Denial Management in Healthcare: An Ultimate Guide

In this blog we go through denial management in healthcare from top to bottom in the name of helping you increase your revenue.

There were nearly 50 million denied healthcare claims in 2021. Based on the total number of in-network claims submitted, that averaged out to a 17% denial rate.

I know what you’re thinking, “That was back in 2021, right after a pandemic. There’s no way that that number is accurate to a post-pandemic industry.” Well, I have some more bad news for you. A more recent study found that the total denial rate increased by 3% more in 2022 than in 2021.

In other words, healthcare claim denials are a plague that every healthcare organization has to not only deal with but also try to figure out ways to manage them.

But, in our 20+ years of business as a medical claims clearinghouse with a focus on denial management, we’ve noticed a pattern. The denial landscape has gotten so out of control that some healthcare organizations just ignore them entirely and write them off as losses at the end of the year.

This all sounds like a nightmare, doesn’t it? I’ll admit that the last few paragraphs paint a pretty dismal picture.

However, just because the majority of the industry has a hard time managing denials doesn’t mean that there isn’t a solution. The key is implementing a solid healthcare denial management process.

That’s just one of the key topics we’re going to cover in this blog. We’re going to go through denial management in healthcare from top to bottom in the name of helping you increase your revenue.

Financial Impact of Solid Denial Management

We’ll get to the different types of denials and how they occur in a moment. Before we get there, let’s talk about how impactful a solid denial management process is to healthcare organizations.

After all, what’s the point of going through and fixing denials if there isn’t much of a payoff? That would be a bad business decision at that point.

The truth is that claim denials are one of the biggest financial bottlenecks that hinder the growth of healthcare organizations.

Let’s work through a theoretical example to help explain that last statement.

Say you’re a doctor at a 5 doctor practice. Based on the industry average, you see about 7 patients per day. If we take the overall denial rate from 2022 that we discussed in the introduction of this blog, 4 claims per week from the patients you see would get denied.

Let’s say that the other 4 doctors at the practice see the same amount of patients daily. Upscaling the math leaves us with 20 denials per week or 80 per month. That’s 11% of your practice’s monthly revenue left on the table.

The truth is that most small practices can not afford that big of a monthly “expense” and oftentimes have to close their doors because of it.

Finance experts suggest that businesses should set aside around 15% of their total revenue for payroll expenses alone. The industry average denial rate makes that number practically unobtainable.

Okay, let’s say that you’re not ignoring the denials that come through your organization.

You try to stay on top of the influx of denied claims by reviewing each of them, assessing whether they could get appealed, and resubmitting them. Usually, this process is a full-time job. In other words, manual denial management is an expense to help manage…expenses. Talk about a cost center.

Easy solution…make sure every claim that you submit is clean and formatted correctly before submission to an insurance organization.

Unfortunately, it’s unrealistic and unattainable to NOT receive any healthcare claim denials. No such thing exists because some denial types are unavoidable.

The key is to shoot for a low denial rate around 2% or lower. To achieve that, you need to make sure that you have sound processes on your front-end before claim submission and back-end when a claim comes back to you with a denied status.

Achieving and implementing processes on both sides of the claim management coin requires a solid understanding of the types of denials, how and where issues occur.

