How to Prevent Claim Denials During Every Phase of The Revenue Cycle

The majority of claim denials are preventable. In this post we look at the three main phases of the revenue cycle and what you can do to ensure that the insurance claims you send out get paid the first time you submit them.

90% of claim denials are preventable.

According to Change Healthcare, of all denials…

- ~24% are due to errors during front-end revenue cycle processes

- ~12% are due to authorization/precertification mid-cycle processes

- ~15% are due to invalid claim data in the back-end.

That’s a lot of money healthcare organizations are betting on to increase their revenue. From the percentages above, we can draw the following conclusions…

- Determining whether an insurance claim will come back as a denial has a lot to do with what happens before the patient walks through the door.

- Back-end denials occur due to lacking front-end procedures

- Determining if something is medically necessary can cause significant denials

So how prevent claim denials on the front-end, mid-cycle, and back-end?

Front-End Revenue Cycle Prevention

Educate Your Staff

It doesn't matter how many automated eligibility or verification tools are available. Denial prevention starts with your staff.

Your front-end staff spends the majority of their time streamlining your waiting room. This often means they're unaware of the expenses associated with front-end denials. But nothing can replace a knowledgeable staff and a solid pre-visit process.

Like any business, there are roles designated to customer service. In healthcare, these roles change slightly but the concept is the same.

The best healthcare staff enhances the patient experience beyond a friendly face. They are as friendly, understand how to interpret insurance policies and can discuss any patient coverage issues.

Establish Partnerships Between Departments

If your billing team isn’t communicating to your front-end office, there is a gap in your processes. Your front-end office needs to know the mistakes they make that are causing denials.

Your office and billing team should work together as a partnership. Both departments should be in constant contact with each other or at least have a way to communicate.

Your billers have the power to help the front office reduce denials. Specifically, they can inform them of specific mistakes they are making.

Similarly, the front office can make the billing office’s job easier. All they have to do is make their best effort during the early stages of the revenue cycle and submit clean claims.

Streamline Patient Scheduling

At the beginning of the revenue cycle, the patient schedules an appointment. According to Healthline, the wait time to have a routine appointment with a doctor is upwards of 24 days.

Think about how much can change in your life in a month? You could move, get married, start a new job, or do a combination of each of these.

If your patients are waiting more than 24 days, you need to put in place an appointment reminding schedule.

While reminding your patients, ask them questions to receive more details about their visit. Doing so will streamline the scheduling process, cut wait times, and enhance the patient experience.

