15 Tips on How to Write Polite Payment Reminder Emails

So how do you construct the perfect message so that you’ll end up getting paid? Here are 15 tips on how to write polite payment reminder emails.

If people don’t pay their bills on time, most businesses wait before sending them to collections. For example, healthcare providers usually wait at least 90 days on average.

That’s good news for clients since they have a large window of time before a negative consequence.

But this could also make them brush their bill to the side. They know they have plenty of time to pay, so they don’t prioritize it right away. This could lead them to forget.

Of course, you don’t want to be waiting 90 days anyway to get paid. You’ll set the due date earlier than this so that you can collect revenue sooner. Chances are that you also send reminders as the due date approaches if you still haven’t received payment.

This way, you prompt the client to pay and they’ll remember they have an outstanding bill. There are different methods of reminders you can send such as by mail, text message, or email. Email may be one of the best of these three options since it’s instant and you can provide the most details, including the invoice itself.

When using this method, it’s important to write polite payment reminder emails. Using overwhelming and threatening late notice messages will just cause stress for the recipient. 60% of people are already anxious about their bills. Bombarding them with too many will increase frustration.

And not including enough details about their invoice can lead them to disregard the email. They might think it’s spam. Or if they lost their original bill, they no longer have some details they need to make the payment.

So how do you construct the perfect message so that you’ll end up getting paid? Here are 15 tips on how to write polite payment reminder emails.

Use a Clear, Non-Threatening Subject Line

The first part of the email that a recipient will notice is the subject line. This is what will grab their attention so they open and read the email.

You want the subject to be clear so that they know what it is: their payment reminder. But you also want to keep it non-threatening so you don’t overwhelm or scare them. You don’t want them to avoid reading the email, leading them to postpone or forget to pay.

Using a subject that sounds demanding won’t be effective. Imagine getting an email with the subject: “PAY NOW OR GET SENT TO COLLECTIONS”. This might freak you out, especially if you didn’t open the email right after you received it. They’ll start to panic about the financial impact this will have on them.

