without warning.

These events are often unpredictable and vary by state, but they’re just one of many reasons to consider digital payment methods.

Digital payments solve for more than just emergency scenarios. Here are several key benefits:

- Faster Payment Cycles: Digital payments are often completed within minutes, reducing your days sales outstanding (DSO) significantly.

- Improved Delivery Reliability: Emails and text-based billing reminders bypass postal delays and get delivered instantly.

- Increased Patient Convenience: Patients can pay from their phone or computer at any time, without the hassle of writing checks or visiting your office.

- Automated Reminders: Payment portals can automatically remind patients of due dates, reducing the need for staff follow-up.

- Lower Operational Costs: No stamps, printing, or envelope stuffing, just streamlined, scalable payment processing.

- Patient Preference Alignment: Most consumers now expect to be able to pay online or through mobile wallets. Meeting this expectation builds trust and satisfaction.

- Real-Time Tracking and Confirmation: You'll know when the statement is delivered, opened, and paid, all without waiting for mail to return.

While mailing can still serve patients who prefer paper, combining it with digital options ensures you're covered even during USPS service disruptions and helps all patients pay faster and more easily.

How Can a Patient Payment Portal Facilitate Timely Payments?

A patient payment portal is a secure, online platform that allows patients to view, manage, and pay their medical bills from any device. Unlike traditional billing methods, a portal gives patients instant access to their balances, without waiting on physical mail or relying on office hours.

Here’s how a payment portal helps improve timely collections:

- Instant Delivery & Access: Patients can receive billing notifications by email or text and pay immediately—no printing or mailing delays.

- 24/7 Convenience: Payments can be made anytime, anywhere—especially important for busy patients who may not open physical mail.

- Secure Login & Account Management: Patients can log in to see their payment history, outstanding balances, and upcoming charges in one place.

- Multiple Payment Methods: Portals can support credit cards, HSA/FSA accounts, bank transfers, and even digital wallets like Apple Pay or Google Pay.

- Autopay & Payment Plans: Many portals allow patients to enroll in automatic payments or set up flexible payment plans directly within the system.

- Fewer Staff Follow-Ups: With automated reminders and real-time confirmation, your team spends less time chasing down payments.

While paper statements still have their place, a digital payment portal empowers both your patients and your practice. It reduces friction, builds trust, and speeds up the path to payment.

What Payment Options Should Be Offered to Patients?

Cash, check, Visa, Mastercard, American Express, Discover, PayPal, Apple Pay, Google Pay,Venmo, Bitcoin, DogeCoin, etc.

You could spend an entire day listing the thousands of different modern payment options available to consumers. In fact, since the introduction of cryptocurrencies, there are more than 1,600 different types.

With so many options available, patients prefer certain forms of payment over others.

If you don’t accept multiple different forms of payment based on what your patient prefers, it’s harder for them to pay you.

How Do Flexible Payment Plans Benefit Patients?

If your biggest problem is that you don’t accept enough forms of payment, the obvious solution is to accept more of them.

When consumers purchase something from a B2C e-commerce organization, they often can buy their items with whichever payment method they prefer most.

Adding multiple forms of payment makes it easier to pay, thus further breaking down patient payment barriers

If you really want to step up your payment option game, research payment gateway solutions. These solutions allow your customers to login securely and pay from an online portal.

How Can Practice Management Improve Financial Health?

Even though we are talking about how to make it easier for your patient to pay you throughout this entire blog piece, it might not be their fault at all.

There’s a chance that the reason it’s hard for you to collect patient payments is due to slow internal procedures.

Specifically, there are two processes that can slow down your collection efforts entirely…

- Not mailing or sending medical bills soon after the patient visit

- Not collecting payments or co-pays at the time of service

When trying to decrease your days sales outstanding (DSO) every moment counts. If your procedures are outdated, you’re missing out on an opportunity to collect faster and improve your cash flow.

How Can Automation Enhance the Payment Process?

Before evaluating automated alternatives, conduct an internal audit of your current patient payment collection process to identify opportunities to improve collections. Look at your process from start to finish with your collection team and determine any blatant holes.

After looking internally, research online or consult with other experts within your field that experienced similar bottlenecks. Find automated alternatives that already exist and see if they fit with your business strategy.

As an example, there are many manual processes involved with paper statement delivery…

- Designing the statement

- Adding line items and data

- Printing

- Envelope addressing

- Mailing

In fact, some organizations hire employees whose sole responsibility is addressing this process.

It’s not only time-consuming but it can be outsourced to an automated patient mailing solution.

Think about how many statements you mail in a given day and how much time it takes. Now imagine how much time you’d save if you automated the entire process.

Conclusion

The biggest takeaway from this piece is that there’s no magic wand that, when implemented, will solve all of your collection issues. We are all naturally a little reluctant to pay large sums of money.

Instead of being aggressive in your collection efforts, focus on convenience. The less barriers of entry or effect required to pay you, the easier it will be to collect your patient payments.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.