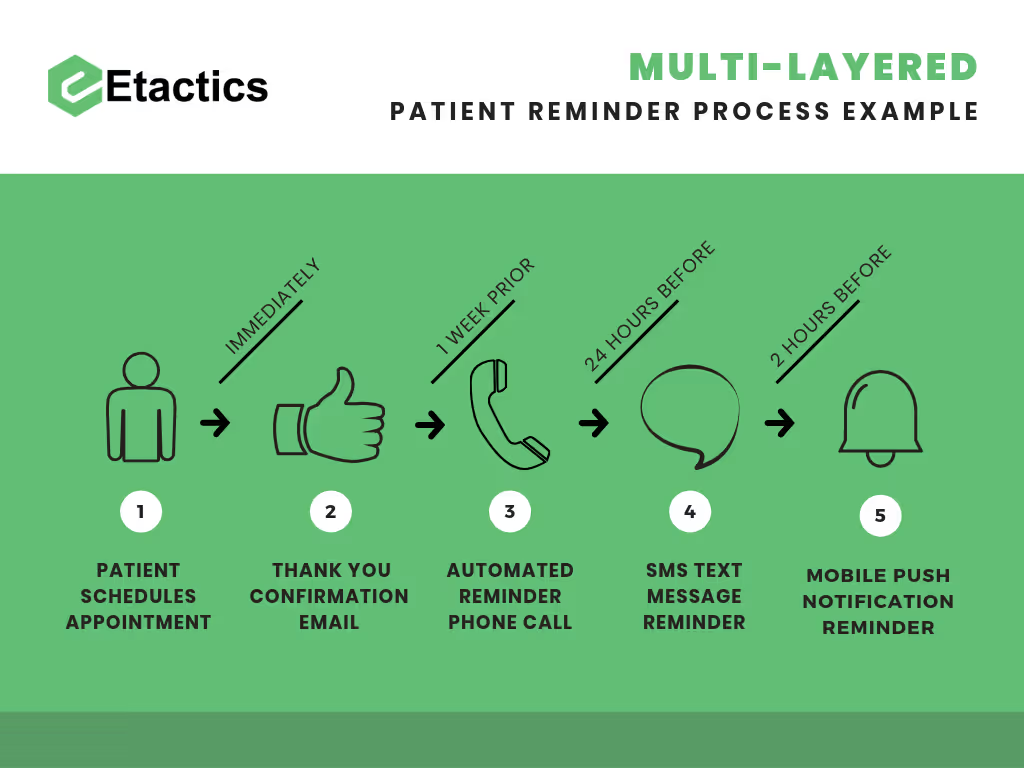

As another step, establish a multi-layered reminder process that uses different forms of communication such as…

- Phone calls

- SMS or text messaging

- Mobile push notifications

Patient’s are busy and many of them would rather spend time outside of the doctor’s office. Below is a visual representation of what a multi-layered reminder process might look like.

Perform Consistent Checks on Information and Eligibility

After scheduling, the next phase is checking eligibility and registration.

The image above shows how much time there is between the patient’s initial scheduling and their appointment date.

This example is for a doctor’s office who goes a little overboard. After scheduling, they check their patient’s eligibility information, set an appointment reminder process, and reach out to them again if there are any discrepancies in their demographic information.

A strategy such as this would have a negative affect your patient experience. As you can see, that can be both overbearing and annoying on a patient. So what’s the solution?

Check the patient’s eligibility before their first reminder. Doing so will remind the patient that they have an appointment and resolve any eligibility issues.

You can immediately see the boost in efficiency in the new combined process. First, it cuts down on patient outreach so that it’s no longer overbearing. Second, it provides necessary reminders. Third, it combines two processes into one, making it easier to manage your claim denials.

Implement Price Transparency

At the end of the day, patients only care about two things when they come in for a doctor visit…

- Treatment

- Pricing

In healthcare, the main goal is to administer the best form of treatment to patients. This often leaves pricing as an afterthought. Pricing for doctor’s visits usually isn’t given until weeks later.

Even worse, an identical form of treatment at one healthcare office might cost three times more at a different location.

Imagine you’re shopping for an iMac but all the prices were unknown. You go to the nearest location that sells them and buy one.

Weeks later you get billed for $3,000. Yikes. You reach out to a friend who bought the exact iMac from a different location around the same time. Their bill comes it at $1,000. Not bad.

Could you imagine how upset you would be if you found out that the iMac your friend purchased was 3 times less? This is is a similar scenario to what happens in the healthcare space.

How should you prepare for price transparency? Research tools that estimate the costs of upcoming services or procedures. These tools, such as eligibility verification, base their costs on a patient’s benefits and historical claim data. You can often find them offered through insurers

Price transparency can educate patients about their financial responsibility. Fewer surprises during billing will lead to an increased willingness to pay.

Understand Time Management and Daily Claim Submission

After the patient’s appointment, you need to get their insurance claim to the payer. Of course, that’s not as easy as it sounds. Payers define a window of time you have to send them a patient’s claim after the date of service.

These are referred to as timely filing deadlines.

If you don’t submit the initial claim within that deadline, you can expect a denial.

So make a competition out of it. See who on your team can submit the most accurate claims on a weekly, monthly, quarterly, and yearly basis. Set prizes for each milestone and winner to motivate your team.

Create attainable goals on company-wide and individual levels.

The main goal should be a set number of days everyone has to send claims by, regardless of the payer.

Determine individual employee submission goals on a personal level. Continue to adjust them as they achieve them. You’ll end up further streamlining your submission workflow along the way.

