35+ Costly Medical Bankruptcy Statistics

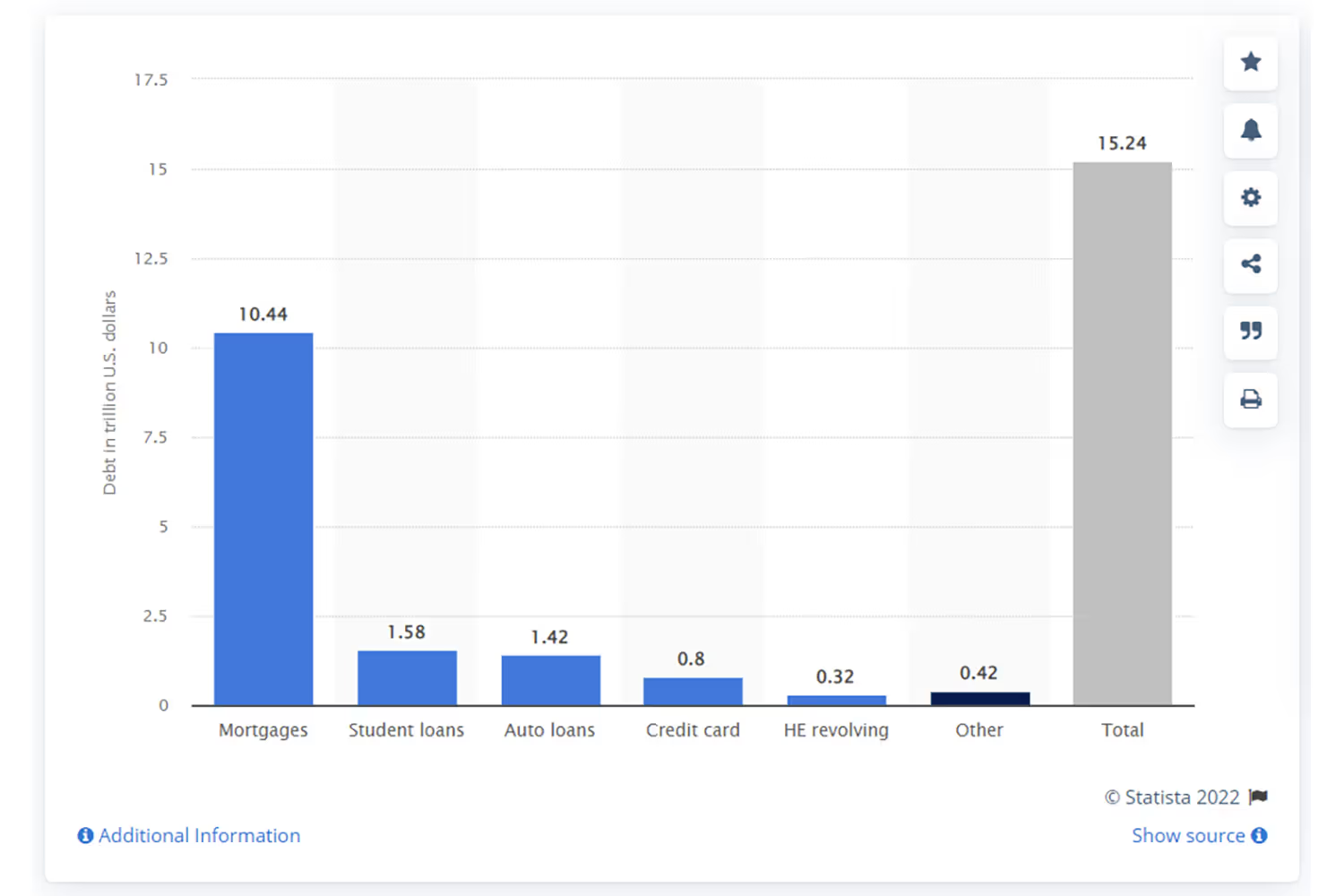

While it doesn’t makeup enough of the total US debt to end up as its own section on this graph, medical debt is a problem for a majority of Americans. Eventually, when these bills become too overwhelming, patients file for bankruptcy to relieve their debt.