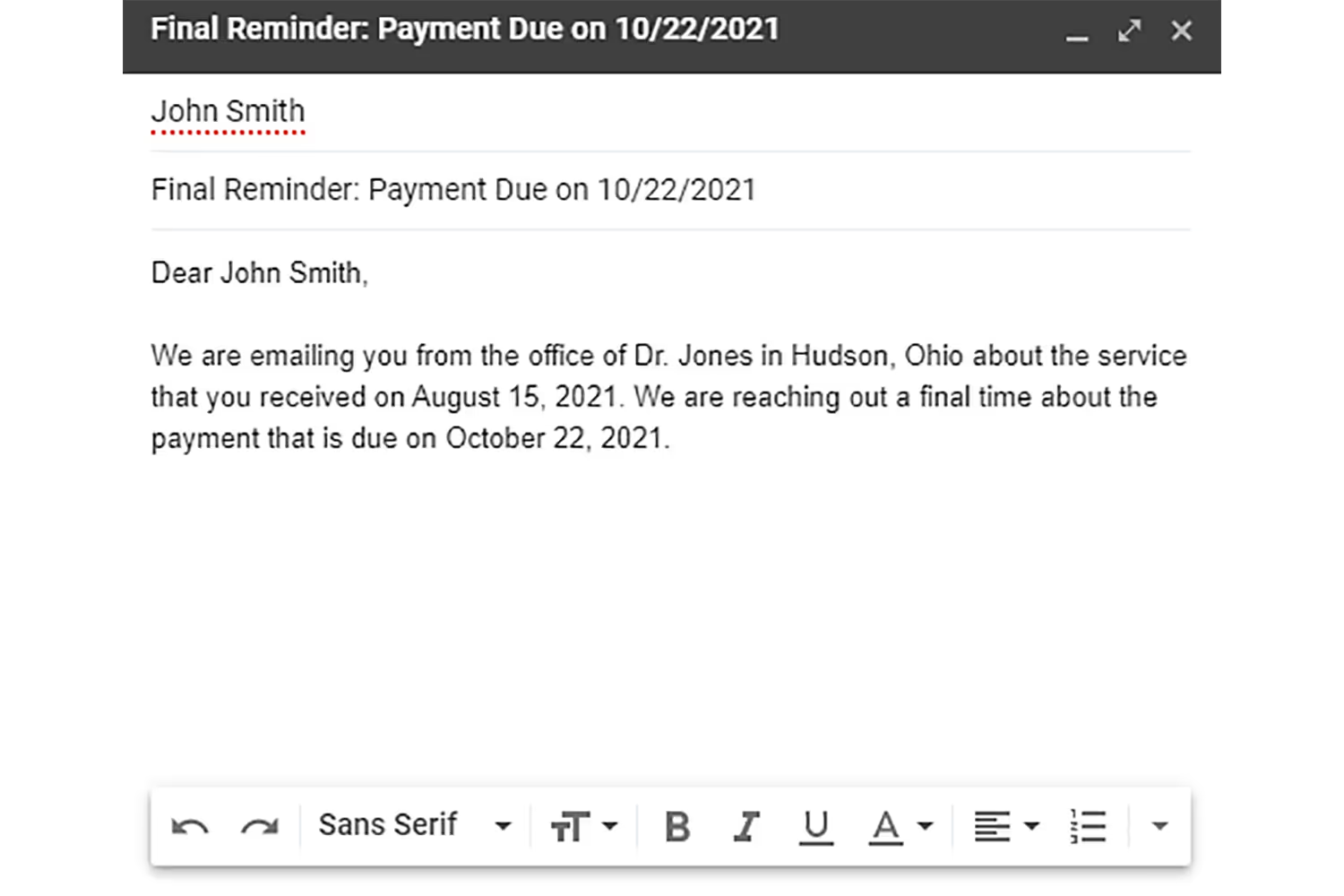

Instead, use a clear subject line that reminds them when to pay by. “Final Reminder: Payment Due on 10/22/2021” will grab their attention but not seem like someone’s intimidating them.

Have a Polite Introduction

After the subject line, you’ll need a polite introduction. This lets the client know who the email is from and what the payment is for.

Without introducing your organization, the client may disregard it. You must remind them at the beginning of the email so they remember they received services from you. This will grab their attention to continue reading about how much they owe, when to pay, and how to make their payment.

Keep The Copy Brief and Friendly

You don’t want to include so much text in your email that the point gets lost. Be friendly in your introduction, but then get to the point.

Focus on only including details about the client’s payment. This way you keep the recipient’s attention on the most important message.

Attach a Copy of The Invoice

Even if you’ve sent the invoice to the client already, it’s helpful to attach it to the email as well. If you do paper billing, they could’ve lost it or thrown it away by mistake. Or maybe it didn’t arrive if it got lost in the mail. If you do electronic billing, they may have missed the electronic notice.

Either way, it’s helpful to send their invoice again so that they have all the information they need to pay. However, always make sure that you send these using encryption so that the client’s financial information is secure.

Reiterate The Payment Terms

Aside from adding the invoice, you can also reiterate the payment terms in case they don’t open the attachment. State how much they owe, the due date, and who they need to pay (your practice).

Even though these details are on the invoice, repeating them in the email message adds emphasis so they remember to pay.