Different Types of Denials

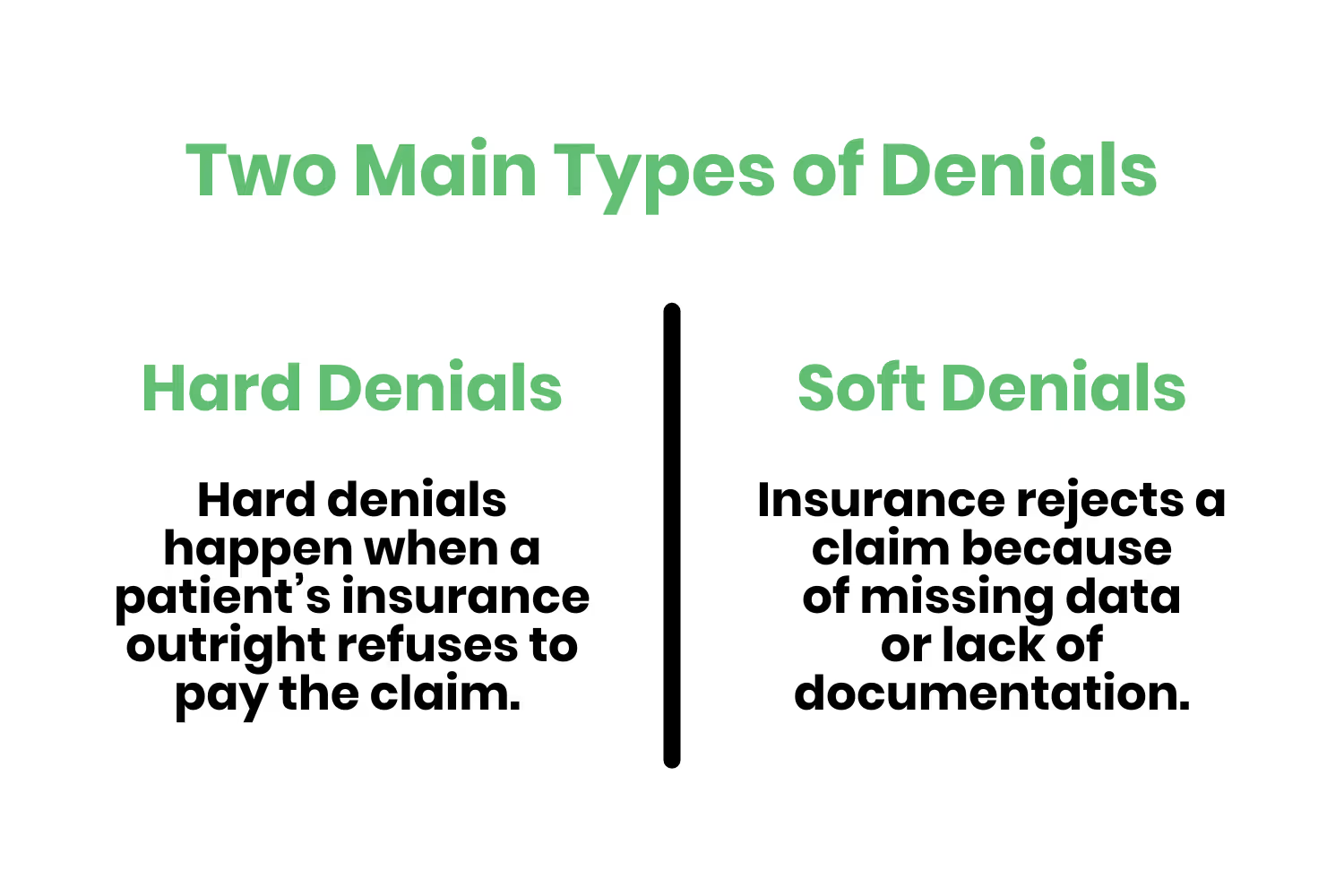

So, how is it possible that some denials aren’t avoidable? Well from a high level, there are two main categories of denials; soft denials and hard denials.

Hard denials happen when a patient’s insurance outright refuses to pay the claim. This usually happens for insurance claims for services that aren’t covered.

When a hard denial comes back to your organization, going through an appealing process won’t cut it. There’s no revenue to recover from with hard denials because the insurance company won’t pay you for services that their client/patient isn’t covered for. In other words, hard denials are always written off as losses.

A soft denial is where the opportunity to recover revenue exists. Soft denials happen when an insurance reviews a claim that a patient has coverage for and rejects it because of missing data or lack of documentation. Soft denials are temporary. Providers can reverse their ruling and receive the balance owed by the insurance. In this case, the provider has to make necessary corrections on the soft denied claim and resubmit the same to the insurance.

Now to answer the question you’re thinking of, “What type of denials do most denied claims fall under?” I have good news for you. The majority of denied claims come back with rejection codes that fall under the soft claim bucket.

In other words, you can overturn most of the denials you’ve received and recover the majority of revenue tied up in them.

Common Denial Reason Codes

Although it’s frustrating to receive denied claims from insurance, they’re obligated to provide you with a reason for non-acceptance.

