Debt Collection Letter Examples: Sample Letters and Templates Included

If a borrower doesn’t pay their bill, then the collector buys these past-due payments from the business or creditor. They then try to collect what the person owes. To do this, they send debt collection letters.

.avif)

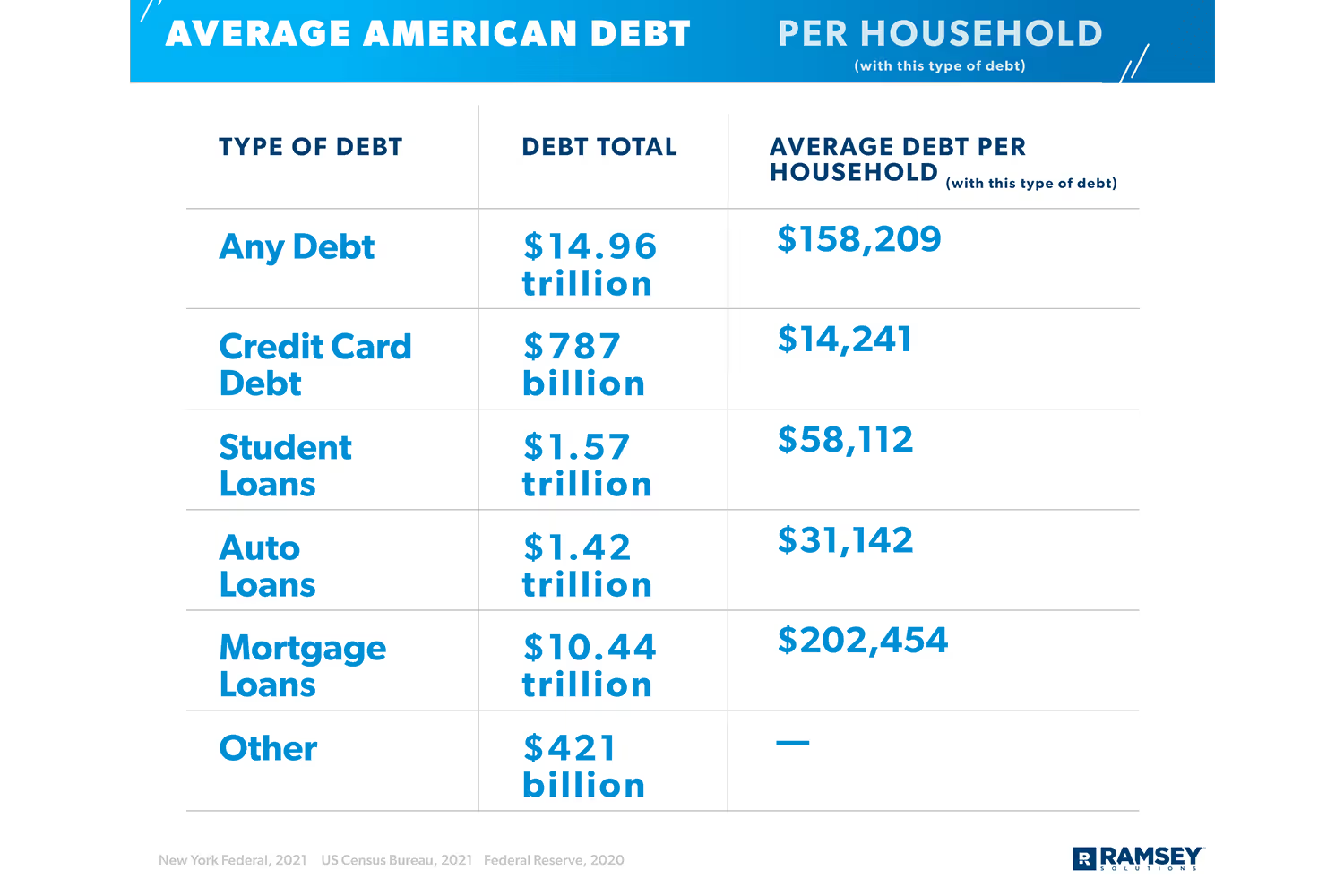

If you are living in debt, you’re not alone. In fact, 77% of American households have at least some kind of debt.