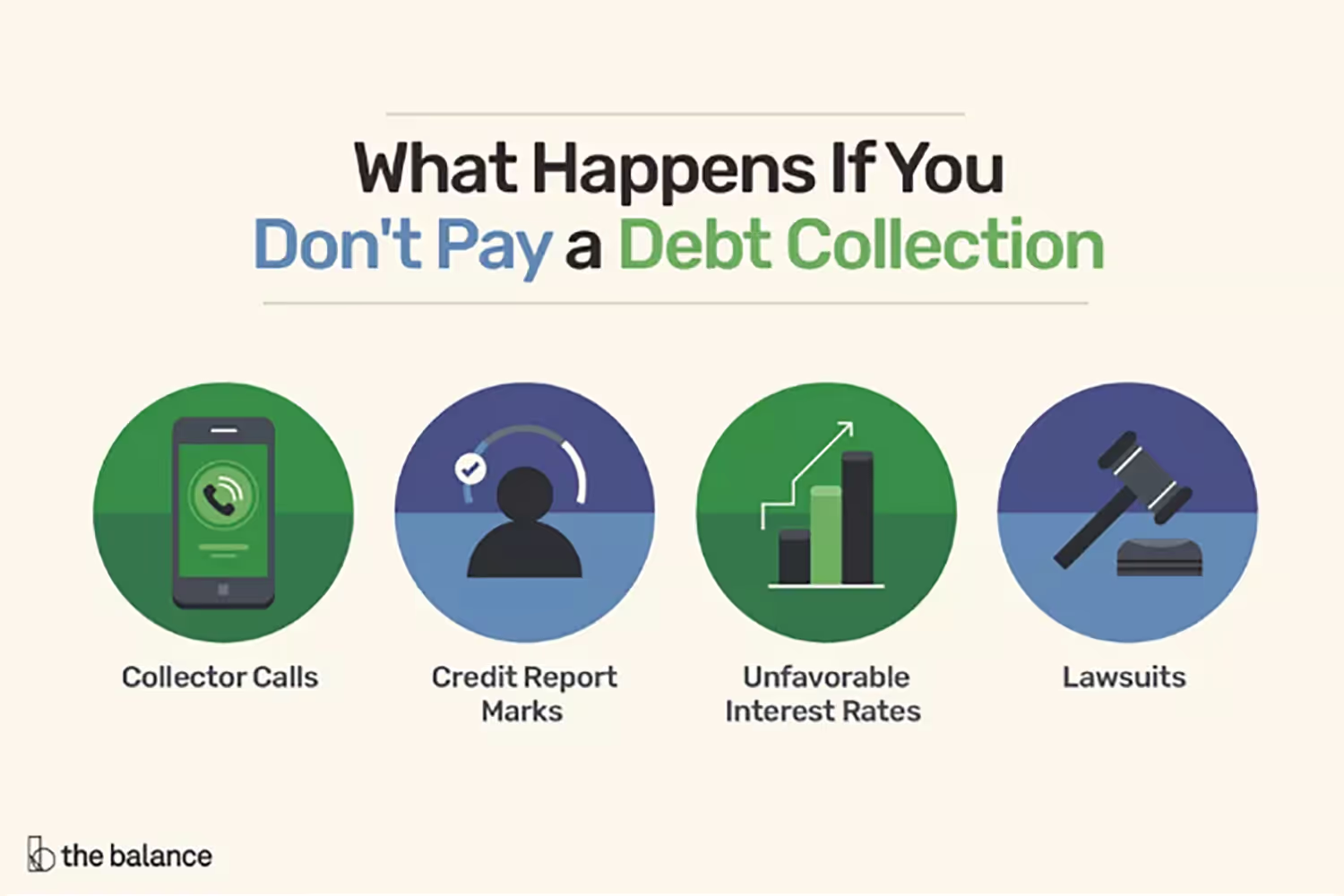

Explain The Outcome of Not Paying

So why do you want to send reminders in the first place? Besides wanting to get paid, you also don’t want clients to receive a penalty.

They might not realize the consequences of not paying on time. This is a chance to remind them of how it would impact them if they don’t. Maybe they wouldn’t be able to visit your practice anymore. Or worse, their debt gets sent to collections.

Again, you don’t want to sound threatening with this. But explaining any penalties serves as a reminder for why they must follow the steps in your email. And if they still don’t pay, then you can utilize these effective past due letters templates.

Don't Wait Too Long to Send

One mistake you can make with payment reminder emails is sending them too late. It isn’t polite to send a first one so close to the due date.

It would be frustrating to receive a reminder email too close that they’re scrambling to get their payment in before it’s late. Sometimes money may be tight and they need to wait until their next paycheck, so reminding them too late could put them in a bind.

Instead of waiting until right before the due date, give them enough notice in advance. You can even send out multiple reminders from the time that you send the first invoice so that they have plenty of time.