Use Automated Claim Scrubbing

Obviously, you need to review all claim information before submission. Healthcare providers have two ways to edit their claims. They can either automatically scrub them or manually edit them.

Revenue cycle organizations, like ourselves, have created solutions that automatically scrub your claims. These solutions include…

- National Coverage Decisions (NCD)

- Local Coverage Decisions (LCD)

- Correct Coding Initiative (CCI)

These solutions allow you to request custom edits, which can filter and highlight mistakes. They will then place affected claims into a work queue for correction.

Your employees already a lot on their plate but implementing automated scrubbing eases their workload. However, these tools are not a cure-all.

Assign a 24 Hour Manual Edit Window

If your team can’t identify coding or charge entry errors before claim submission, you can expect rejections.

While you are setting achievable submission goals you should also keep editing in mind. Before submission, you need to edit each claim to make sure the information is accurate.

Every time you adjust your submission goals also change your editing window deadline. Initially give your team two or three days to edit.

If you change one deadline, adjust the other in tandem. Eventually, your edit window will hit its sweet spot of 24 hours.

Keeping up with your claims by editing them every day ensures that your A/R days are accurate. This also allows enough time to identify mistakes that may have happened before submission.

Middle Revenue Cycle Prevention

Preventing claim denials is largely handled at the beginning and end of the revenue cycle.

But there are also steps you can take during the middle of the revenue cycle to optimize performance. Having a strong mid-cycle requires a skilled team of Health Information Management (HIM) professionals. If your team of HIM professionals doesn't own the necessary skills they can be the root cause of denied claims.

Review Medical Codings

Coding plays a huge role during mid-cycle procedures.

Medical coders are experts in documentation review, code assignment, and appropriate code description interpretation. Coders assign procedure codes for surgical procedures and all diagnosis codes.

These codes are hard-coded in a Charge Description Master (CDM) and assigned to the claim based on a department level selected charge code.

To ensure medical codings are accurate and correct, consult with a coder when setting up the CDM.

Train for Proper Documentation

Similarly to scrubbing and edits, there are also tools that help ensure proper documentation automatically. If you go the automation route also check documentation manually. This will make sure the tool did everything right.

There’s a lot of potential for error while a physician documents their patient’s care. On top of that, giant standardized resources like ICD-10 add greater chances to mess things up.

To further your efforts toward accurate claims, set-up training courses. These courses will ensure continual education for both physicians and HIM employees.

If you don’t have consistent training in place, schedule a few every quarter. During each training, review your current processes, ask for feedback, and announce new requirements.

Poor documentation practices have a direct effect on losing revenue. Implementing a sound strategy on handling documents eliminates rejections.

Execute Audits, Processes, and Compliance

While your HIM team is working through their stages of the revenue cycle, execute audits on their output. Look if they are…

- Assuring appropriate documentation

- Coding accurately and productively

- Taking corrective actions in documentation and coding processes

Each time you conduct an audit, weaknesses will present themselves. Once you know your greatest mid-cycle weaknesses, create processes to strengthen your practices.

Although compliance is important throughout every phase of the revenue cycle, it’s more blatant in the mid-cycle. Compliance plays a major role in each of these stages…

- Documentation

- Chargemaster set-up

- Charge capture

- Claim processing

Conducting audits and streamlining your processes will also inadvertently enhance your compliance practices. But sometimes medical coding interpretations change. This requires you to stay up-to-date to catch any new suggested actions for compliance.