Do you cringe when you hear the word debt? If I had to guess, hearing that word would make you imagine all of the bills that you have to pay off. Maybe this causes anxiety for you.

If so, you aren’t alone. 72% of people stress about money at some point each month. This has to do with the fact that 77% of all American households have debt, leading to around $15 trillion of debt in the United States alone.

What kinds of debts lead to that large of an amount? When answering that question, your mind might go to credit card payments, student loans, or your mortgage. These of course contribute to that total, with home mortgages being the most common.

But what falls into this “other” category shown on this chart? Another debt that many people owe is medical bills.

While it doesn’t makeup enough of the total US debt to end up as its own section on this graph, medical debt is a problem for a majority of Americans. Eventually, when these bills become too overwhelming, patients file for bankruptcy. Even worse, this financial problem may even lead to people skipping healthcare treatment.

So just how bad is this issue? Here are over 35 medical bankruptcy statistics that demonstrate this problem in healthcare.

The Cost of Healthcare

It’s becoming more difficult to manage bills because of the rise in healthcare costs. People were already struggling to afford their care. But now, they need to make even larger payments. So just how expensive are these costs to lead to something as severe as bankruptcy?

- The average cost of family premiums increased 54% and workers’ contribution increased 71% since 2009. Yet, wages have only increased 26% over the same period. (Kaiser Family Foundation)

- Out-of-pocket medical costs contributed to 26% of personal bankruptcies for low-income households in 2011. (Northwestern University)

- High-deductible health plans can have out-of-pocket costs up to $7,050 for a single person and $14,100 for a family. (The Balance)

- Half of the people with high deductible plans can’t afford a bill equal to their deductible without going into debt. (Policygenius)

- More than one-quarter of Americans struggle to afford their medical bills. (Kaiser Family Foundation)

- Estimates show that national healthcare spending will grow at an average rate of 5.4% from 2019 to 2028, reaching $6.2 trillion by 2028. (Centers for Medicare & Medicaid Services)

- The average hospital cost is $2,607 per day in the US. The average overnight stay jumps to $11,700. (Debt.org)

- As of 2020, the national health expenditure grew 9.7%, reaching $4.1 trillion. This translates to over $12,000 per person. (Centers for Medicare & Medicaid Services)

- Drug prices increased an average of 4.2% in 2021 for more than 900 brand-name drugs. This set a new record for increases. (The Commonwealth Fund)

Frequency of Debt

Because of these high costs of healthcare, people struggle to pay their bills. This, on top of the other common debts that they already have, leads to frequent rates of medical debt.

But delaying payment because they can’t afford their bills leads to more problems. Eventually, their bills get sent to collections which negatively impacts their credit.

- Debt collectors hold $140 billion of medical debt. A previous estimate was much more narrow at $81 billion. (Stanford Institute for Economic Policy Research)

- In 2021, 50% of Americans had medical debt. This was up from 46% in 2020. (Debt.com)

- In June 2020 alone, 17.8% (nearly one in five Americans) had medical debt in collections. (JAMA Network)

- The mean amount was $429.

- The average of this debt was highest in the South at $616, compared to the lowest in the Northeast at $167. (JAMA Network)

- It was also higher for poor zip code income areas at $677, versus $126 in rich zip code income areas.

- In states that immediately expanded Medicaid, the average medical debt decreased by 44% from 2013 to 2020. (JAMA Network)

How Common is Medical Bankruptcy?

This problem isn’t new. Even with increases in healthcare costs and challenges of insurance coverage, this issue has been around for decades. It’s not uncommon for people to think that the COVID-19 pandemic caused a rise in medical debt. However, the increase wasn’t as significant as some would think because it was already such a huge problem. Instead, there’s now more attention on the issue of medical bankruptcy.