Of course, if they told you the reason and let you know where the error was within the claim sent it would be too easy. Insurances send denied claims back with “reason codes” attached to them. The industry term for these reason codes is Claim Adjustment Reason Codes (CARC). CARCs are formal and determined and distributed by X12. The only problem is that there are several hundred of them.

Luckily, we’ve helped healthcare organizations manage their denied claims for a few decades. In other words, much like I mentioned in the introduction to this blog post, we’ve noticed a pattern.

There are common denial codes that healthcare organizations tend to see more often than others…

- CO 4: The code for the procedure isn’t consistent with the modifier used. Or, that a necessary modifier is supposedly missing.

- CO 16: The claim received lacks information or contains submission and/or billing error(s) needed for adjudication.

- CO 18: Exact duplicate claims or services.

- CO 45: The fee exceeds the maximum allowable amount for a service charge. Or, the fee exceeds the contracted fee arrangement.

- CO 97: The benefit for a service is in the allowance/payment for another service that was already adjudicated.

- CO 151: The information submitted in the claim doesn’t support the frequency of services.

- CO 197: Precertification/authorization/notification absent

- PR 31: The insurance couldn’t find the patient as a member.

- PR 177: Patient doesn’t meet eligibility requirements

- PR 204: The services, medicines and/or equipment aren’t covered under the patient’s current benefit plan.

That’s a ton of codes and definitions to try to understand, so let’s put them into more digestible buckets like we did with hard and soft denials…

- Inaccurate coding

- Missing information

- Incorrect modifiers

- Duplicate claim submission

- Inaccurate patient information

- Prior authorization issues

- Eligibility issues

Inaccurate Coding

Inaccurate coding is one of the most common forms of soft denials because of the intricacies associated with clinical, billing and administrative data. At a very high level, these denials happen due to human error.

However, the more we uncover about the coding aspect of medical claims, the more intricate it becomes.

Medical coding is a process that a professional coder goes through. This process involves converting everything that occurred during an encounter with a patient into a billable claim. The truth is that most healthcare organizations either have a team of professional medical coders on staff or they outsource this aspect to a third-party organization.

The intricacy associated with medical coding doesn’t exist with deciding how to handle the process, though. It exists within the process itself. You see, clinical, billing and administrative data get converted into alphanumeric codes including…

- Current Procedural Terminology (CPT)

- Healthcare Common Procedure Coding System (HCPCS)

- International Disease Classification (ICD)

To make matters worse, insurance also puts additional pressure on the medical coding process because of their timely filing limits. A timely filing limit is a deadline that insurance companies place on their acceptance of a claim based on the date of service.

The amalgamation of different types of code types with the added pressure of timely filing limit deadlines opens the door to errors.

Missing Information

Missing information in a claim that comes back as a denial is a fairly straightforward fix. If you didn’t include the information of what’s needed in a claim before submitting it to insurance, of course, it’s going to come back as a denial.

For that type of denial, you fix the missing information and resend the claim. This type of denial should get caught BEFORE submission. Luckily clearinghouses (like us) provide claim scrubbing services that notify and fix these errors for you beforehand.

Incorrect Modifiers

Missing information is an easy fix. Incorrect modifiers are, on the other hand, a lot more complicated.

Having a denial due to incorrect modifiers relates to incorrect coding. Modifiers are a subset of the alphanumeric codes used to translate what happened during a patient encounter. They’re usually only a 2-digit add-on that denotes an alteration of the standard use of the procedure code it's attached to.

Let’s look at a few examples of common modifiers attached to CPT codes…

- 22: Unusual procedural services

- 51: Multiple procedures

- 59: Distinct procedure

- 76: Repeat procedure by the same physician

- 77: Repeat procedure by another physician

- 78: Unplanned return to the operating room

- 91: Laboratory test(s) performed more than once on the same day

Each of these modifiers tacks on to the CPT code. For example, 8424484224 - 91 indicates that a lab performed two separate renin assays for the same patient on the same day.

The 91 modifier in that example is essential. If it wasn’t there, there’s no way for the insurance organization to know that separate tests for the same thing happened on the same day. That detail usually leads to different amounts of dollars attributed.