Have a Scheduled Emailing System

If you do send out period reminders, use a scheduled emailing system to keep the messages consistent. Sending at random intervals could lead to multiple emails going out too early where they still forget once it approaches the due date.

Using an automated scheduling system will release these messages at selected intervals. That way, you don’t bombard the client with multiple emails close together. Instead, they’re spread out between the invoice going out and the due date. This continuously reminds the client without giving excessive or minimal notice.

Send at an Appropriate Time

Speaking of when you should send payment reminder emails, also be aware of the time and day that you send them. People are less likely to check their emails on the weekend or during the evening.

You want these messages to be at the top of someone’s inbox so they don’t get lost. 23% of opened emails are within the first hour after delivery. After one day, the likelihood that the email will get opened is under 1%.

Because of this, it’s important to target the time and day that people are most likely to be checking their email. Instead of sending them at 5:00 on a Friday when people are logging off for the weekend, consider sending them on Monday at the start of the workday. That way, the person is most likely to see it after signing on.

Include a Convenient Quick-Pay Method

One helpful tool you can add to your polite payment reminder emails is a quick-pay method. Since you’re asking them to pay, it’s nice to give them a way to do it right then so they can stop worrying about it.

Especially with the more reminders you send, clients will get annoyed. Maybe they keep forgetting to write out a check and mail it, and they’re tired of having to hear from you. But if you include a fast way to pay, they’ll be thankful they can just get it over with.

Confirm Their Receipt

If a client makes their payment through the email you send, it’s necessary to confirm the receipt of it. That way the person knows that there’s no further action needed.

Even if they mail it in, you can still send a follow-up email once you receive it. This is just another way to confirm that the payment is complete and the client doesn’t need to worry about it anymore.

Direct Them to Other Payment Options

Everyone has a preferred payment method. Some people may want to use a traditional method rather than quick online options. Or they may want to set up a payment portal to do automatic payments so they don’t need to receive future reminders.

Whatever options you offer, it’s a good idea to include these in the email. This caters to all demographics whether they prefer online or paper methods.

