Denial Code PR 31: What it is & How to Handle it

If you get a claim denial back, say a common claim such as PR 31, you might be wondering, “How do I know what the denial reason is?” Let’s start by going over what a denial code even is.

When it comes to denial management in medical billing, the U.S. experiences large market sizes each year.

In fact, according to the U.S. Healthcare Denial Management Markets, in 2021 denial management reached a value of $3.54 billion. And experts say that this could rise to almost $6 billion dollars by 2027!

If you’re reading this and you’re in the medical billing field, I’m sure I don’t have to spell out why these numbers seem to be on the rise. If you’re new here or looking to get into the industry, here are a few reasons.

This is maybe obvious, but how about the fact that there is a growing number of medical claim denials? But let’s get a little more specific here.

Here are some of the top reasons for claim denials according to a survey by Experian:

- 48% Authorizations

- 42% Provider eligibility

- 42% Code inaccuracies

- 37% Incorrect modifiers

- 35% Failure to meet submission deadlines

- 34% Patient information inaccuracy

Additional reasons for an increased amount of claim denials are errors in medical billing and healthcare claims, the need for better standardization, and the lack of trained professionals. So if you get a claim denial back, say a common claim such as PR 31, you might be wondering, “How do I know what the denial reason is?” Let’s start by going over what a denial code even is.

Denial Codes and Clearinghouses

Okay so we know that claims can sometimes come back with denial codes, but what are they and how do you read them?

In the medical billing industry, denial codes are messages sent back from an insurance company that specifies why they cannot accept the claim. These codes are part of a standard format and have hundreds of reasons why a claim may not be able to continue in the revenue cycle.

These codes are a problem for medical billers for a few reasons.

Number one, if the insurance company is not able to accept a claim… Well, then your practice is not getting paid. At least not on time. That’s where the second problem arises. Billers may sometimes have to wait for days on a claim. If that claim has an error, days can turn into weeks before it returns to the biller with a denial code.

Assuming this practice doesn’t use a clearinghouse they then have to take the time to correct their issue, send the claim back out, and cross their fingers they don’t have to wait another couple of weeks just to figure out they need to make more adjustments. All the while, missing out on revenue.

So obviously we all want to avoid denial codes, but sometimes running into them is inevitable. Ideally, you are utilizing a clearinghouse before sending your claims straight to the insurer. The beauty of filtering your data through a third-party organization like a clearinghouse, is that instead of waiting days or weeks to find out if your claim has an error, you only need to wait hours. Then you can quickly fix the issue and have the corrected claim sent on its way!

But even if you get back the claim denial in record time, you still need to be able to read it. Claim adjustment reason codes (CARCs) are going to be your best friends in this situation. This is where you can find the reason for the denial. Denial code PR 31, which I mentioned earlier, is one of the more common codes a medical biller might see.

In case you’re interested, a few other common codes we’ve broken down include…

What is Denial Code PR 31?

I keep mentioning denial code PR 31, so without any further adieu here it is.

First, if you’re wondering what the ‘PR’ stands for, it is ‘patient responsibility’. Codes that start with ‘PR’ bill on a patient level, who is medically liable (or sometimes to the secondary insurance).

PR 31 specifically means that the patient isn’t found as a member of the insurance company in question. Whether this means the insurance number isn’t submitted correctly or the patient information did not get entered correctly, credentials are not adding up.

Another reason you may receive this claim denial is if you send the information to the wrong insurance company. No matter the reason, if you see this code on your claim, it’s best to understand that there is some sort of issue with the verification process.

How to Handle PR 31 Denial Code

So you get back a PR 31 denial code and don’t know where to start. You’re sure you entered everything correctly, do you really have to go through all of that paperwork again?

Here are some steps you can take to make sure you cover all of your bases.

First, check the previous date of service notes if there are any available. If the patient has gotten any denials before, there could be information there that can pinpoint exactly what the problem is without you having to go full Nancy Drew.

If you can’t find any previous notes, you should then check the patient's eligibility with the insurance company. They may not have insurance through them in the first place. If you find that the payer actually insures the patient, you should check your software next.

This means going through the information you entered and making sure there are no typos in the patient’s name or policy number. Note that it’s common for female patients last names to change after marriage. If this is not updated through their insurance company information, this can cause a PR 31 denial code.

If you find an error in entered information, or with the patient’s insurance status, that’s good news for you! Fix these issues and resubmit your corrected claim.

If you check everything and it still all looks good, you can contact the patient to double-check that all of the information is correct and/or call the insurance company to ask for a reprocess.

If you need to call the insurance claims department to find out the correct details before reprocessing, here are a few helpful tips to navigate through the issue with a representative…

- See if the representative can find the patient through the policy number.

- If they are not able to find the patient through the policy number, ask them to try to find their first name, last name, and date of birth.

- If the representative is still unable to find the patient, have them check the social security number, telephone number and address.

- Ask for the claim number.

After any corrections, make sure to resubmit all open claims for this patient.

Should I Care About Denial Code PR 31?

So, let’s get to brass tax. Should you care about denial code PR 31? Relax, the short answer is, “Yes.”

It would be a shame if you got this far into the blog post only to find out that it really didn’t matter in the grand scheme of things.

The truth is that receiving denials also means you’re not receiving money. Healthcare claim denials have a direct, negative impact on your bottom line.