And the problem has always affected more than just the lower class. According to the American Journal of Medicine, most medical debtors in 2007 had middle-class occupations, were well-educated, and owned homes. These people even had to resort to mortgaging a home to pay their health bills.

- A 2001 study in 5 states determined that 46.2% of bankruptcies were healthcare-related. (Am. J. Med.)

- In 2007, 62.1% of all bankruptcies were medical. (Am. J. Med.)

- 92% of these people had medical debts over $5,000 (10% of pretax family income). (Am. J. Med.)

- The share of bankruptcies attributed to medical problems increased by 49.6% from 2001 to 2007. (Am. J. Med.)

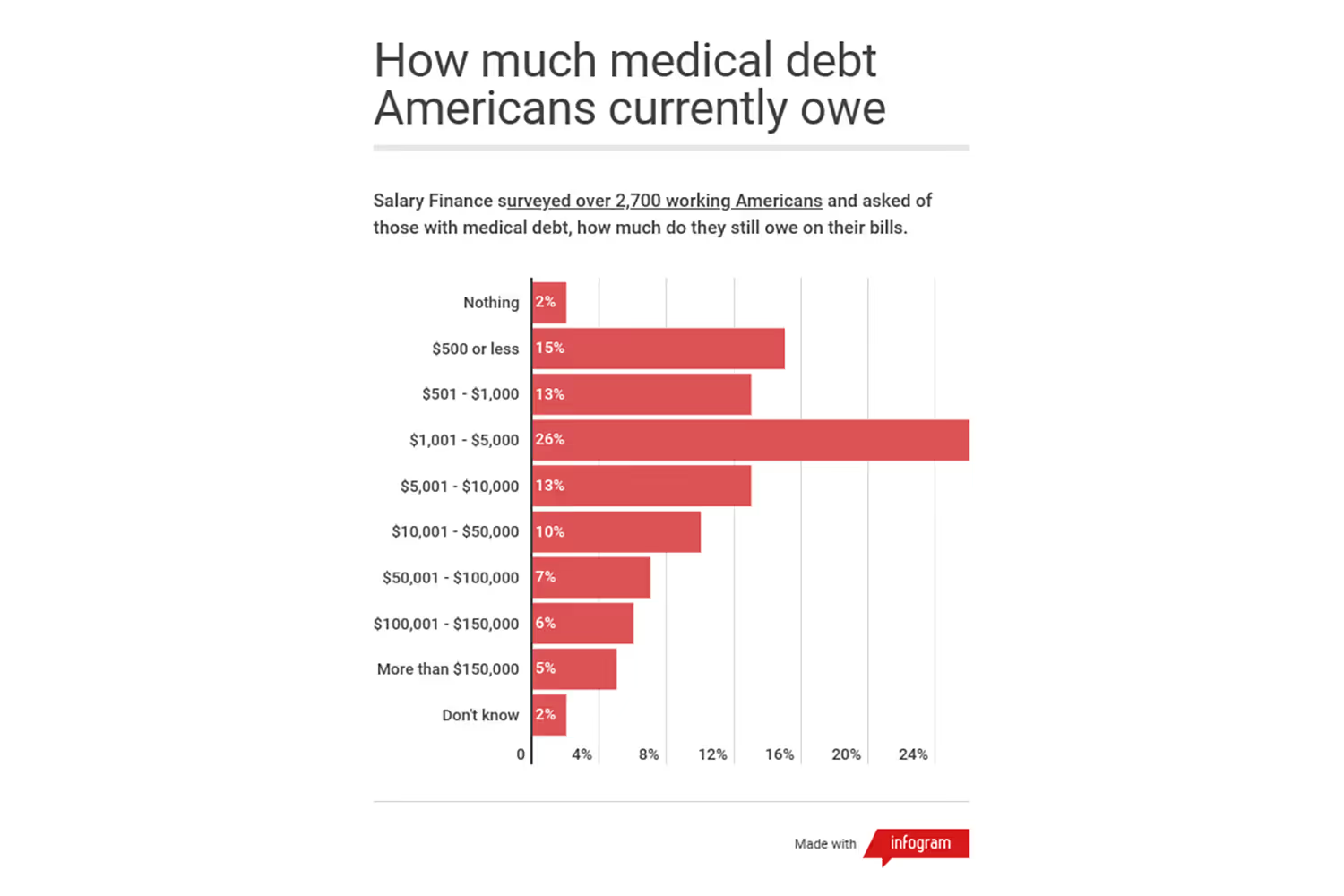

- A survey of working adults found that 54% of people with medical debt had defaulted on their bills. (CNBC)

- 28% owe over $10,000.

- Around 50% of people with medical debts had no other serious past delinquencies listed on their credit reports. (Consumer Financial Protection Bureau)

- In a given year, 19% said that a collection agency had contacted someone in their household. (Kaiser Family Foundation)

- 9% declared personal bankruptcy due to medical bills at some point. (Kaiser Family Foundation)

Effects of Debt and Bankruptcy

Financial hardships that come from medical bills lead to anxieties and postponing treatment. People may fear taking on new debts, or they can’t keep up with the current ones that they already have.

But it isn’t safe for people to sacrifice their health because of the cost, and financial anxieties don’t help. Because of this, organizations are intervening to alleviate the burden. Some nonprofits will pay these bills on behalf of the debtor.

Providers also want to get their money, which isn’t possible if their patients default on their payments. As a solution, more providers are setting up payment plan options for their clients so that they can pay over time and not turn to medical bankruptcy.