Back-End Revenue Cycle Prevention

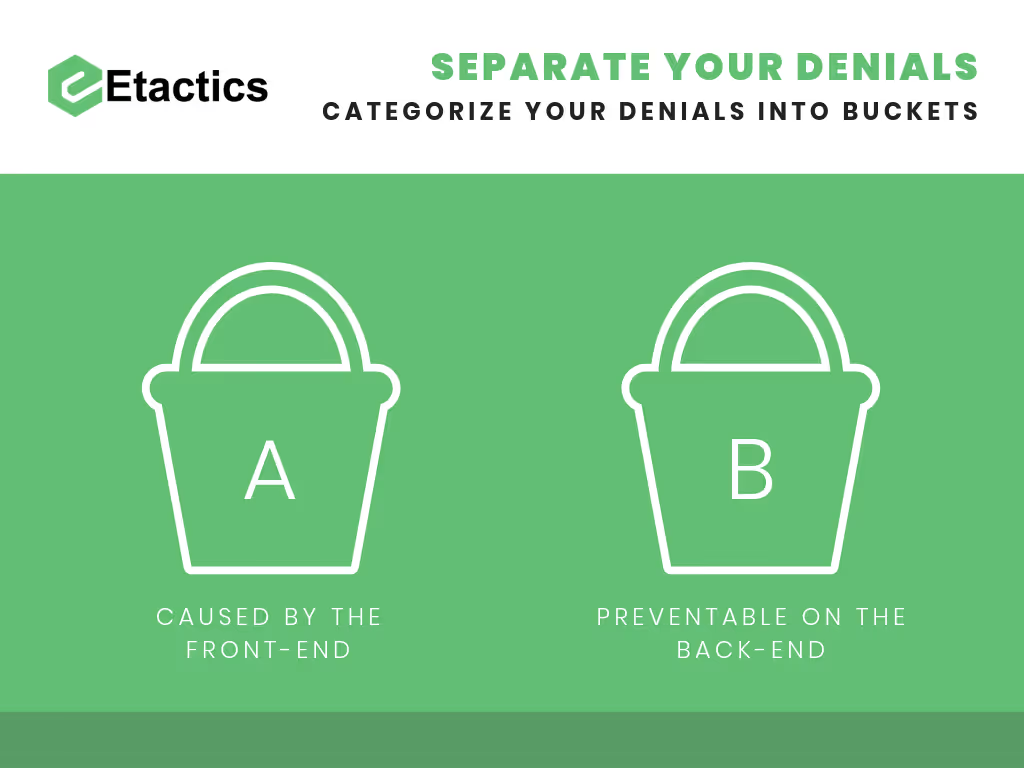

Separate Claim Denials into Buckets

Ask yourself the following question. When you initially receive denials, what’s your process for handling them?

There are two main types of denials, those that are preventable in the back-end and those that need attention when they occur. Instead of having your team work on your denials as they come in, place them separate them into two buckets…

- One bucket for preventable

- One bucket for front-end denials

Once you sort your claim denials into these two buckets, your back-end team can prioritize how they work and resubmit them.

Conduct Root-Cause Analysis

This preventative step is directly related to the one listed above. Now that you know which of your claim denials are preventable, you’ll also know where your bottlenecks are in your front-end.

The best part about receiving claim denials is that they list the reason why it came back to you. If they’re sorted into the front-end bucket, you immediately know how they got there.

By looking at each denial individually, you can conduct a simple root-cause analysis. This analysis will help determine your weaknesses in your front office and enhance your processes.

Automate Forms and Letters

When you’re filing for an appeal on claim denials, you’ll most likely need to fill out an appeal form or letter. This is tedious and takes precious time away from your back-end billing office.

What’s worse is that appeal forms and letters require a lot of the same information. Whoever is doing this task will likely become frustrated or even unmotivated.

To save them some time, research the revenue cycle companies who offer automatic appeal form and letter technology.

Cut back on your team’s manual efforts by offering automated alternatives for your most tedious tasks.

Conclusion

After reading each section I’m sure you’ve noticed a pattern. Most processes involved with preventing claim denials have automated alternatives.

These alternatives can save you and your team a lot of time but aren’t a magic wand. The best way to prevent claim denials is to use a mixture of automated tools and manual processes.

Use automated tools to complete your most tedious tasks but review everything manually to ensure it’s correct before resubmission.

Additional Readings and Sources

- https://www.beckershospitalreview.com/finance/7-strategies-to-prevent-claims-denials.html

- https://revcycleintelligence.com/news/exploring-key-components-of-the-healthcare-revenue-cycle

- https://www.physicianspractice.com/denials/front-desk-your-defense-against-claims-denials

- https://journal.ahima.org/2017/12/01/how-to-move-from-denial-management-to-prevention/

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.