Offer Your Understanding

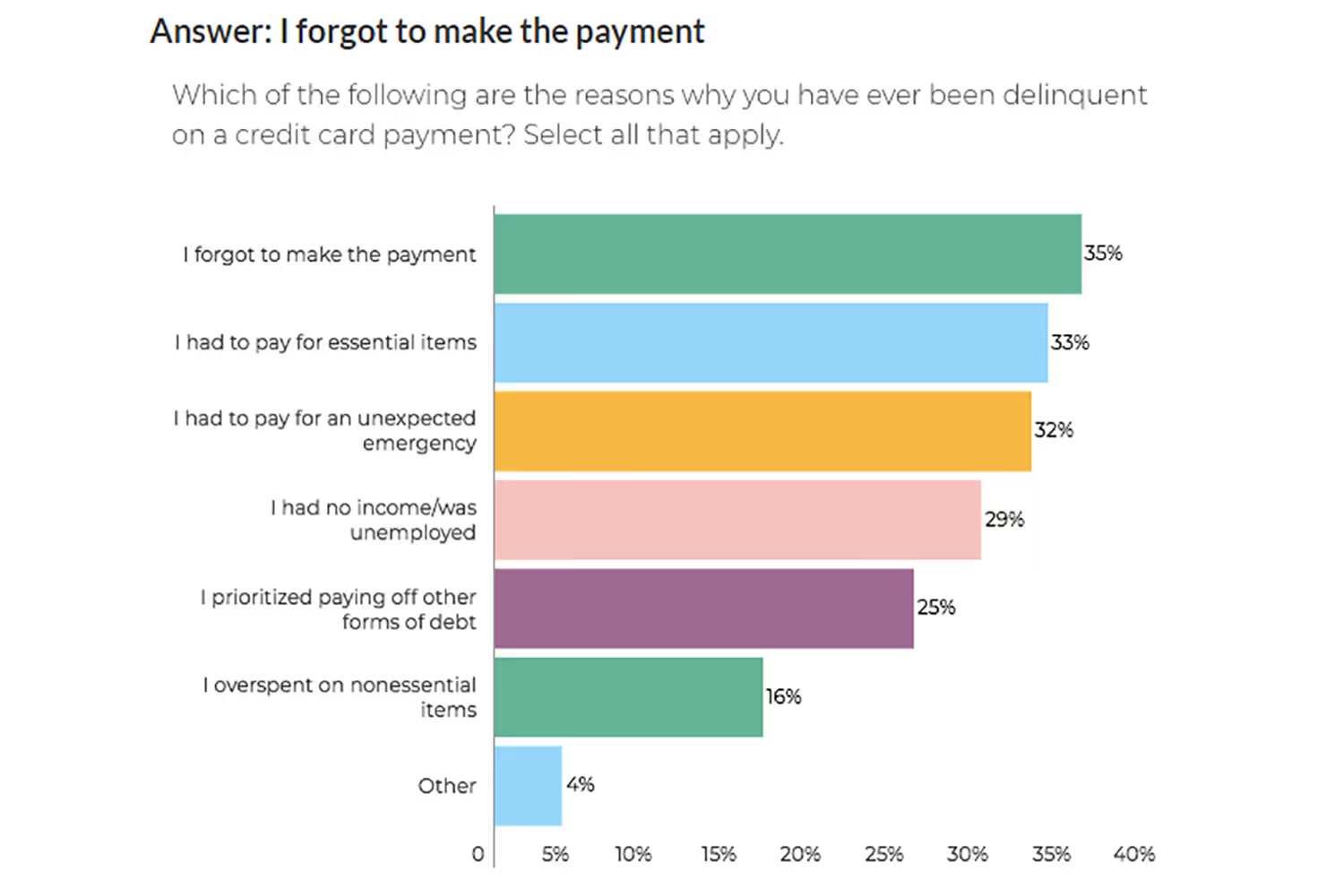

There are reasons why people have overdue payments. They may have simply forgotten. This is the top reason why people have delinquent credit card payments. Of all reasons for late payments, 35% of people said that it was because they forgot.