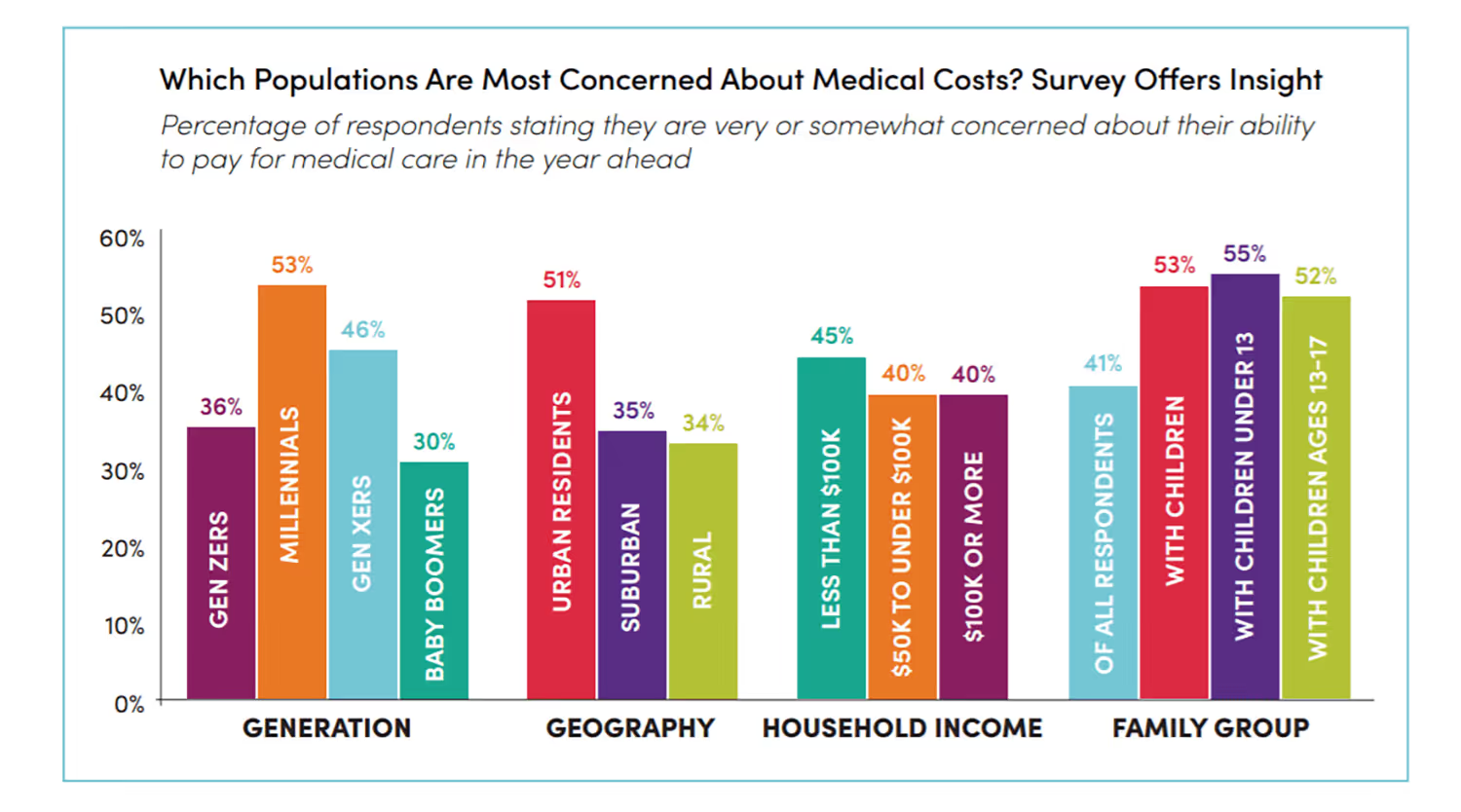

- 37% of survey respondents said that they are very or somewhat concerned that they wouldn’t be able to pay for healthcare in the coming year. (AccessOne)

- 53% of these respondents are families with children.

- 53% are Millennials and 46% are Gen Xers.

- Of around 25% of Americans ages 18 to 64 who reported having problems paying medical bills, 44% said that these bills had a major impact on their families. (Kaiser Family Foundation)

- Medical expenses adversely impact over two million people. (The Balance)

- People go into more debt trying to pay off their current health bills. 34% increase their credit card debt when trying to pay off this medical debt. (Kaiser Family Foundation)

- One in three Americans delays receiving care because of the cost. (Kaiser Family Foundation)

- Within a year, 51% of adults with employer health coverage said that they or someone in their household either skipped or delayed medical services due to cost. (Kaiser Family Foundation)

