The Ultimate Guide to Dunning Letters: What They Are, How to Write Them

If you’ve ever had an overdue payment before, you’ve seen a dunning letter. While being on receiving end of them isn’t fun, they’re a necessary part of every organization’s collection process.

If you’ve ever had an overdue payment before, you’ve seen a dunning letter. They are also known as dunning notices.

The term “dunning letter” is accounting jargon for a piece of writing you receive from a business that you’ve used services from, but haven’t paid for yet. Sometimes they’re included on the invoice in message form.

Either way, you’ve waited so long to pay for these services that you’re now considered a delinquent by the business because your balance with them is overdue.

The last part of that explanation is what separates this type of correspondence from other payment-related letters. You’ve put off paying for so long that the business you purchased goods and/or services from has no choice but to send you another notification that you still owe them money and what the total amount due is.

Being on the receiving end of a dunning letter isn’t something to look forward to.

Maybe you’ve waited to settle the outstanding balance because you’re still saving up to try and afford what you purchased. Or, maybe you’ve waited to pay off your outstanding balance because you’re still saving up to try and afford what you purchased. Or maybe you’re in charge of a business that’s waiting to collect your outstanding balances before paying off the debts you owe. Regardless of which side of the coin you’re on, receiving a formal dunning letter may be less than ideal.

They’re an essential piece in any well-oiled collection process. Yet, not every organization understands that fact. Even if you do, that doesn’t mean you’re currently writing and sending out effective dunning letters. So let's go over the dunning letter process, tips on drafting an effective dunning letter, and how dunning efforts can help you ensure timely collection.

Importance of Dunning Letters in Invoice Collections

Businesses have to stay on top of and in communication with their accounts that haven’t paid them yet or risk closing their doors for good. It’s that simple. Ignoring an outstanding payment here and there may not seem like such a big deal, but it can add up quickly and escalate to needing to take legal action.

Let’s say that you’re a business owner who charges your clients in the form of invoices. That’s nothing new, it’s a safe and common form of collecting payment.

Regardless of which medium you use to send your invoice, your client will pay you back the moment they receive it, right? That's not quite how the dunning process works.

Although that sounds nice and should be how the world operates, it’s not. Even if you have positive customer relationships, they might not pay you right away for a variety of reasons. It may take some extra time to collect the debt due to factors including:

- They haven’t received what they purchased yet

- Their accounting cycle hasn’t arrived yet

- Your payment options aren’t convenient

- They never received the invoice (maybe you sent it to the wrong address)

- They could never afford your services in the first place

I hinted at some of those listed reasons in the introduction. The point I’m trying to make is that it takes a surprisingly long amount of time to collect from people that you’ve sold to. There is a metric to define that amount of time and it’s called Days Sales Outstanding (DSO). The average DSO across all industries was 56 days in 2024.

In other words, sending dunning letters is an inevitable process that you’ll have to implement within your organization in an attempt to decrease your DSO.

After reading all of that you’re probably wondering two things about dunning letters and collections performance:

- When do I send these letters?

- Does sending dunning letters work?

When and How to Send a Dunning Letter?

A dunning letter shouldn’t act as the first correspondence you’ve sent to your clients who have outstanding balances. By this time in their financial journey, they should’ve received multiple payment reminders about their account status as it aged.

After all, sending reminders regarding their balance with you before their payment term ends lowers their chances of delinquency by 33%. But that still leaves a 66% chance that your clients won’t pay you on time.

Dunning letters go out in stages, based on how many days have passed since the due date…

- First dunning letter - 1 net day.

- Second letter - 30 net days.

- Third letter - 60 net days.

- Fourth letter - 90 net days.

- Final notice - 120 net day.

Although the process could go on for half a year, it doesn’t always have to. Further, there is room to experiment with how many days in between you wait to send subsequent letters.

At a certain point, the costs of the labor and time put into trying to inform the customer of an overdue account equals the amount of the outstanding balance itself.

At a certain point, the costs of the labor and time put into trying to collect from an overdue account equals the amount of the outstanding balance itself.

When that happens most organizations will give up on the process internally and send the delinquent to a collections agency.

Timing for Sending Dunning Letters

The short answer to that question is yes. If this arduous process didn’t work, I wouldn’t write a blog post about it. I’m being facetious.