The total of any debt in the United States is $14.96 trillion. According to Ramsay Solutions, this is an average of $158,209 per household. Mortgage loans make up the majority of debt, followed by student loans, then auto loans, and finally credit card debt. There are other costs as well, but these are the most common.

Of course, people can manage these by making consistent payments to the organization they owe. For instance, homeowners make monthly mortgage payments to their lenders.

These bills become problematic when the borrower misses a payment or stops making them altogether. No one wants to end up in that situation, but the reality is that it can be hard to keep up with too many payments. This results in one-quarter of Americans who don’t pay their bills on time.

Enter: debt collectors. Although some people may associate debt collection with persistent calls and high-pressure tactics, there is a professional way to go about it. The collection process can simply be. well-timed reminder letter sent along with an invoice. Let's go over some examples of collection letter samples that can simplify your company's collection strategy.

What Does a Debt Collector Do?

But just in case you stumbled here looking for the definition, let me summarize. Debt collectors do exactly what it sounds like they do…collect debts. If a borrower doesn’t pay their bill, then the collector buys these past-due payments from the business or creditor. They then try to collect what the person owes.

Oftentimes, unpaid debts go unnoticed, leading to a negative impact on your company's operations. This is why many organizations opt to invest in a revenue cycle management (RCM) company. The automation included in this type of software helps smooth out the debt collection process in many ways. Including sending out compliant debt collection letters.

Understanding Debt Collection Letters

A debt collection letters reminds an individual that they owe money. The goal is that the person will finally pay, especially now that their bill is in the hands of a collection agency. After all, no one wants to deal with any potential legal action.

I’m sure you can agree. Even as a debt collector, you don’t want to handle potential lawsuits. But how do you get people to pay before it gets to that point?

What is the Purpose of a Debt Collection Letter?

Writing an effective yet ethical letter is the first step to initiating this process. You might be wondering what exactly I mean by “ethical.” It’s more than just writing a polite letter. As a debt collector, there are legal requirements that you need to follow.

If I had to guess, most people aren’t missing their payments simply because they don’t feel like paying. A more probable reason is that they have financial difficulties making it impossible to afford. Because it’s a sensitive situation, the government offers protections for people when it comes to collection agencies’ attempts to get their money.

Legal Regulations and Legal Actions to Know

The Fair Debt Collection Practices Act protects individuals from inappropriate and abusive behavior from debt collectors. This law states that collectors can’t…

- Lie about who they are, the amount owed, or potential outcomes

- Use abusive practices or harass the debtor

- Threaten to hurt the person

- Use obscene or profane language

- Repeatedly call or text the person

- Treat the person unfairly

- Tell anyone else about the money owed other than the debtor’s spouse

- Contact a debtor before 8 AM and after 9 PM unless the individual agrees

- Contact the person at work if they said they can’t receive calls there

- Continue contacting the person after they’ve written a request to stop

There’s a movie from 2009 called Confessions of a Shopaholic. The main character, Rebecca Bloomwood, owes a debt collector thousands of dollars. The collector, Derek Smeath, violates so many of these rules. He harasses her by repeatedly calling her personal and work phone, and he shows up at her apartment and place of work.

In one scene, Bloomwood is a guest on a talk show on live television. She doesn’t know that Smeath is in the audience. When the talk show host asks the audience for questions, he exposes Bloomwood’s debts in front of the entire audience and on live television.

Of course, the film is a comedy so they don’t focus on how he was breaking so many rules that the FDCPA would have protected her from. But it’s a good example of what collection agencies shouldn’t do.

How to Write a Debt Collection Letter

When writing an effective collection letter, it's important to communicate the urgency of the situation without coming off as rude.

A professional debt collection notice should simply state the purpose of the letter, the amount of debt, and inset payment options for a quick and painless process.

So now that you know the ethics behind contacting those who owe money, here are some effective debt collection letter examples that you can use.

Effective Debt Collection Letter Template

People likely already know that they owe money since they would’ve received a bill before it went to collections. Although, they might not know what the time frame is before this transfer happens.