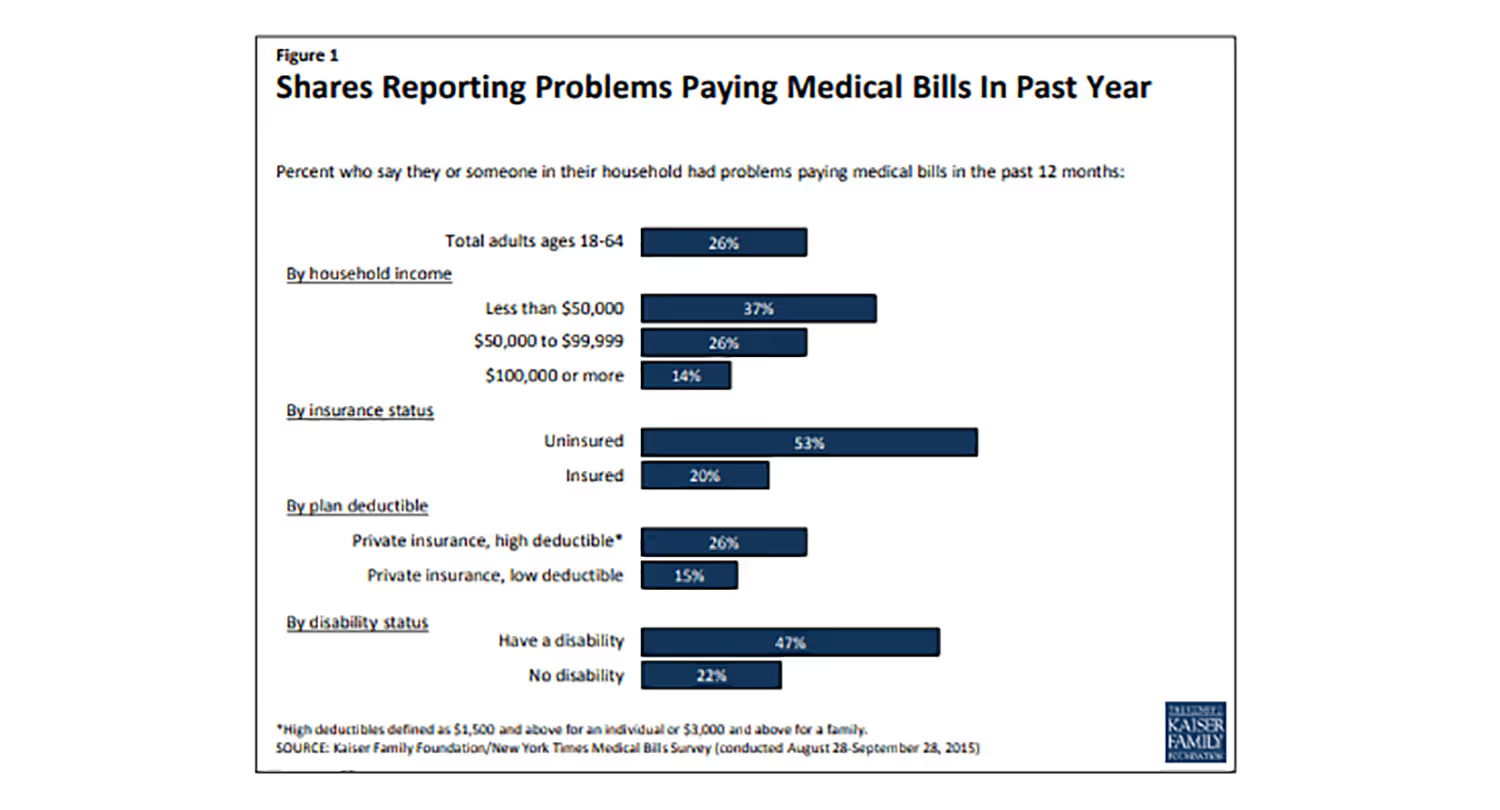

While this is a common mistake, others can’t afford to pay. 41% of working-age Americans either have medical bill problems or are paying off medical debt. In 2016, 26% of adults under age 65 said that they or someone in their household had trouble paying medical bills in the previous year.

Although specific to the healthcare industry, those statistics hold true across the board in some cases as well.

The point I’m trying to make is that. No one wants to be in one of these situations where they need a reminder. It may just cause more stress over debt. Because of this, it’s polite to be sensitive. Let them know that you understand they may have forgotten or are in a difficult financial situation.

This will make them feel less stressed knowing that you realize they may be struggling. And from there, you can provide details about assistance if they need it.

Connect Them to Payment Assistance

Once you show your understanding for those struggling to pay, it’s helpful to offer a solution. This reinforces your polite payment reminder email.

Rather than just acknowledging their struggles, you provide advice to help. This benefits them if they’re experiencing financial challenges and also your business so you get paid.

If you offer beneficial repayment plans, you can include those or have them contact your billing team. But there are also outside financial assistance and charity options. Since not everyone knows of these, it’s convenient for you to direct them to available resources.

Once they have these resources, they can get help sooner so you can get paid.

Direct Them to Your Billing Team

Finally, be sure to direct them to your billing team if they have any questions. Include the contact information so it’s easy for them to get a hold of the department when managing their bills.

Otherwise, they’ll get bounced around on the phone to reach the necessary assistance. This just wastes their time (and yours) so it’s a polite thought to include it in the reminder.

Conclusion

Since clients know that there’s a large time frame before facing a penalty, they might push off paying a bill. But as a business, you want to receive revenue as soon as possible.

As you send reminders, be clear enough so the client has all the details they need to get their money to you. It wouldn’t be helpful if they don’t know how much they owe or how they can get their payment to you.

But also be sensitive to possible scenarios for why they haven’t paid. You don’t want to stress or intimidate them so much that they end up switching practices. Since bills make a majority of people anxious, you need to be polite when bringing up that they haven’t paid.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.