But, just how much of an impact does PR 31 have?

Well, usually a payer will choose CARC 26 or 27 to indicate that they know the patient, but that their coverage lapsed.

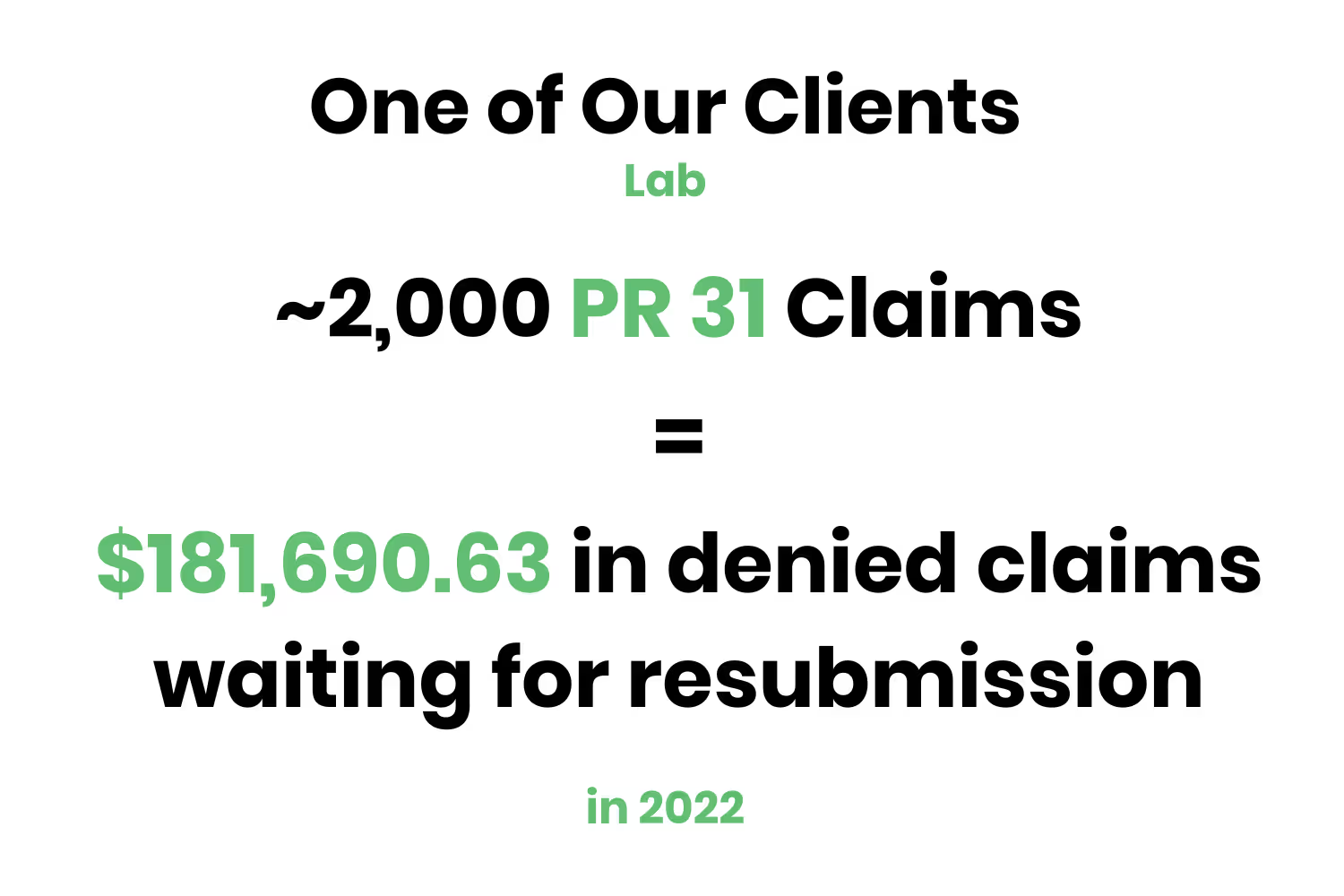

For example, one of our larger labs had roughly 2,000 denials during the entire year of 2022.

Of course, that doesn't mean that these denials aren't expensive. When denied for this reason, payers will zero-pay the claim and the provider will get paid nothing!

The larger lab referenced earlier had $181,690.63 worth of denials in 2022! The key takeaway here is to make sure you are verifying a patient's coverage with a payer using an eligibility tool before sending out the claim.

That will prevent staff from needing to figure out the patient's insurance later and rebilling the claim.

Conclusion

With large amounts of claims to sift through day-to-day, it is an unreasonable expectation for medical billers to be able to catch all mistakes. The bottom line is this: the best way to make sure you collect on revenue, is to have someone else worry about making sure your claims are correct before sending them to the payer.

Revenue Cycle Management companies are available to manage your claims as well as any denials they may find. This tool utilizes a checkpoint system that ensures the identification of any errors in coding plus correction prior to submitting. This is otherwise known as claims scrubbing.

Having an RCM at your disposal allows your staff to focus on the big picture. Relieving your team from having to worry about monotonous day-to-day administration tasks allows them to better focus on more critical endeavors. Patient responsibility claims can be tricky to collect on, so make sure you are able to equip the right tools to optimize your reimbursement from payers!

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.