The time it takes for an account to go to collections differs for lenders, creditors, and even by state. For example, Georgia’s foreclosure process period is just 37 days while New York’s can take up to 445 days. That difference is significant: a little over a month, versus well over a year.

Repossession on car loans usually starts by 60 days. Credit cards on the other hand usually go to an in-house collection department before going to a formal collection agency.

You get the point. Various factors contribute to the timeline for when a debt collector gets involved.

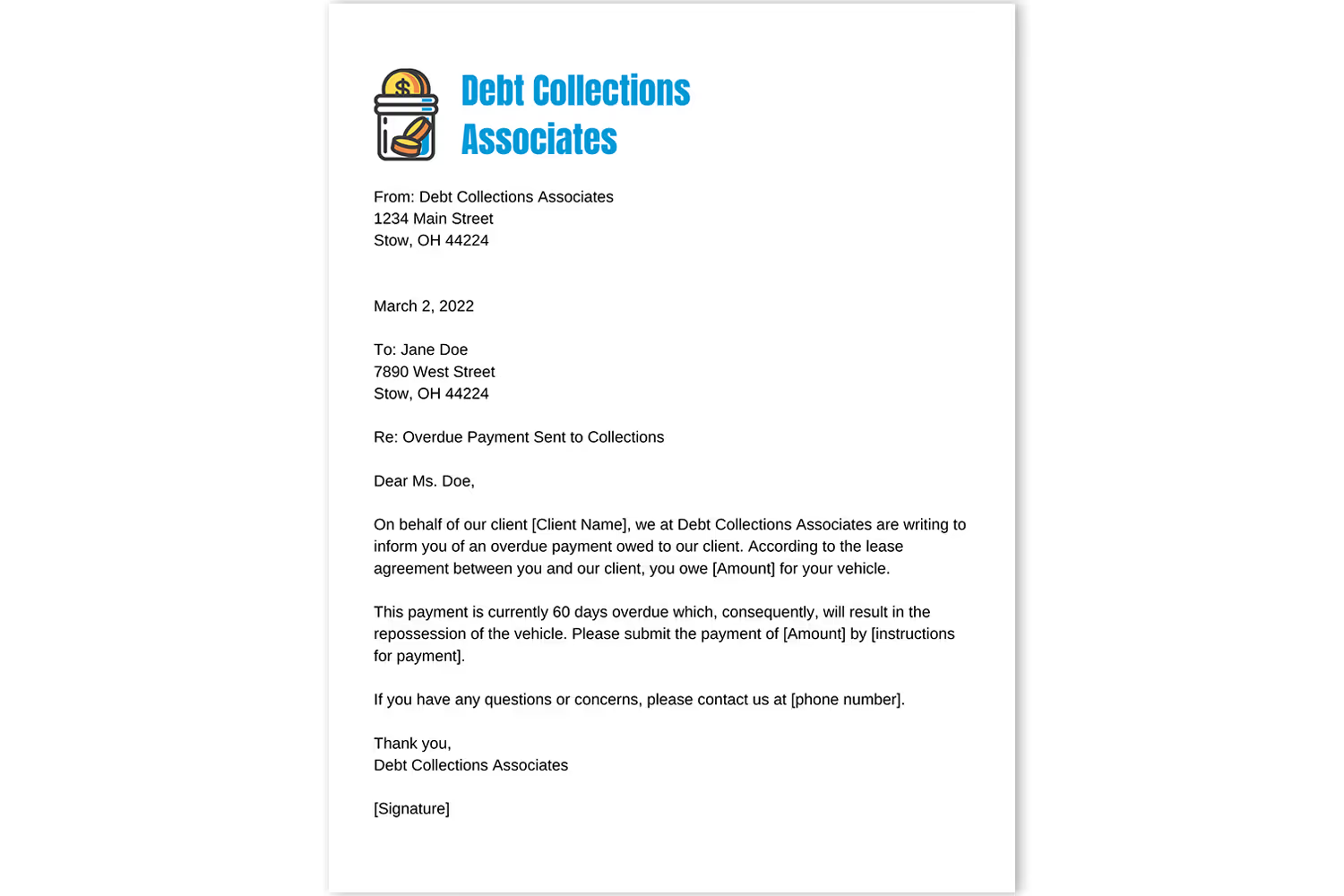

This is why you need to send an initial letter stating that you’re now responsible for collecting payment.