What’s worse, modifiers require documentation to validate their use. If the related, supporting documentation isn’t included…it's going to lead to a denial. A claim associated with missing modifier documentation will remain in a denied status until you present the required documentation.

Duplicate Claim Submission

Insurance’s don’t want to pay more than once for the same claim. That makes sense, paying for the same thing twice usually isn’t a good business model.

As such, sending a duplicate claim to the insurance company will result in a denial.

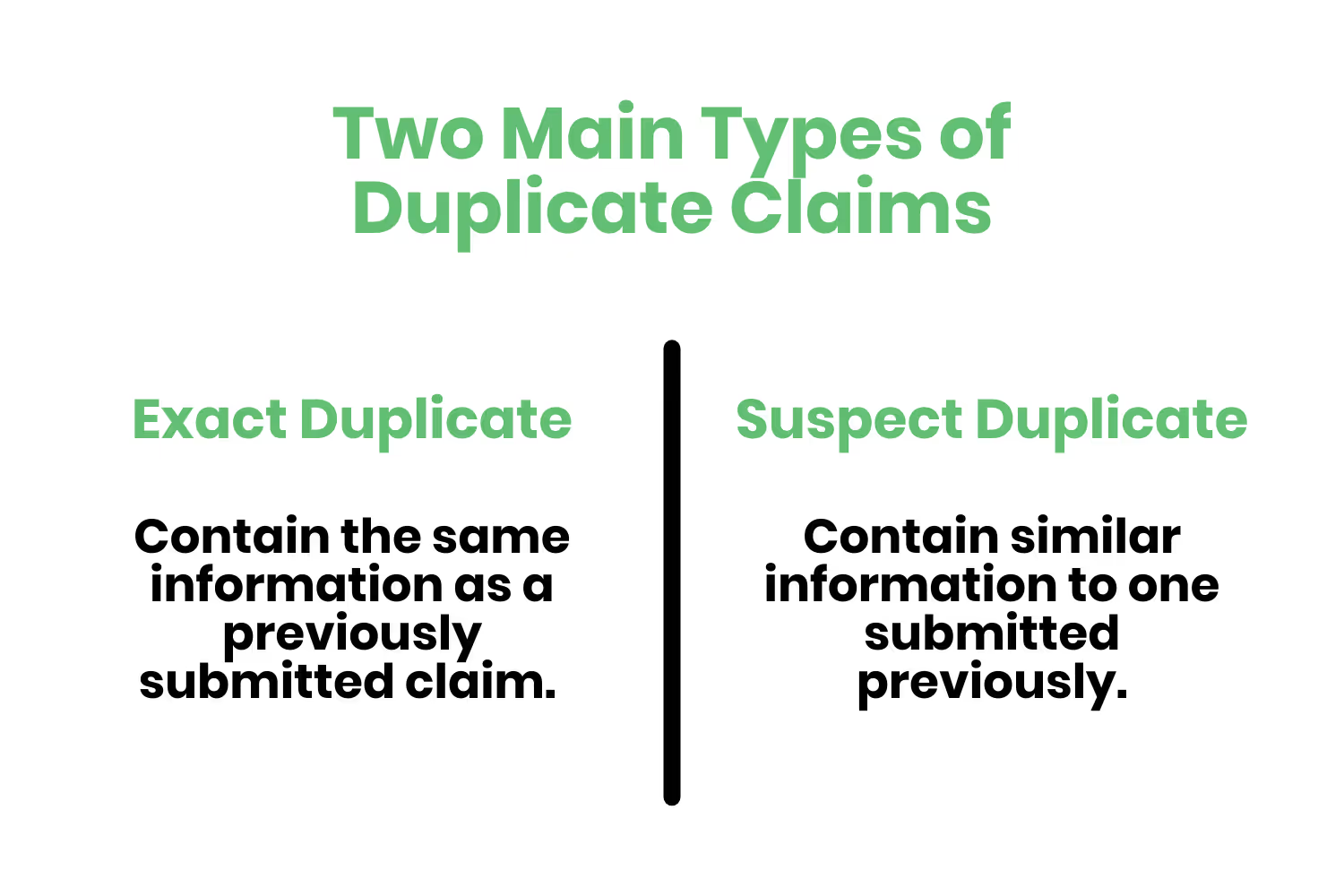

Just like with hard and soft denials. You may define duplicate claims into two different categories; exact duplicates and suspect duplicates.

