30+ Mind-Boggling Health Insurance Claim Denial Statistics

Well, submitting claims doesn’t guarantee that a doctor will receive payment. Unfortunately, many claims end up denied. To provide the point I’m trying to make, here over 30 health insurance claim denial statistics.

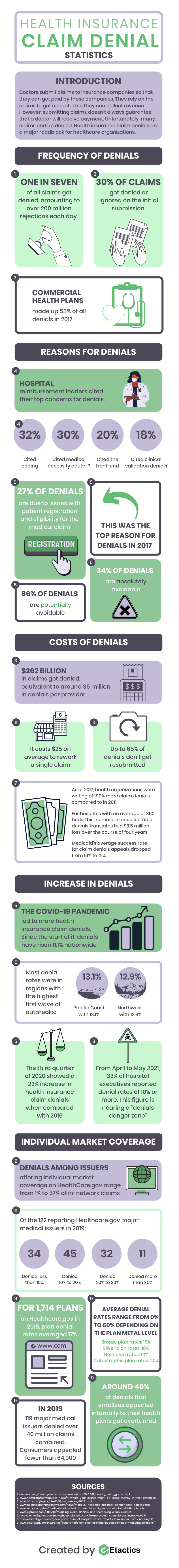

Doctors submit patient claims to insurance payers so that they can get paid. They rely heavily on their patients’ claims to get accepted so they can collect revenue and increase their bottom line.

Sounds simple, right?

Well, submitting claims doesn’t guarantee that a doctor will receive payment. Unfortunately, many claims end up denied. Health insurance claim denials are a major roadblock for healthcare organizations…even if they submit appeal letters.

To provide the point I’m trying to make, here over 30 health insurance claim denial statistics.

Frequency of Denials

- One in seven of all claims get denied, amounting to over 200 million rejections each day. (AARP)

- 30% of claims get denied or ignored on the initial submission. (HBMA)

- Commercial health plans made up 58% of all denials in 2017. (HFMA)

Reasons for Denials

- Hospital reimbursement leaders cited their top concerns for denials. (Healthcare Finance)

- 32% said coding

- 30% said medical necessity acute IP

- 20% said the front-end

- 18% said clinical validation denials

- 27% of denials are due to issues with patient registration and eligibility for the medical claim. This was the top reason for denials in 2017. (AJMC)

- 86% of denials are potentially avoidable and 34% are absolutely avoidable. (AJMC)

Costs of Denials

- $262 billion in claims get denied, equivalent to around $5 million in denials per provider. (HFMA)

- It costs $25 on average to rework a single claim. (CIPROMS Medical Billing)

- Up to 65% of denials don’t get resubmitted. (HFMA)

- As of 2017, health organizations were writing off 90% more claim denials compared to in 2011. (Revcycle Intelligence)

- For hospitals with an average of 350 beds, this increase in uncollectable denials translates to a $3.5 million loss over the course of four years. (Revcycle Intelligence)

- Medicaid’s average success rate for claim denials appeals dropped from 51% to 41%. (Revcycle Intelligence)

Increase in Denials

- The COVID-19 pandemic led to more health insurance claim denials. Since the start of it, denials have risen 11.1% nationwide. (AJMC)

- Most denial rates were in regions with the highest first wave of outbreaks: (AJMC)

- Pacific Coast with 13.1%

- Northwest with 12.9%

- The third quarter of 2020 showed a 23% increase in health insurance claim denials when compared with 2016. (AJMC)

- Between April and May 2021, 33% of hospital executives reported health insurance claim denial rates of 10% or more. This figure is nearing a “denials danger zone.” (Revcycle Intelligence)

Individual Market Coverage

- Denials among issuers offering individual market coverage on HealthCare.gov range from 1% to 57% of in-network claims. (Kaiser Family Foundation)

- Of the 122 reporting Healthcare.gov major medical issuers in 2019 (Kaiser Family Foundation):

- 34 denied less than 10% of claims

- 45 reporting issuers denied 10% to 20%

- 32 issuers denied 20% to 30%

- 11 issuers denied more than 30%

- For 1,714 plans offered on Healthcare.gov in 2018, plan denial rates averaged 17%. Averages ranged from 0% to 60% depending on the plan metal level. (Kaiser Family Foundation)

- Bronze plan denial rates were around 15%

- Silver plan denial rates were around 18%

- Gold plan denial rates were 14%

- Catastrophic plan denial rates were 20%

- In 2019, 119 major medical issuers together denied over 40 million claims. Consumers appealed fewer than 64,000. (Kaiser Family Foundation)

- Around 40% of denials that enrollees appealed internally to their health plans got overturned. (Kaiser Family Foundation)

Conclusion

The frequency of denials can vary upon different factors, such as by insurance company or insurance plan.

Some rates are nearly 0% while others are as high as 60%. But there are many that are approaching a dangerous zone of denial rates.

During the COVID-19 pandemic, rates began increasing. While an 11.1% increase may not sound like much, it leads to billions of dollars in denials. Submitting claims is expensive enough, not to mention the cost of having to resubmit a claim.

Because of these higher rates and costs to resubmit, many providers choose not to resubmit and are unable to collect their revenue.

As healthcare insurance claim denial rates continue to increase, it’s even more important that doctors are meticulous with submitting their claims.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.