The sample above includes a space for the agency to state who they’re collecting on behalf of. This way, the person who owes knows why they’re receiving the letter. By including the amount, deadline, and instructions to pay, this individual knows how to settle their balance without facing the stated penalty.

Required Validation Letter From Debtor

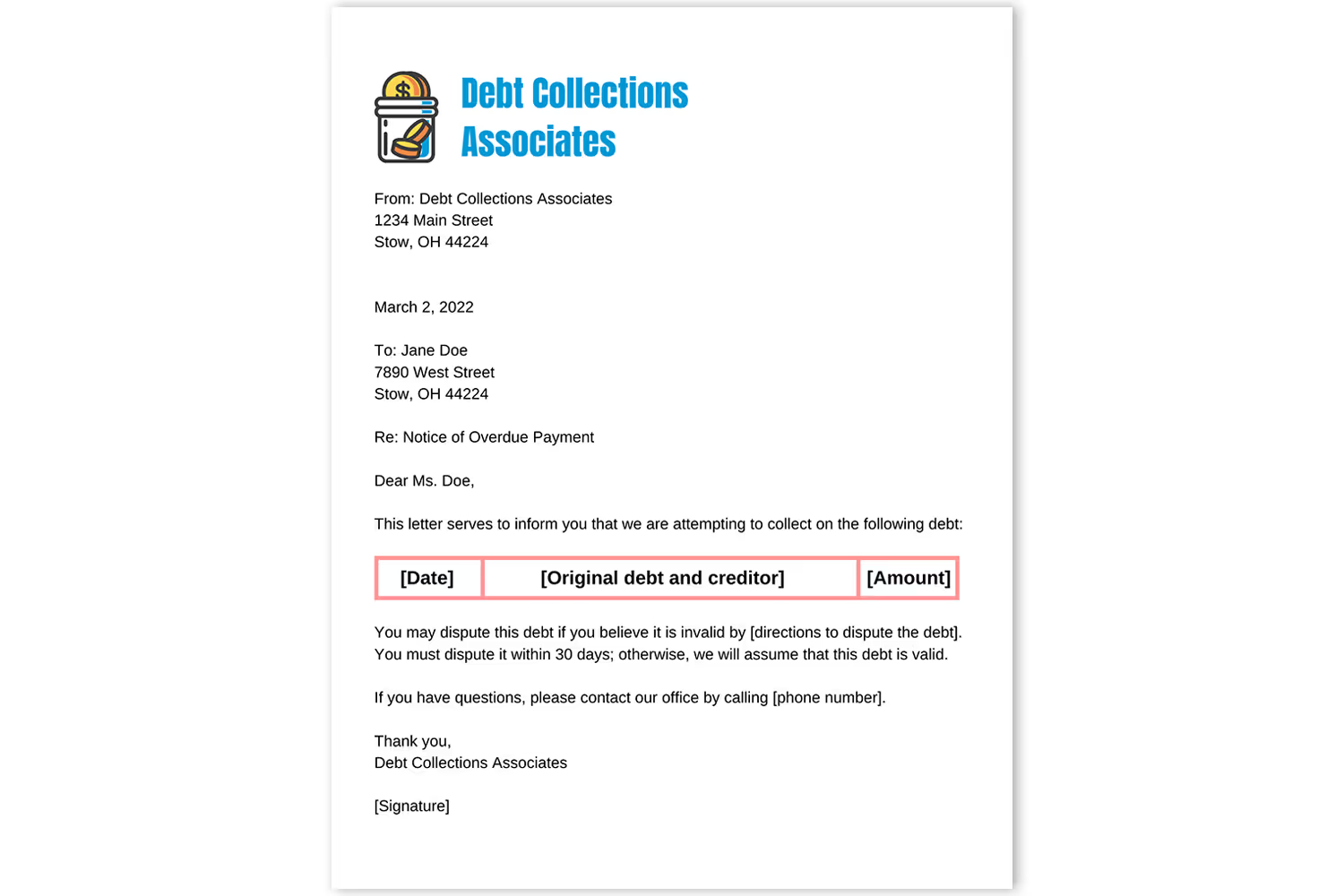

It’s a requirement that debt collectors send a validation letter within five days of first contacting an individual. These most likely include some of the same information as the initial debt collection letter example in the previous section.