Exact duplicate claims are straightforward. They contain the same information as a previously submitted claim.

A suspect duplicate claim contains similar information to one submitted previously.

Sending a few duplicate claims here and there by accident isn’t going to have a significant impact on your revenue. But, there are real-world cases where duplicate claims have led to fraud allegations and massive payouts.

Luckily, both categories of duplicate claims exist as soft denials. In other words, organizations may correct them and resubmit them. Since there are fraud cases associated with duplicate claim submissions, though, it behooves every organization to go through duplicate claim denials very carefully before submitting them.

Inaccurate Patient Information

Similar to having missing information, the patient information provided in the submitted claim may have inaccuracies.

These happen very frequently so let’s work through a couple of common examples.

- Submitting a claim without including the patient’s current address on file and using a previous address instead.

- The patient shifts coverage within an existing payer from a preferred provider organization (PPO) to a high deductible healthcare (HDHC) plan.

Claim scrubbing provided by your clearinghouse partner (like Etactics) helps catch inaccuracies before submission. Which saves you a lot of time and effort.

Prior Authorization

Also known as precertification or prior approval, prior authorization is a cost-control process where providers must receive permission from a health plan before delivering a specific service to a patient and/or beneficiary. To put it simply, it exists to determine what’s medically necessary.

Examples of where prior authorization exists as a requirement include…

- Medical services

- Diagnostic procedures

- Treatment plans

- Prescription drugs

- Medical device administration

If this process doesn’t happen before administering service, the claim doesn’t qualify for payment coverage.

To understand what prior authorization is, let’s work through an example.

Imagine you’re a doctor who’s seeing a patient for a check-up and they’re discussing knee pain issues. As the doctor, you recommend that they go see a specialist to take a closer look at the patient’s knee to figure out what’s going on. Upon the visit with the orthopedic surgeon, the specialist recommends that the patient undergo knee arthroscopy. As such, you agree with the specialist and determine that the procedure is necessary to address the underlying knee issue. Thus, you document the patient’s medical history, symptoms and reasons why the surgery is necessary alongside the specialist.

This prior authorization process helped justify the knee arthroscopy procedure from a medical standpoint. This process reduces the financial burden on the patient since the patient’s insurance would now cover the procedure.

Insurances provide and spell out the details for their prior authorization requirements within their contracts.

Patient Eligibility

The truth is that different insurance plans cover different medical procedures. Although it would be nice, no single insurance plan covers every treatment plan and/or procedure either.

Thus, patients who have different insurances are eligible for different procedures and treatments.

Eligibility issues stem from not capturing and/or understanding the specific coverage a patient has. And most often it’s the former in that last sentence.

Healthcare organizations often fail to confirm their patient’s insurance information BEFORE their visit. As such, it behooves every healthcare company to implement a process where they confirm this information with the patient beforehand. This process should still occur for “regular” patients of a practice.

The eligibility checking process should exist as a formal policy. The policy should require that front desk employees scan the patient’s ID and insurance card and perform eligibility verification to help curb these types of denials.

Preventing Denials in Healthcare

There are a ton of different moving parts throughout the denial management process. It’s so complex and there are so many ways that mistakes could occur that you might not feel very confident in trying to establish a solid denial management process.

Within each section that spoke about common denial reasons, we also walked through how to prevent them.

In any case, there are high-level aspects that you may implement at your organization that could further boost your denial and prevention management efforts.

Workflow Analysis

One of the best steps associated with implementing a better denial management process is an intrinsic analysis.

Start by taking a look at your denials on a deeper level to look for patterns. What issues are those denials citing? If they’re oftentimes citing preauthorization and/or eligibility, you should take a deep dive into your pre-service workflows.

Do your denials all tend to come from the same handful of insurances? Establish a checklist for the claims associated with those insurances. Before sending any claims to those insurances, have your employees work through the checklist.