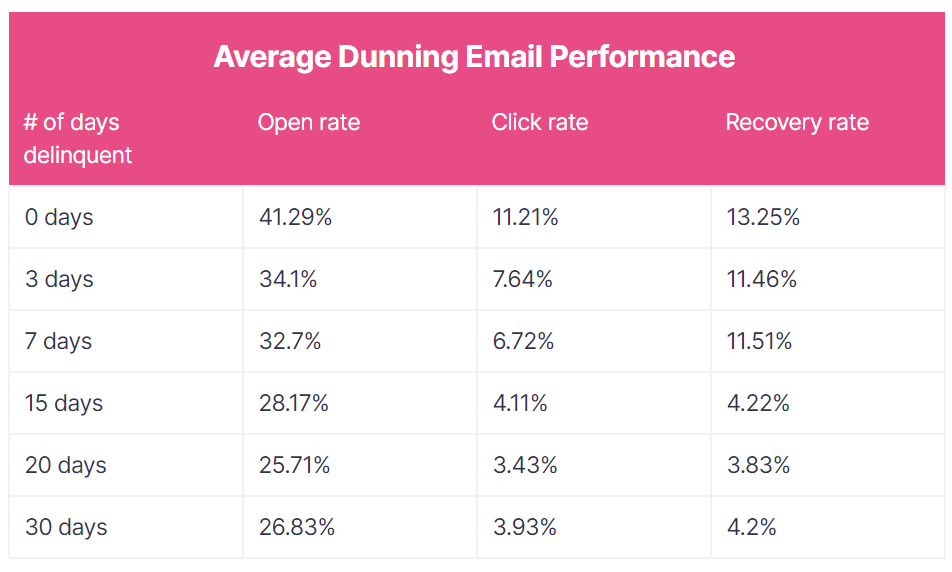

According to baremetrics, the recovery rate for dunning emails decreases by almost 10% by the sixth attempt.

Baremetrics’ chart above and the rates within it are a little bit different than what I’ve mentioned so far because it’s specific to email (more on that later). The biggest takeaway from this chart is that the “older” the outdated account balance, the less likely the chance of recovery.

Yet, I bet the recovery rate for each dunning email that baremetrics sent out was much higher than you imagined. Not to mention it was above 10% for the first three messages that they sent.

That’s worth the effort, if they hadn’t sent those messages at all they would lose out on a recovery rate of almost 50% from outdated balances. That’s a ton of money they were able to bring in.

What Should a Dunning Letter Template Include?

When you write a dunning letter, always write in a clear and concise way to foster direct communication. The hardest part about it is coming up with effective verbiage that not only tells the recipients why you’re sending them a letter but also prompts action.

At this point, you’ve already spent a lot of time and money trying to collect on your overdue balances. In other words, you want to make sure that whatever you send them in these last-ditch attempts to prompt payment works.

Methods for Sending Dunning Letters

Before you’ve started to even think about what you’re going to include in your dunning letters, you need to figure out the right medium.

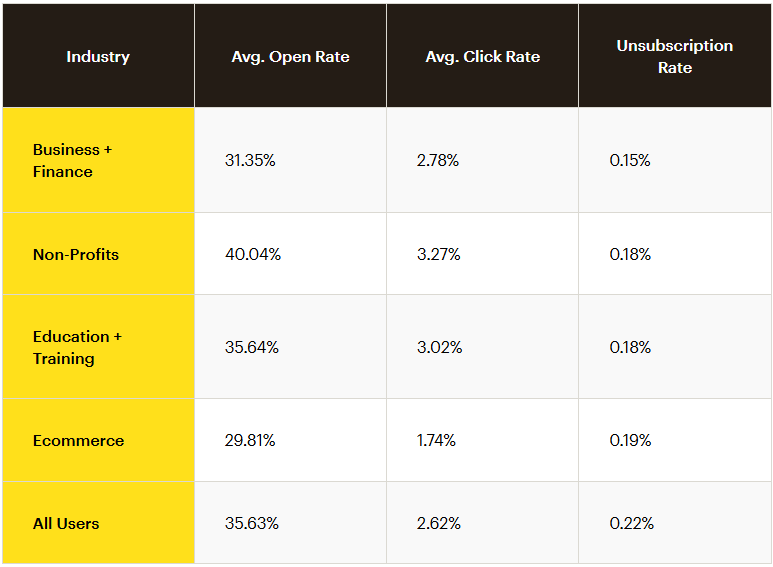

I hinted at the importance of how you choose to send this type of account notification to your clients in the previous section when I referenced Baremetrics’ study. Email is a popular medium to use, but they have an average click rate between 3.27% and 1.74% depending on your industry.