However, there are a little bit more details that they need to include to qualify as a validation letter. By law, they must state…

- The name of the creditor/business that the person allegedly owes

- The amount owed

- That the individual has the right to dispute the debt and must do so within 30 days

If the person makes a dispute, then the collector must provide written evidence of the debt.

Depending on how you structure the first letter you use to contact an individual, you might not need to send an entire separate validation letter. As long as the initial one includes the required details by law, you’re all set.

You’ll most likely end up sending a letter specifically for this reason if you first contact the person by phone. Since they don’t yet have the information in writing when you call, you must send it to them within five days.

Reminder Collection Letter - Payment Plan Option

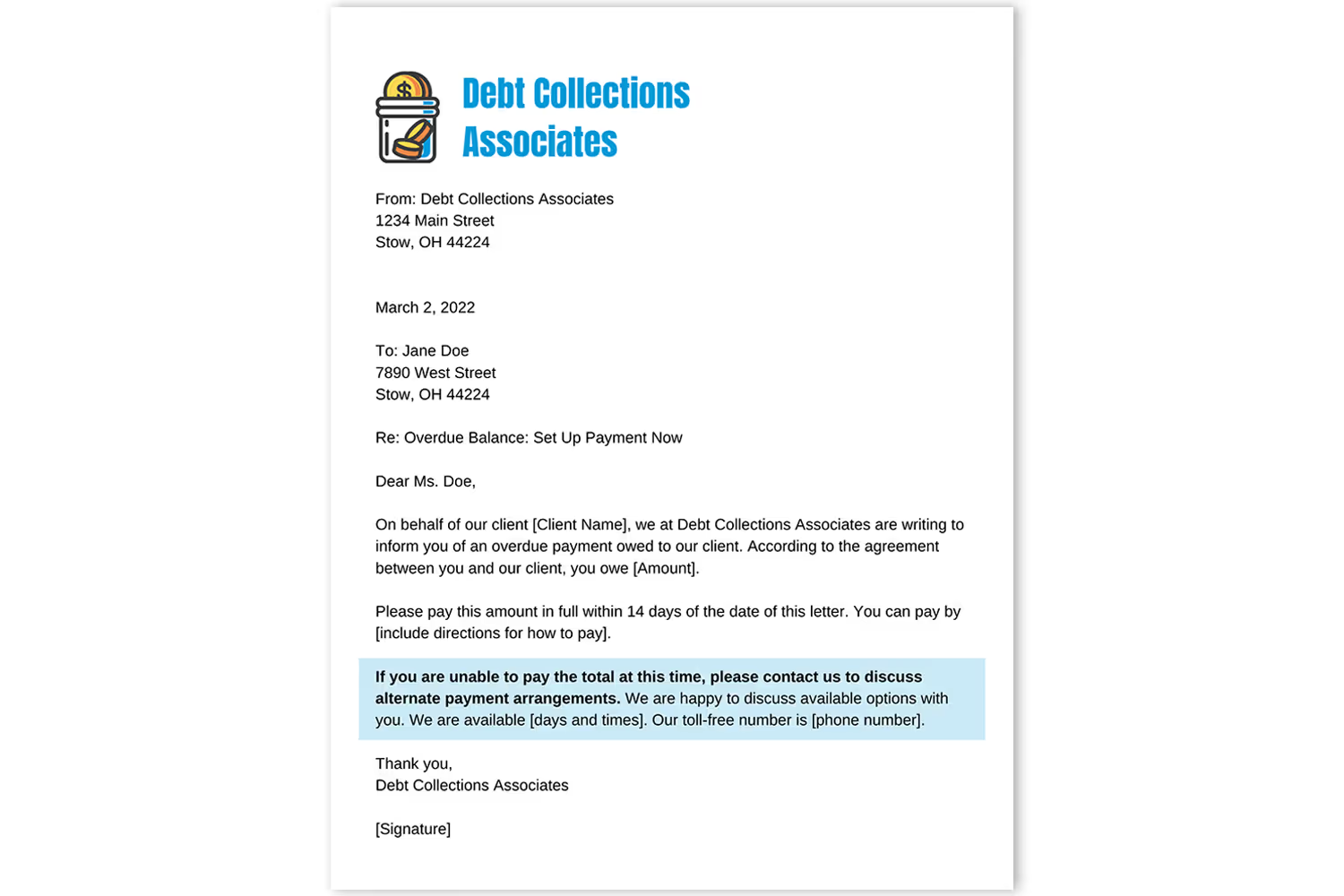

As I already mentioned, a reason why many debts go unpaid is due to financial difficulties. For instance, over 25% of Americans struggle to afford their medical bills. And over half of those people have no other debts besides these medical bills.

Because of the financial challenges, payment plans are a helpful way for both the person who owes and the organization that’s collecting. Since the person has avoided paying their bill for so long, they still might not have the money by the time it reaches collections.

Offering a way for them to make payments in increments helps them decrease their debts over time. Sure, it might not be the full amount that they owe you. But a little is better than nothing, you’ll receive the full payment eventually, and it isn’t as much of a hassle as going to court.

These plans will also help ease the anxiety that people have surrounding bills. 72% of Americans stress about money each month. So if they’re able to break up how much they owe at one time, it becomes more manageable.

Successful Debt Collection Email Sample Letter

Did you know that 99% of people check their emails everyday? So if you are looking for a way to reach your client quickly, look no further. Having an automated passed due email sent out periodically is an easy way to strengthen your organization's cash flow and accounts receivable process.

Include a direct subject line that quickly explains the content of the email. Similar to physical types of debt collection letters, you want to include the amount due as well as ways the client can make a payment. Include the best way to reach your company if they have any additional questions.

Final Notice Letter for Debt Collection Sample

Sometimes you have no choice but to take legal action. No matter what you try, you just can’t get the individual to pay.

It’s not like you can keep calling them until they’re so annoyed that they finally pay you. After all, that would go against the FDCPA. So what do you do?