Denial Prioritization

It’s not realistic to take a look at all of the common denial reasons we walked through and instantly implement their solutions yourself.

So, where should you start?

Prioritizing the denials that come to your organization is easy.

Every denial you’ll ever receive has a dollar amount associated with them. Take a look at that dollar amount and prioritize which ones to try to correct and resubmit starting with the ones that result in the highest returns.

Staff Training and Education

It’s common for healthcare organizations to have departments devoted to the revenue cycle. But the truth is that many of the issues that lead to denials happen outside of the revenue cycle department.

For instance, denials associated with eligibility and verification happen due to workflow issues with your front-end and scheduling department.

Thus, you need to train and educate your staff on what to look out for within the scope of their responsibilities to help deter denials.

Third-Party Partners

I’ve alluded to this point throughout the blog post, but there are third-party organizations out there that exist solely to help you with your revenue cycle.

The right clearinghouse partner can make all the difference in your claim and denial management process. They exist as the middleman between you and your patient’s insurance organizations. Etactics is a medical claims clearinghouse that’s been around for over 20 years.

In other words, we’ve made connections with thousands of different insurance organizations over of two decades. So, we’re familiar with each of their claim submission requirements.

Switching to the right clearinghouse partner (like us) means you’ll have more time to focus on running your organization and seeing patients. It will also ease your mind knowing that your claims will not only get submitted correctly but also have a lower chance of receiving a denial.

Conclusion

Denial management in healthcare is a long and arduous process. There are a ton of resources, people and workflows associated with claim submission…which unfortunately opens the door to mistakes and more denials.

Yet ignoring denials and writing them off isn’t an option due to the expenses associated with them.

Thus, having effective denial management in healthcare should be a priority due to the financial stability associated with it. Effective denial management processes start by understanding common denial reason codes and implementing proactive strategies for prevention.

But the most efficient and effective way to instantly increase your denial management processes is by sourcing the right clearinghouse partner.

Emphasize your product's unique features or benefits to differentiate it from competitors

In nec dictum adipiscing pharetra enim etiam scelerisque dolor purus ipsum egestas cursus vulputate arcu egestas ut eu sed mollis consectetur mattis pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus mauris aliquam ornare nisl purus at ipsum nulla accumsan consectetur vestibulum suspendisse aliquam condimentum scelerisque lacinia pellentesque vestibulum condimentum turpis ligula pharetra dictum sapien facilisis sapien at sagittis et cursus congue.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Incorporate statistics or specific numbers to highlight the effectiveness or popularity of your offering

Convallis pellentesque ullamcorper sapien sed tristique fermentum proin amet quam tincidunt feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Use time-sensitive language to encourage immediate action, such as "Limited Time Offer

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

- Pharetra curabitur et maecenas in mattis fames consectetur ipsum quis risus.

- Justo urna nisi auctor consequat consectetur dolor lectus blandit.

- Eget egestas volutpat lacinia vestibulum vitae mattis hendrerit.

- Ornare elit odio tellus orci bibendum dictum id sem congue enim amet diam.

Address customer pain points directly by showing how your product solves their problems

Feugiat vitae neque quisque odio ut pellentesque ac mauris eget lectus. Pretium arcu turpis lacus sapien sit at eu sapien duis magna nunc nibh nam non ut nibh ultrices ultrices elementum egestas enim nisl sed cursus pellentesque sit dignissim enim euismod sit et convallis sed pelis viverra quam at nisl sit pharetra enim nisl nec vestibulum posuere in volutpat sed blandit neque risus.

Vel etiam vel amet aenean eget in habitasse nunc duis tellus sem turpis risus aliquam ac volutpat tellus eu faucibus ullamcorper.

Tailor titles to your ideal customer segment using phrases like "Designed for Busy Professionals

Sed pretium id nibh id sit felis vitae volutpat volutpat adipiscing at sodales neque lectus mi phasellus commodo at elit suspendisse ornare faucibus lectus purus viverra in nec aliquet commodo et sed sed nisi tempor mi pellentesque arcu viverra pretium duis enim vulputate dignissim etiam ultrices vitae neque urna proin nibh diam turpis augue lacus.