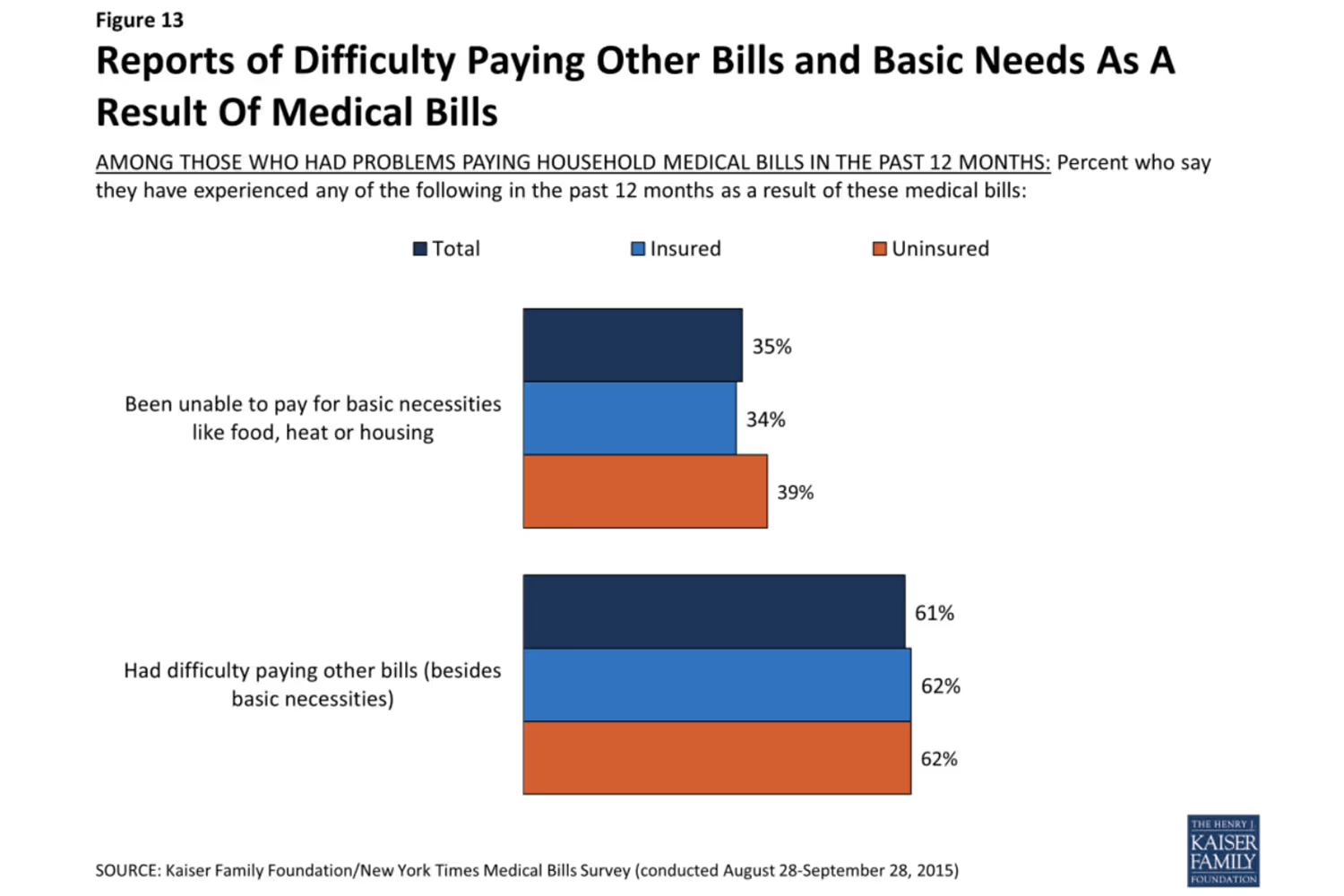

- 35% of people, whether insured or uninsured, struggled to afford necessities like food, heat, or housing due to problems with medical bills. (Kaiser Family Foundation)

- RIP Medical Debt is a nonprofit that buys consumer debt from healthcare providers using donated funds. The nonprofit received a gift of $2 million from Nomi Health. RIP Medical Debt used this to relieve $225 million in healthcare debt for 176,000 people. (Forbes)

- 17% of people who can’t afford their deductibles set up a payment plan with their provider. (Policygenius)

Conclusion

When considering why so many people are in debt, it’s common that people will think of costs such as houses, credit cards, or student loan payments. After all, these make up a majority of debts in the US.

However, healthcare is another contributing factor for many people. For half of those who owed on medical bills, they had no other serious debts. Sure, that might be a good sign that they don’t have other payments they owe on.

But their health bills are still difficult to keep up with. As healthcare and insurance costs increase, people struggle even more. When they can’t manage these payments, their accounts end up getting sent to collections. That certainly doesn’t help their financial situation.

Since this isn’t a new problem, many people have already faced this medical debt at some point. The financial challenge causes anxiety for so many people which just makes them delay or cancel care entirely.

As a solution, some organizations ease the burden by paying patients’ medical bills. The healthcare industry itself is also trying to help by allowing payment plans and focusing more on price transparency. If patients know their options upfront, they’ll be able to shop around for services that they can better afford. And when they can pay over time, they’ll better manage the costs so they can reduce what they owe without turning to bankruptcy.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.