You write a letter stating that this is their final chance to pay before you take legal action. This often gets referred to as a demand letter.

These shouldn’t come off as threatening, since the FDCPA protects people against threats. Instead, state that you’ve tried contacting them already, you have no choice but to pursue legal action, and that they can contact you with any concerns or questions.

Hopefully, this is enough to get their attention so that they’ll settle their bill before you have to go to court. But unfortunately, that’s not always the case. If they deny your claim that they owe money or they ignore the letter altogether, then you can take legal action by bringing the lawsuit to court.

In some situations, the recipient may request that you only contact their attorney. If that happens, then you must oblige unless their attorney fails to respond to you within a reasonable timeframe.

Solidifying an Effective Collection Strategy

Since debt is such a common issue, it isn’t unlikely that people will occasionally struggle to pay their bills on time. Making a payment a few days late until the next paycheck hits the bank is one thing.

But for it to turn into a month or longer is another story. When this happens, the organization that the person owes will likely send the account to collections. From there, the debt collector gets involved.

Since they likely won’t want to pursue legal action right away, they make the effort to get money from the debtor. After all, no one wants their credit damaged from their account going to collections.

Approaching those who owe money is a sensitive situation. There are most likely financial challenges involved, hence why it’s taking so long for them to pay. To protect these people from potentially abusive collection tactics, the government requires collectors to abide by certain practices.

So when these professionals write their letters to get payment, they need to structure them carefully. By following the tips of these debt collection letter examples, they’ll be sure to use effective and ethical practices.

Solidifying an Effective Collection Strategy

Approaching those who owe money is a sensitive situation. There are most likely financial challenges involved, hence why it’s taking so long for them to pay. To protect these people from potentially abusive collection tactics, the government requires collectors to abide by certain practices.

So when these professionals write their letters to get payment, they need to structure them carefully. Some companies choose to hire debt collection agencies to help them navigate legal proceedings. But for the rest of the general public, by following the tips of these debt collection letter examples, you can be sure your collection efforts are ethical.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.