That’s low. Yet, the percentages given in the chart from the previous section are much higher. How is that possible?

The success of dunning letter emails you send depends on a mixture of what you include in your message and the demographic of the individuals you’re sending to. Different generations prefer different means of communication, which is a problem healthcare organizations are trying to tackle.

For example, if the majority of your clients are a part of the Baby Boomer generation, it’s helpful to know that they prefer face-to-face and/or voice communication. Maybe boosting your collections is only one phone call away. Others may prefer reminders that their payment is overdue via text messages or physical letters.

Choose the most effective mediums for who you’re sending your messages to and use them all at once.

Essential Elements of a Dunning Letter Template

Now that you’ve picked a few mediums through which you’ll send your dunning letters, it’s still not time to start thinking about what you’ll include within it.

Instead, you need to figure out what it’s going to look like. Regardless of which type of communication you choose, it has to catch the attention of your recipients.

The fact of the matter is that we’re all flooded with business communications daily. We drive to work in the morning and see billboards scattered across the highway, hear radio hosts recommend that we purchase something during their shows, and receive push notifications that block our screens while trying to navigate.

It’s estimated that we see between 6,000 to 10,000 every day. Your delinquent accounts aren’t immune to that statistic.

The point I’m trying to make is that the dunning letters you send aren’t that much different from advertisements. Of course, the purpose of an advertisement is to entice someone into purchasing a product. For a dunning letter, someone has already purchased something but hasn’t paid.

Yet, sending clients a letter asking them to pay in a stack of junk mail (whether via email or physically) could get lost.

In other words, you have to ensure that the way you style your correspondence to delinquent accounts stands out. Your dunning strategies should aim to remind the customer of any dunning fees while also aiming to retain their business. A strong dunning letter template should always include the following:

- Clearly state the total amount due and payment deadline.

- Provide payment options to facilitate timely payments.

- Invoice number/Account identification number.

- Late fees and/or potential consequences.

Using the Right Tone to Encourage Timely Payments

Even though it’s frustrating to continue to pursue collecting on your outstanding balances, that doesn’t mean that it should bleed into the content that they send you.

Commanding that your clients with overdue balances pay you as soon as possible isn’t going to work. Doing so will only make you come off like a 1920s loan shark or gangster (arguably less effective).

Coming off as threatening when asking for payment didn’t work for the mobster “Snakes” in the classic film, Angels With Filthy Souls. It’s more famously known as the black and white movie that Kevin Mcallister watches in Homealone when he’s first finding out that he may have the house to himself.

So what tone should you use?

To be able to write an effective dunning letter, you need to be able to change the tone of your message over time. The first series of letters that you send should focus on cooperation and use polite language. Think of an "I hope this message finds you well" tone. If the account continues to age while it’s overdue, the tone should shift toward one that’s more straightforward and fosters a sense of urgency.

The reality is that when an account reaches 120 days overdue, you’re most likely headed toward not pursuing further business with that customer. Thus, those last few letters will most likely only contain information about the account, amount due and original due date.

Irrespective of the tone, dunning letters should always include…

- Amount due

- Date of the unpaid invoice

- Invoice number/Account identification number

- Late fees and/or interest penalties.

The Role of Automation in an Effective Dunning Process

The dunning process can feel time-consuming if done manually, but businesses can address this by investing in automated accounts receivable (AR) efforts. Accounts receivable is the money owed to a business after they provide goods or services.

Automating the collection of these payments includes the process to send a dunning letter at the right time. This ensures a better cashflow while relieving some of the responsibility and tedious work from your accounts receivable management team.

Instead of manually tracking overdue payments, your team can set up a payment reminder system to:

- Schedule and send dunning letters out at key intervals (e.g. 30 days).

- Personalize messages with important information such as the invoice number, due date, and the amount due.

- Give clear instructions on how to settle the original invoice easier and (if possible) offer various payment methods for simplicity.

By incorporating automation into the dunning process, businesses can expect improvement in days sales outstanding numbers as well as increased cash flow.

Amplify Your Collection Process

Dunning letters are an essential part of every business’s collection process. It would be great if your clients paid you the moment you sent them your invoice, but it’s not that easy in the real world.

Sending this type of correspondence isn’t the hard part, it’s prompting action through the traditional dunning process that makes things difficult. All of the factors that I discussed in this ultimate guide help you collect from your delinquent accounts so that you can close outstanding balances while not losing money on time and effort. Dunning letters can significantly shorten the formal collections process.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.